100K After Taxes California

The pursuit of financial goals often leads individuals to ponder the potential of achieving substantial post-tax earnings, particularly in regions known for their high cost of living. This exploration delves into the concept of earning 100,000 dollars annually after taxes in the diverse and dynamic state of California. With its renowned cities, thriving industries, and varied economic landscapes, California presents both opportunities and challenges for those aiming to reach this financial milestone. This comprehensive analysis aims to provide insights into the feasibility, strategies, and considerations associated with earning 100,000 dollars after taxes in the Golden State.

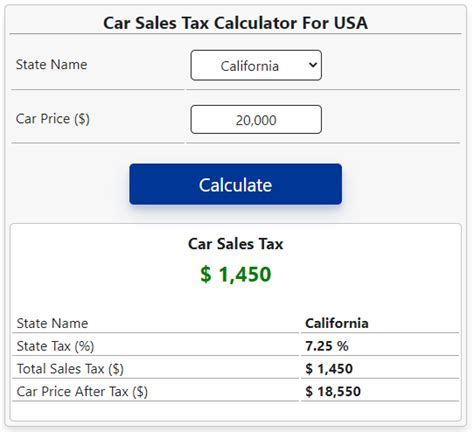

Understanding the Tax Landscape in California

California, with its progressive tax system, imposes varying income tax rates based on an individual’s earnings. As of 2023, the state income tax rates range from 1% for the lowest income bracket to 13.3% for incomes exceeding 1 million dollars. This means that an individual’s tax liability can significantly impact their take-home earnings, especially when considering the state’s relatively high cost of living.

The 100K After-Tax Earnings Goal

Earning 100,000 dollars annually after taxes in California represents a significant financial achievement, offering a comfortable lifestyle and financial stability in many parts of the state. This goal becomes more challenging when considering the state’s diverse tax structure and the varying cost of living across different regions.

Breaking Down the Income Requirements

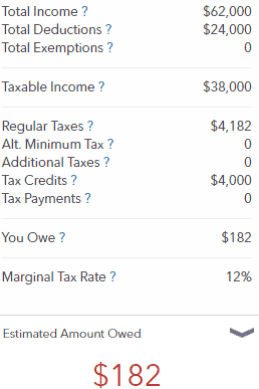

To reach the 100,000-dollar after-tax income mark, individuals must first earn a pre-tax income that accounts for the state’s tax deductions. Depending on the individual’s tax bracket and other factors such as deductions and credits, the pre-tax income required to achieve this goal can vary significantly.

| Income Tax Bracket | Pre-Tax Income Required |

|---|---|

| Up to $8,500 | $8,500 - $10,000 |

| $8,500 - $44,999 | $10,000 - $47,000 |

| $45,000 - $95,999 | $47,000 - $101,000 |

| $96,000 - $275,999 | $101,000 - $286,000 |

| $276,000 - $1,000,000 | $286,000 - $1,046,000 |

| Over $1,000,000 | Over $1,046,000 |

These estimates are based on the 2023 California tax rates and assume no deductions or credits. The actual pre-tax income required may vary based on individual circumstances.

Strategies for Achieving 100K After-Tax Earnings

Attaining the 100,000-dollar after-tax income goal in California necessitates a strategic approach that considers both income generation and tax management. Here are some strategies to consider:

1. Choose High-Demand Careers

California’s diverse economy offers numerous high-paying career paths. Pursuing professions in fields such as technology, finance, healthcare, or specialized trades can lead to higher earnings. For instance, software developers, financial analysts, physicians, and skilled tradespeople often command competitive salaries.

2. Explore Freelancing and Self-Employment

Freelancing and self-employment provide flexibility and the potential for higher earnings. In California, many individuals find success as independent contractors, consultants, or business owners. This path allows for tax benefits such as deductions for business expenses, potentially reducing overall tax liability.

3. Optimize Tax Strategies

Working with a tax professional can help individuals navigate California’s tax landscape effectively. Strategies such as maximizing deductions, contributing to retirement accounts, and exploring tax credits can lower taxable income and increase take-home pay. Additionally, understanding the state’s tax rules for investments and real estate can provide further opportunities for tax optimization.

4. Consider Cost-of-Living Adjustments

California’s cost of living varies significantly across regions. While cities like San Francisco and Los Angeles are renowned for their high expenses, other areas offer more affordable options. Individuals may consider relocating to regions with lower costs, which can stretch their earnings further and make achieving the 100K after-tax goal more feasible.

