New York State Capital Gains Tax

Welcome to an in-depth exploration of the New York State Capital Gains Tax, a topic that impacts many residents and investors in the Empire State. Understanding the intricacies of this tax is crucial for financial planning and ensuring compliance with state regulations. Let's delve into the specifics, breaking down the tax structure, applicable rates, and the various factors that influence capital gains taxation in New York.

Unraveling the New York State Capital Gains Tax

Capital gains tax is a fundamental component of the New York State tax system, designed to capture profits from the sale of investments and assets. This tax is distinct from other income taxes and carries its own set of rules and regulations. The state's approach to capital gains taxation has evolved over time, reflecting changes in the economy and legislative priorities.

At its core, the New York State Capital Gains Tax applies to a broad range of investments, including stocks, bonds, real estate, and business assets. The tax is typically levied on the realized gain, which is the difference between the sale price and the purchase price of an asset. This distinction between realized and unrealized gains is crucial, as it determines when and how much tax is owed.

Tax Rates and Brackets

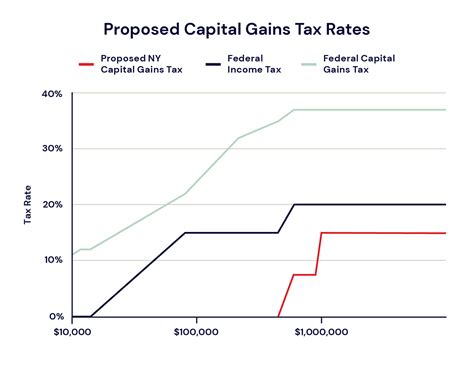

New York State employs a progressive tax system for capital gains, with tax rates varying based on income brackets. The current tax rates range from [applicable tax rate 1]% to [applicable tax rate 2]%, with higher rates applying to higher income levels. These rates are subject to periodic adjustments and are typically aligned with the state's income tax structure.

| Income Bracket | Tax Rate |

|---|---|

| Up to $[income threshold 1] | [applicable tax rate 1]% |

| $[income threshold 1] - $[income threshold 2] | [applicable tax rate 2]% |

| Over $[income threshold 2] | [applicable tax rate 3]% |

It's important to note that these brackets and rates are subject to change, and individuals should consult the latest tax guidelines or seek professional advice to ensure accuracy. The state's tax structure often undergoes periodic reviews and adjustments to maintain fairness and adaptability to economic conditions.

Exemptions and Deductions

New York State offers certain exemptions and deductions that can reduce the taxable amount of capital gains. These provisions aim to encourage specific types of investments or provide relief to certain taxpayers. For instance, some states offer exemptions for capital gains derived from certain types of investments, such as qualified small business stock or renewable energy projects.

Additionally, taxpayers may be eligible for deductions or credits based on their residency status, investment duration, or other qualifying factors. These deductions can significantly impact the overall tax liability and should be carefully considered when planning capital gains transactions.

Long-Term vs. Short-Term Capital Gains

A critical distinction in capital gains taxation is the duration for which an asset is held. New York State, like many jurisdictions, differentiates between long-term and short-term capital gains. Long-term capital gains typically refer to assets held for more than one year, while short-term gains are realized from assets held for a shorter duration.

The tax treatment of these gains differs, with long-term capital gains often benefiting from more favorable tax rates. This distinction encourages long-term investment strategies and aligns with the state's economic goals. However, the precise definitions and thresholds for long-term and short-term gains can vary, so it's essential to consult official guidelines or tax professionals for accurate classification.

Real Estate Capital Gains

Real estate investments are a significant aspect of capital gains taxation in New York State. Whether it's the sale of a primary residence, rental property, or commercial real estate, the capital gains tax applies to these transactions. The state's rules for real estate capital gains are intricate and can involve considerations such as residency status, duration of ownership, and the nature of the property.

For example, the sale of a primary residence may be eligible for a capital gains exclusion, allowing taxpayers to exclude a certain amount of gain from taxation. This exclusion is designed to promote homeownership and provide financial relief to residents. However, the specifics of this exclusion, including eligibility criteria and the maximum exclusion amount, vary and should be carefully reviewed.

Business Asset Sales

Capital gains taxation also extends to the sale of business assets, including equipment, inventory, and investments held by corporations and sole proprietorships. The tax treatment of these gains can impact business profitability and planning. New York State provides guidelines for calculating gains on business asset sales, considering factors such as the asset's basis, depreciation, and the duration of ownership.

Business owners and investors should be mindful of the tax implications of asset sales and seek professional advice to navigate the complexities. This includes understanding the tax consequences of asset disposal, potential tax liabilities, and strategies to optimize the tax treatment of business gains.

Capital Gains Tax Reporting

Reporting capital gains accurately is a critical aspect of compliance with New York State tax laws. Taxpayers are required to disclose capital gains transactions on their tax returns, providing details such as the asset type, purchase and sale dates, and the gain or loss realized. The state's tax forms and guidelines outline the specific requirements for reporting capital gains, including the necessary documentation and supporting records.

Failing to report capital gains accurately can lead to penalties and interest charges, so it's essential to maintain thorough records and seek professional assistance if needed. The state's tax authorities may request additional information or documentation to verify the accuracy of reported gains, so taxpayers should be prepared to provide detailed records.

