Alaska Sales Tax

The sales tax system in Alaska is a unique and intriguing topic that offers an insightful look into the state's approach to taxation. Unlike most states in the United States, Alaska does not levy a general statewide sales tax. This peculiarity has shaped the state's economy and the way businesses operate, creating a distinct landscape for consumers and retailers alike. Let's delve into the details of Alaska's sales tax structure, its implications, and the future prospects it holds.

The Absence of Statewide Sales Tax

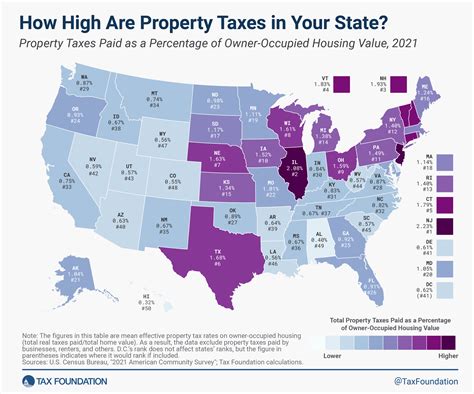

Alaska is one of five states in the US that does not impose a statewide sales tax. Instead, the state's sales tax is determined and collected at the local level, primarily by boroughs and cities. This localized approach provides each municipality with the autonomy to set its own tax rates, leading to a diverse landscape of tax structures across the state.

Local Sales Tax Rates

The local sales tax rates in Alaska vary significantly, with some areas levying a tax as low as 1%, while others impose rates as high as 7.5%. These rates are typically a combination of municipal and borough taxes, with additional taxes possible for specific areas or services. For instance, the Municipality of Anchorage, the state's largest city, has a sales tax rate of 7.5%, which includes a 2% municipal tax and a 5.5% borough tax.

Here's a glimpse at the sales tax rates in some major Alaskan cities:

| City | Sales Tax Rate |

|---|---|

| Anchorage | 7.5% |

| Fairbanks | 6.0% |

| Juneau | 5.1% |

| Ketchikan | 4.5% |

These rates are subject to change, and it's essential for businesses and consumers to stay updated on the current tax rates in their respective areas.

Taxable Items and Exemptions

Alaska's sales tax applies to a wide range of goods and services, including clothing, electronics, and restaurant meals. However, there are certain exemptions, such as groceries and prescription medications. The state also does not tax specific services like legal and medical services, as well as certain educational and professional services.

Impact on Businesses and Consumers

The absence of a statewide sales tax in Alaska presents both opportunities and challenges for businesses. On one hand, it allows businesses to set competitive prices by avoiding a uniform state tax. On the other hand, the complex landscape of local taxes can pose administrative challenges, particularly for businesses operating in multiple jurisdictions.

For consumers, the varying tax rates can be a source of confusion, especially for those traveling across the state. However, it also offers the opportunity to plan purchases strategically, taking advantage of lower tax rates in certain areas.

The Alaska Statewide Tax Structure

While Alaska does not have a traditional sales tax, it does impose other forms of taxation that contribute significantly to the state's revenue. The state levies a gross income tax on certain businesses, particularly those engaged in oil and gas extraction. Additionally, Alaska collects taxes on the extraction and production of minerals, as well as a limited state fuel tax.

The Alaska Permanent Fund Dividend

One of the most unique aspects of Alaska's tax system is the Alaska Permanent Fund Dividend. This program, funded by the state's oil revenues, provides an annual dividend to eligible residents. The dividend amount varies each year and is determined by the earnings of the Alaska Permanent Fund. In recent years, dividends have ranged from a few hundred to over a thousand dollars per resident.

Impact on the State's Economy

Alaska's unique tax system has had a profound impact on the state's economy. The absence of a statewide sales tax has encouraged economic growth and business development, particularly in tourism and retail sectors. The state's reliance on oil and mineral taxes, however, also brings volatility to its revenue stream, as these industries are subject to global market fluctuations.

The Future of Alaska Sales Tax

The topic of implementing a statewide sales tax in Alaska has been a subject of debate for years. Proponents argue that a statewide tax would provide a more stable and predictable revenue stream for the state, reducing its reliance on volatile oil and mineral revenues. It could also simplify the tax system for businesses, making it more efficient and less administratively burdensome.

However, critics argue that a statewide sales tax would disproportionately affect lower-income individuals and could potentially harm Alaska's competitive advantage in certain economic sectors. The debate is likely to continue, with the state's unique tax system remaining a defining feature of its economic landscape.

Potential Changes and Innovations

Despite the lack of a statewide sales tax, Alaska's tax system is not static. The state has implemented various tax reforms and innovations in recent years, such as the introduction of the Alaska Individual Tax Return, which simplifies the tax filing process for individuals. Additionally, the state is exploring the potential of remote sales tax collection, which could impact the way online businesses operate in Alaska.

Frequently Asked Questions

How does Alaska’s lack of a statewide sales tax affect its economy?

+

Alaska’s absence of a statewide sales tax has had a positive impact on its economy, particularly in the tourism and retail sectors. It has encouraged economic growth and business development by allowing for competitive pricing and a diverse tax landscape. However, it also introduces administrative complexities for businesses operating in multiple jurisdictions.

What are the main sources of revenue for Alaska’s state government?

+

Alaska’s state government relies on a variety of revenue sources, including oil and mineral taxes, gross income taxes on certain businesses, and limited state fuel taxes. Additionally, the state benefits from the earnings of the Alaska Permanent Fund, which provides annual dividends to eligible residents.

How does Alaska’s unique tax system compare to other states in the US?

+

Alaska’s tax system is unique among US states, as it does not impose a statewide sales tax. This sets it apart from most other states, which rely on a combination of sales taxes, income taxes, and property taxes for revenue. Alaska’s reliance on oil and mineral taxes, as well as its Permanent Fund Dividend program, further distinguishes its tax landscape.

Are there any plans to implement a statewide sales tax in Alaska?

+

The idea of implementing a statewide sales tax in Alaska has been a topic of debate for many years. While proponents argue for a more stable and predictable revenue stream, critics highlight the potential negative impacts on lower-income individuals and the state’s competitive advantage in certain economic sectors. The debate is ongoing, and it remains to be seen if a statewide sales tax will be implemented.