Regional Analysis: Where to Live and Work

California’s vast geography presents a range of options for individuals aiming to earn 100,000 dollars after taxes. Each region offers unique opportunities and challenges.

1. The Bay Area: A Tech Hub

The San Francisco Bay Area, including cities like San Francisco, Oakland, and San Jose, is renowned for its thriving tech industry. While the cost of living is high, the region offers numerous high-paying jobs in technology, finance, and entrepreneurship. Tech giants like Google, Apple, and Facebook provide lucrative opportunities, and the startup culture fosters innovation and potential for rapid career growth.

2. Los Angeles: Entertainment and Beyond

Los Angeles is not only the entertainment capital of the world but also a hub for various industries. The city’s diverse economy includes film, television, music, fashion, and technology. Professionals in entertainment, media, and creative fields can find lucrative careers. Additionally, Los Angeles offers opportunities in healthcare, finance, and real estate.

3. San Diego: A Balanced Lifestyle

San Diego presents a balanced approach to work and life. The city offers a vibrant tech scene, a growing biotech industry, and a strong military presence. With a lower cost of living compared to the Bay Area or Los Angeles, individuals can achieve a higher standard of living on the same earnings. San Diego’s diverse economy provides opportunities in various sectors, making it an attractive option for those seeking a more affordable yet rewarding lifestyle.

4. Silicon Valley: Innovation and Opportunity

Silicon Valley, located within the Bay Area, is synonymous with innovation and technology. Home to some of the world’s most influential tech companies, this region offers unparalleled career opportunities. While the cost of living is high, the potential for rapid career growth and high earnings makes it an attractive destination for tech professionals.

Challenges and Considerations

While the prospect of earning 100,000 dollars after taxes in California is enticing, it’s essential to consider the challenges and factors that can impact financial goals.

1. High Cost of Living

California’s renowned high cost of living is a significant factor to consider. Housing, transportation, and everyday expenses can be significantly higher than in other parts of the country. This can impact an individual’s ability to save and achieve financial milestones, especially when considering the state’s progressive tax system.

2. Tax Complexity

California’s tax system, while offering progressive rates, can be complex. Understanding tax rules, deductions, and credits is crucial to optimizing earnings. Working with a tax professional can help navigate these complexities and ensure individuals are taking advantage of all available benefits.

3. Competition and Job Market

California’s diverse and thriving economy attracts talent from across the globe. This can lead to a highly competitive job market, especially in high-demand industries. Individuals must be prepared to showcase their skills, stay updated with industry trends, and be willing to adapt to changing market demands.

Future Outlook and Opportunities

California’s economic landscape is dynamic and ever-evolving. The state’s focus on innovation, technology, and sustainability presents numerous opportunities for growth and financial success. As industries continue to evolve, individuals who stay adaptable and skilled can position themselves for long-term financial gains.

The state's commitment to renewable energy, sustainable practices, and technological advancements opens doors for careers in emerging fields. Additionally, California's reputation as a global leader in entertainment, media, and technology ensures a continuous flow of opportunities for those willing to pursue them.

Conclusion

Earning 100,000 dollars after taxes in California is a significant financial goal, achievable through a combination of strategic career choices, tax optimization, and regional considerations. While challenges exist, the state’s diverse economy and abundant opportunities make it an attractive destination for those seeking financial growth and a high standard of living. By understanding the tax landscape, exploring high-demand careers, and adapting to the dynamic job market, individuals can position themselves for long-term financial success in the Golden State.

What is the average income in California?

+The average income in California varies across regions and professions. According to recent data, the median household income in California is approximately $75,000. However, this figure can vary significantly based on factors such as location, industry, and occupation.

Are there any tax benefits for specific industries in California?

+Yes, California offers various tax incentives and credits to encourage growth in specific industries. For instance, the state provides tax credits for film and television production, renewable energy projects, and research and development activities. These incentives can benefit individuals working in these sectors and reduce their overall tax liability.

How do I find high-paying job opportunities in California?

+Finding high-paying job opportunities in California requires a strategic approach. Utilize online job platforms, professional networking events, and industry-specific job boards. Stay updated with industry trends and be proactive in seeking out career growth opportunities. Consider reaching out to recruiters or joining professional associations to access exclusive job listings.