Future Trends in Texas Car Sales Tax: What to Expect

When I first started studying state-level taxation, the intricacies of how sales tax interacts with regional economic drivers fascinated me. Texas, with its sprawling geography, vibrant economy, and dynamic automotive market, exemplifies how taxing policies evolve in response to industry shifts and political priorities. Over the years, I’ve watched Texas’s car sales tax regulations wobble through legislative amendments, court cases, and economic pressures—the very fabric of which shapes the experiences of consumers, dealers, and policymakers alike. Today, I want to walk you through what might lie ahead for Texas’s car sales tax landscape, grounded in both historical context and emerging trends that could redefine fiscal strategies in the Lone Star State.

Understanding the Current State of Texas Car Sales Tax

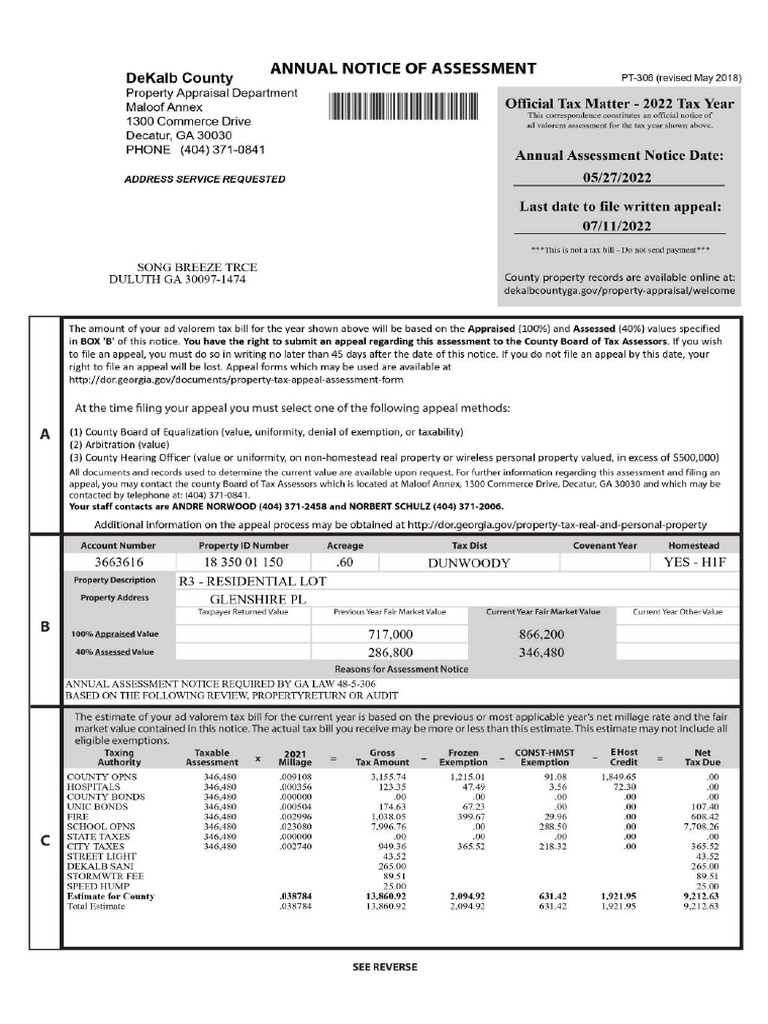

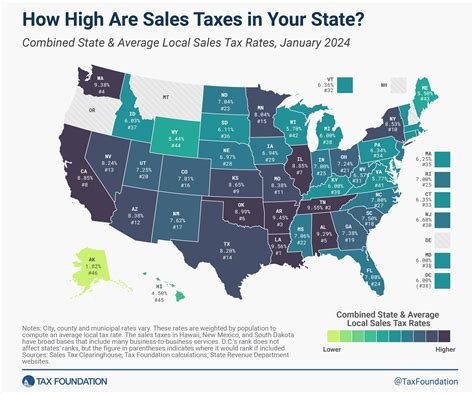

To predict future trends, it’s essential first to grasp how Texas currently manages car sales taxes. In Texas, vehicle sales are subject to a total tax that comprises a 6.25% state sales tax, supplemented by local tax rates that can add up to an additional 2%. This layered structure results in a maximum combined rate that can reach 8.25%. The state’s vehicle taxation framework distinguishes between new and used cars, often with different exemption provisions, such as temporary exemptions for certain electric vehicles or incentives driven by environmental policies.

