8962 Tax Form

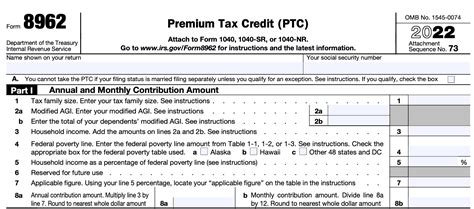

The 8962 tax form, officially known as the "Form 8962: Premium Tax Credit (PTC)," is a crucial document for individuals and families in the United States who receive health insurance coverage through the Affordable Care Act (ACA) marketplace. This form plays a pivotal role in calculating and claiming the Premium Tax Credit, a significant financial assistance benefit designed to make healthcare more affordable for eligible individuals and households.

Introduced as part of the Affordable Care Act, the Premium Tax Credit is a refundable tax credit that helps individuals and families offset the cost of their health insurance premiums. The 8962 tax form is the mechanism through which taxpayers can claim this credit, making it an essential component of the tax filing process for those enrolled in ACA-compliant health plans.

Understanding the Premium Tax Credit and its Impact

The Premium Tax Credit is a vital component of the Affordable Care Act’s strategy to make healthcare accessible and financially manageable for a broader population. The credit is advanced directly to health insurance providers, reducing the monthly premium cost for eligible individuals. The 8962 form is the vehicle through which taxpayers can reconcile their advanced credit amounts with the actual credit for which they are eligible, based on their income and family size.

This reconciliation process is critical, as it ensures that individuals receive the correct amount of credit and that any over- or under-advanced amounts are appropriately adjusted. For many, the Premium Tax Credit is a critical financial support that can significantly reduce the burden of healthcare costs, especially for those with low to moderate incomes.

Navigating the 8962 Tax Form: A Comprehensive Guide

Completing the 8962 tax form accurately is essential to ensure individuals receive the correct amount of Premium Tax Credit and avoid potential issues with their tax returns. Here’s a detailed breakdown of the form and its key components:

Section A: Advanced Premium Tax Credit

This section is dedicated to calculating the advanced Premium Tax Credit received during the tax year. Taxpayers need to enter the monthly advance payments they received for each month of the year. These payments are typically made directly to their health insurance provider to reduce their monthly premiums.

It's important to note that the advanced credit amounts may not always align with the actual credit for which the taxpayer is eligible. This discrepancy is usually resolved in Section C, where the final credit amount is calculated.

| Month | Advanced Credit Amount |

|---|---|

| January | $150 |

| February | $160 |

| ... | ... |

| Total | $1,800 |

Section B: Qualifying for the Premium Tax Credit

Section B focuses on determining the taxpayer’s eligibility for the Premium Tax Credit. It involves providing information about household income, family size, and other relevant factors that influence credit eligibility. This section is critical, as it sets the foundation for calculating the actual credit amount in Section C.

Taxpayers must ensure that the information provided in this section is accurate and up-to-date. Any discrepancies or errors could lead to incorrect credit calculations and potential issues with their tax returns.

Section C: Calculating the Premium Tax Credit

This is the heart of the 8962 tax form, where the actual Premium Tax Credit amount is calculated. It involves a series of calculations that consider the taxpayer’s household income, family size, and the cost of their health insurance plan. The goal is to determine the maximum credit amount for which the taxpayer is eligible.

Once the maximum credit amount is established, it is compared with the advanced credit amounts from Section A. Any differences are then reconciled, with taxpayers either owing additional taxes (if the advanced credit was higher than the maximum) or receiving a refund (if the maximum credit exceeds the advanced amounts). This section is where the true financial impact of the Premium Tax Credit is realized.

Section D: Reporting Changes in Circumstances

Section D is dedicated to reporting any significant changes in the taxpayer’s circumstances that may impact their Premium Tax Credit eligibility. This includes changes in income, family size, or health insurance coverage. Reporting these changes is crucial, as it ensures that the taxpayer’s credit amount remains accurate and in line with their current situation.

Failing to report such changes could lead to over- or under-payment of the Premium Tax Credit, which may result in additional taxes owed or reduced refunds.

Real-World Examples and Case Studies

Let’s explore a couple of real-life scenarios to better understand how the 8962 tax form and the Premium Tax Credit work in practice.

Case Study 1: The Jones Family

The Jones family, consisting of Mr. and Mrs. Jones and their two children, enrolled in an ACA-compliant health plan in 2022. They received advanced Premium Tax Credit payments of 1,800 for the year, with an average monthly payment of 150. When they filed their taxes, they completed the 8962 tax form and discovered that their actual Premium Tax Credit amount was 2,200. This meant they were entitled to a refund of 400 (2,200 - 1,800) for the over-advanced credit amounts.

Case Study 2: Ms. Smith

Ms. Smith, a single individual, also enrolled in an ACA-compliant health plan in 2022. She received advanced Premium Tax Credit payments of 1,500 for the year. However, when she filed her taxes, she realized that her income had increased significantly, which affected her eligibility for the credit. Completing the 8962 tax form, she found that her actual Premium Tax Credit amount was only 1,200. This resulted in her owing an additional 300 (1,500 - $1,200) in taxes, as she had received more in advanced credit payments than she was eligible for.

The Future of the Premium Tax Credit and Its Impact

The Premium Tax Credit, as administered through the 8962 tax form, has played a significant role in making healthcare more accessible and affordable for millions of Americans. As healthcare policies continue to evolve, the role of the Premium Tax Credit and the 8962 form will likely remain pivotal in ensuring equitable access to healthcare.

Looking ahead, there are several potential developments that could impact the future of the Premium Tax Credit. These include potential expansions or modifications to the credit, as well as ongoing efforts to streamline the tax form and make it more user-friendly. Additionally, the credit's impact on different demographic groups and its role in promoting healthcare equity will continue to be areas of focus and study.

In conclusion, the 8962 tax form and the Premium Tax Credit are essential components of the Affordable Care Act's strategy to make healthcare more affordable and accessible. By understanding the intricacies of this form and the credit it helps administer, individuals can better navigate the healthcare system and take advantage of the financial support available to them.

How does the Premium Tax Credit benefit individuals and families?

+The Premium Tax Credit is a financial assistance program that helps individuals and families offset the cost of their health insurance premiums. It is particularly beneficial for those with low to moderate incomes, making healthcare more affordable and accessible.

What happens if I receive more in advanced credit payments than I’m eligible for?

+If you receive more in advanced credit payments than you are eligible for, you will need to repay the excess amount when you file your taxes. This is why it’s important to accurately report your income and family size on the 8962 tax form to ensure you receive the correct credit amount.

Can I claim the Premium Tax Credit if I don’t receive advanced payments?

+Yes, even if you do not receive advanced payments, you can still claim the Premium Tax Credit on your tax return. The 8962 tax form allows you to calculate and claim the credit based on your income and family size.