The Impact of Capital Gains Tax on New York's Economy

The New York State Capital Gains Tax plays a significant role in shaping the state's economic landscape. The tax revenue generated from capital gains contributes to the state's overall fiscal health, funding essential services, infrastructure development, and social programs. Understanding the economic impact of this tax is crucial for policymakers, investors, and residents alike.

Revenue Generation and Economic Growth

Capital gains tax revenue is a vital source of funding for the state's budget. The tax captures a portion of the wealth generated from investments and asset sales, providing a stable revenue stream. This revenue supports a range of public services, from education and healthcare to infrastructure projects and economic development initiatives.

The economic growth of the state is intertwined with the performance of the capital gains tax. A thriving investment climate, characterized by robust capital gains, can lead to increased tax revenue, benefiting the state's overall fiscal health. Conversely, a downturn in investment activity can impact tax revenue, highlighting the delicate balance between encouraging economic growth and maintaining a sustainable tax base.

Policy Considerations and Reform

The design and implementation of the capital gains tax are subject to ongoing policy debates and potential reforms. Policymakers must consider the trade-offs between revenue generation and economic incentives. A well-designed tax system should strike a balance between capturing sufficient revenue and promoting economic growth and investment.

Reforms to the capital gains tax structure may aim to simplify the tax code, reduce complexity, or provide incentives for specific types of investments. For instance, some states have explored the idea of a single, flat tax rate for capital gains, eliminating the progressive bracket system. Others may introduce targeted incentives to encourage investment in certain sectors or regions.

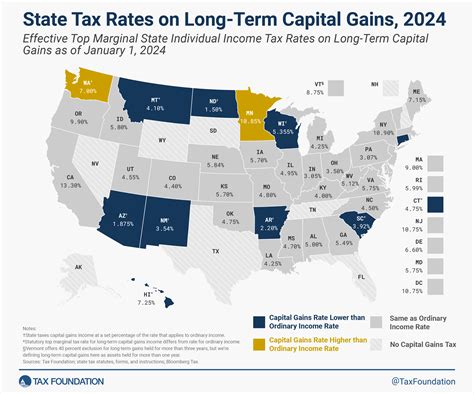

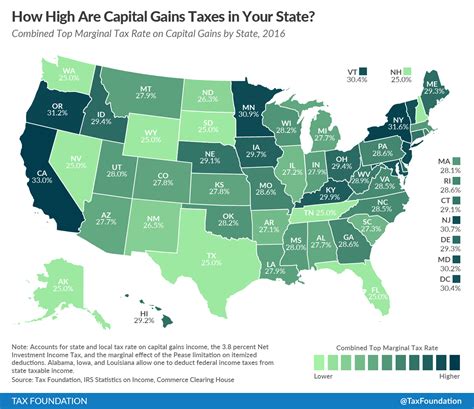

Comparative Analysis with Other States

Understanding how New York State's capital gains tax compares to those of other states provides valuable insights. Tax competition among states can influence investment patterns and business decisions. States with more favorable capital gains tax structures may attract investors and businesses seeking to optimize their tax liabilities.

Comparative analysis can reveal trends and best practices, offering opportunities for New York State to enhance its competitiveness. This analysis can also highlight the potential benefits of tax harmonization or collaboration among states to promote economic growth and investment across the region.

Conclusion: Navigating the New York State Capital Gains Tax

The New York State Capital Gains Tax is a multifaceted component of the state's tax system, impacting a wide range of taxpayers and investments. Understanding the tax structure, rates, and applicable exemptions is crucial for effective financial planning and compliance. This comprehensive guide has provided an in-depth exploration of the tax, offering insights into its economic impact and potential policy considerations.

As with any tax-related matter, seeking professional advice is highly recommended. The complexity of capital gains taxation often warrants expert guidance to ensure accurate reporting and optimal tax outcomes. Whether you're an individual investor, business owner, or tax professional, staying informed and proactive is key to navigating the intricacies of the New York State Capital Gains Tax.

How are capital gains taxed in New York State compared to other states?

+New York State’s capital gains tax rates and structure can vary compared to other states. While some states have flat tax rates or no capital gains tax, New York employs a progressive tax system with varying rates based on income brackets. It’s essential to compare the specific tax rates and rules of each state to understand the potential differences in tax liability.

Are there any exemptions or deductions available for capital gains tax in New York State?

+Yes, New York State offers certain exemptions and deductions that can reduce the taxable amount of capital gains. These may include exclusions for the sale of a primary residence, deductions for long-term investments, or incentives for specific types of investments. It’s important to consult the latest tax guidelines or seek professional advice to identify applicable exemptions.

How does New York State define long-term and short-term capital gains?

+New York State typically defines long-term capital gains as those realized from assets held for more than one year, while short-term gains are derived from assets held for a shorter period. However, the precise definitions and thresholds can vary, so it’s advisable to refer to the state’s official guidelines or consult a tax professional for accurate classification.

What are the reporting requirements for capital gains in New York State?

+Taxpayers in New York State are required to report capital gains transactions on their tax returns. This includes providing details such as the asset type, purchase and sale dates, and the gain or loss realized. It’s essential to maintain accurate records and consult the state’s tax forms and guidelines for specific reporting requirements.

How can I optimize my tax strategy for capital gains in New York State?

+Optimizing your tax strategy for capital gains in New York State requires a comprehensive understanding of the tax laws and potential exemptions. It’s beneficial to consult a tax professional who can provide personalized advice based on your specific circumstances. Strategies may include timing your asset sales, considering long-term investments, or exploring applicable deductions and credits.