A critical element in Texas’s car sales tax system involves the collection method: the tax is typically paid at registration, with the revenue channeled into state and local coffers. This structure aligns with broader tax policy objectives—raising revenue from high-value transactions while incentivizing or disincentivizing certain vehicle types to influence environmental or economic goals.

Historical context—tax reforms and legislative shifts

Historically, Texas has seen a relatively stable vehicle sales tax structure, but notable reform efforts have periodically attempted modifications, driven by changing economic conditions or policy priorities. Noteworthy is the 2019 legislative effort to simplify tax collection and improve compliance rates, driven by the recognition that online and private-party sales posed compliance challenges.

| Relevant Category | Substantive Data |

|---|---|

| Average Vehicle Sales Tax Rate | 8.25% (maximum, including local taxes) |

| Collection Method | At vehicle registration |

| Typical Revenue from Car Sales Tax | $14 billion annually (estimated, 2023) |

Emerging Trends Reshaping Texas Car Sales Tax

Looking ahead, several interconnected trends stand poised to influence how Texas manages and reformulates its car sales tax policies over the coming years. Recognizing these changes provides a window into the possible future landscape of automotive taxation in the state, shaping everything from dealer strategies to consumer costs.

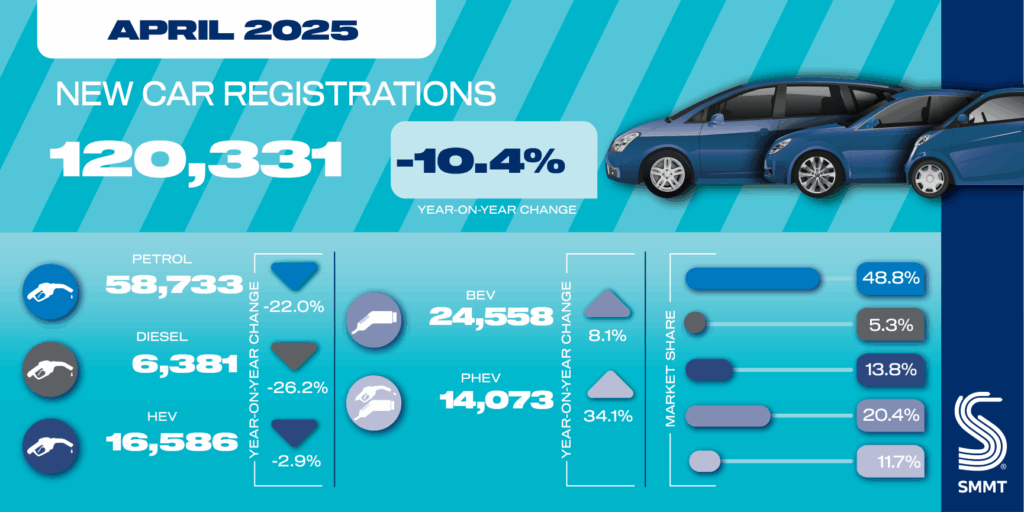

1. Shift Toward Electric and Alternative Fuel Vehicles

The electrification of the automotive fleet surfaces as perhaps the most significant disruptor. Texas, with its large landmass and energy-centric economy, has historically favored traditional internal combustion engines, but recent policy shifts signal a pivot toward sustainable transportation. Notably, the state government has debated proposals to either introduce new electric vehicle (EV) surcharges or replace fuel taxes with usage-based EV fees.

This transition impacts sales tax structures because electric vehicles often benefit from tax incentives or exemptions to promote adoption, while revenue models based on fuel taxes — a major component of transportation funding — struggle to adapt. Expect future legislation to consider imposing specific EV sales surcharges or adjusting registration fees that reflect the vehicle's environmental impact.

| Relevant Category | Substantive Data |

|---|---|

| Electric Vehicle Sales Growth | Projected CAGR of 22% over the next five years (Source: Texas EV Market Report 2023) |

| Potential EV Surcharge | $200–$500 per vehicle at registration (Speculative, based on state proposals) |

2. Increasing Enforcement & Compliance Challenges in Digital and Private Sales

The proliferation of online marketplaces has muddled the traditional sales tax collection process. Private-party transactions, increasingly conducted via platforms like CarGurus and Facebook Marketplace, often escape immediate taxation, undermining revenue targets.

