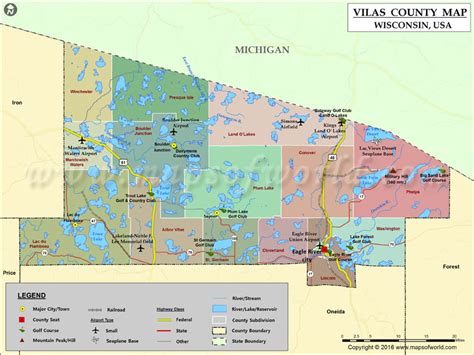

Vilas County Tax Records

Vilas County, nestled in the picturesque northwoods of Wisconsin, is renowned for its pristine lakes, vibrant forests, and a strong sense of community. Amidst this natural beauty, the topic of Vilas County Tax Records might not be the most captivating, but it is undeniably important. Understanding the intricacies of property taxes is crucial for homeowners, prospective buyers, and anyone interested in the economic landscape of this charming county.

Navigating Vilas County Tax Records: A Comprehensive Guide

Diving into the world of tax records can be daunting, but with the right approach, it becomes a valuable tool for financial planning and understanding the local economy. In this guide, we’ll demystify the process, offering a clear and concise understanding of Vilas County’s tax system.

Property Assessment: The Foundation of Taxation

At the heart of the Vilas County tax system is the process of property assessment. This involves evaluating each property within the county to determine its fair market value, which serves as the basis for calculating property taxes. Assessors take into account various factors, including the property’s size, location, and recent sales data of comparable properties.

| Assessment Period | Assessment Ratio |

|---|---|

| Every 2 Years | 100% |

Vilas County utilizes a 100% assessment ratio, ensuring that properties are taxed based on their full market value. This approach promotes fairness and consistency across the county.

Tax Rates and Calculations

Once the assessed value of a property is determined, it is multiplied by the applicable tax rate to calculate the annual property tax. Vilas County’s tax rates vary depending on the specific municipality and school district in which the property is located. These rates are established by local governing bodies and can change annually.

For instance, let's consider a property located in the town of Conover. The current tax rate for this municipality is 0.025%, meaning that for every $1,000 of assessed value, the property owner would pay $2.50 in property taxes.

| Municipality | Tax Rate |

|---|---|

| Conover | 0.025% |

| Eagle River | 0.030% |

| Land O' Lakes | 0.028% |

These rates are subject to change, so it's advisable to consult the most recent tax information for accurate calculations.

Online Resources for Tax Records

Vilas County offers a user-friendly online platform, Property Tax Records, where residents and interested parties can access detailed tax information. This platform provides:

- Property Tax Lookup: Search by address or parcel number to view the assessed value, tax rate, and estimated taxes for a specific property.

- Tax Payment Options: Explore various methods to pay property taxes, including online payments, e-check, and traditional mail-in options.

- Tax Calendar: Stay informed about important tax-related dates, such as assessment periods, tax payment deadlines, and appeals processes.

- Contact Information: Direct access to the Vilas County Treasurer's Office for any inquiries or assistance.

The online platform is a valuable resource, ensuring transparency and ease of access to tax-related information for all county residents.

Tax Appeals and Grievances

In cases where property owners believe their assessed value is inaccurate, Vilas County provides a formal tax appeal process. This process allows property owners to challenge their assessed value and potentially reduce their tax burden.

The appeal process typically involves the following steps:

- Filing an Appeal: Property owners must submit an appeal application within a specified timeframe, usually after the assessment period.

- Evidence and Hearing: Owners present evidence to support their case, and a hearing is scheduled to review the appeal.

- Decision and Notification: The Vilas County Board of Review makes a decision, and property owners are notified of the outcome.

It's important to note that appeals should be based on factual evidence and a thorough understanding of the assessment process. Professional guidance from tax consultants or attorneys can be beneficial during this process.

Understanding Tax Exemptions

Vilas County offers various tax exemptions to eligible property owners, which can significantly reduce their tax liability. These exemptions include:

- Homestead Exemption: A reduction in assessed value for primary residences, providing a financial benefit to homeowners.

- Veteran's Exemption: A discount on property taxes for eligible veterans, recognizing their service to the country.

- Senior Citizen Exemption: An exemption specifically for senior citizens, easing the tax burden for this demographic.

To claim these exemptions, property owners must meet specific criteria and apply through the Vilas County Treasurer's Office.

The Economic Impact of Vilas County Taxes

Vilas County’s tax system plays a crucial role in the local economy. Property taxes are a significant source of revenue for the county, municipalities, and school districts, funding essential services and infrastructure projects.

A well-managed tax system not only ensures the financial stability of the county but also promotes economic growth. It attracts businesses, supports local industries, and contributes to the overall prosperity of the region.

Conclusion: A Transparent and Accessible Tax System

Vilas County’s commitment to transparency and accessibility in its tax records is commendable. The online platform, coupled with a clear and fair assessment process, empowers property owners to understand and manage their tax obligations effectively.

As we navigate the world of Vilas County Tax Records, it becomes evident that this system is not just about revenue generation but also about fostering a sense of community and economic stability. By providing accessible information and fair practices, Vilas County ensures that its residents can thrive and contribute to the vibrant life of this picturesque region.

How often are property assessments conducted in Vilas County?

+Property assessments in Vilas County are conducted every two years. This ensures that property values are regularly updated and taxes are calculated fairly and accurately.

Can I pay my property taxes online in Vilas County?

+Absolutely! Vilas County offers an online payment platform where you can conveniently pay your property taxes using a credit card, e-check, or other digital payment methods. This platform is secure and user-friendly.

What happens if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Vilas County Board of Review provides a formal process for such appeals. It’s advisable to gather evidence and consult a tax professional to strengthen your case.