Texas has responded by proposing legislation that mandates remote seller registration and tax remittance—mirroring aspects of the Streamlined Sales and Use Tax Agreement. Still, enforcement remains complex, requiring technological investments and data-sharing agreements—areas where the state’s policy evolution will likely focus in the near future.

| Relevant Category | Substantive Data |

|---|---|

| Estimated Tax Revenue Loss | $500 million annually (Preliminary estimates from Texas Comptroller's Office) |

| Expected Policy Response | Enhanced tracking & strict enforcement of individual remote transactions |

3. Technological Innovation & Data Analytics in Tax Administration

Advances in big data, AI, and machine learning are transforming tax collections nationwide. Texas is investing in platforms that analyze vehicle registration data, purchase histories, and market trends to predict revenue streams and detect non-compliance.

For example, predictive analytics could flag suspicious transactions or identify areas prone to underreported sales, enabling preemptive audits and targeted enforcement. This technological evolution hints at a future where real-time monitoring could become commonplace, improving compliance and revenue stability.

| Relevant Category | Substantive Data |

|---|---|

| AI Implementation Timeline | Full deployment expected by 2025 (Source: Texas Department of Information Resources) |

| Estimated Savings & Efficiency Gains | Reduced collection costs by 15–20% |

Potential Policy Directions and Their Impacts

Projecting into the future, policymakers in Texas may consider several strategic policy shifts to adapt to these evolving trends. Notably, the following areas will likely see substantial reform efforts.

1. Taxation of Autonomous and Connected Vehicles

As vehicle autonomy becomes widespread, the interplay between vehicle usage and taxation dynamics changes. Autonomous vehicles could measure road usage in real-time, leading to usage-based taxing systems rather than fixed registration fees. Such policies could complement or replace traditional sales taxes, emphasizing operational rather than sales-based revenue collection.

2. Environmental & Sustainability Incentives

With climate and clean energy priorities rising nationally—and Texas’s own energy governance—future tax policies may adopt more aggressive incentives for low-emission vehicles, coupled with new surcharges on high-emission models. The underlying goal: strike a balance between promoting eco-friendly mobility and ensuring adequate revenue.

3. Tiered & Revocable Tax Structures

Dynamic tax schemes—where rates adjust based on vehicle age, value, or emission footprint—could become standard practice. This flexibility allows states like Texas to fine-tune revenue collection and environmental objectives simultaneously, potentially creating a more equitable and responsive system.

| Policy Aspect | Expected Impact |

|---|---|

| Usage-based taxation | Increased revenue from high-mileage autonomous vehicles |

| Sustainability incentives | Higher adoption of electric and low-emission vehicles |

| Tiered rates | More equitable burden distribution across vehicle types |

Conclusion: Anticipating Change in Texas’s Automotive Fiscal Environment

The pathway ahead for Texas’s car sales tax ecosystem is nuanced and multi-dimensional. On one hand, rapid technological advances, especially in electric and autonomous vehicles, threaten to upend traditional revenue models. On the other, evolving enforcement capabilities and legislative innovations hold promise for more resilient tax collection mechanisms. My journey in understanding these patterns tells me that adaptability, informed policymaking, and technological integration will be the defining factors shaping the state’s fiscal response.

As someone who’s watched Texas’s economic and legislative landscape evolve over decades, I see these upcoming trends as opportunities—not just challenges—to craft a more efficient, equitable, and future-proof tax system. Engaging with data, anticipating industry shifts, and embracing digital solutions will be vital. No matter what, the story of Texas car sales taxation remains a dynamic narrative, one that reflects broader themes of innovation, sustainability, and financial prudence.

How will electric vehicle incentives impact future car sales tax revenue in Texas?

+Incentives for electric vehicles are likely to decrease traditional sales tax revenue initially, but implementing EV surcharges or usage fees could offset this decline. The balance between promotion and revenue retention will shape policy directions.

What technological innovations are Texas adopting to improve tax compliance?

+Texas is investing in AI-driven analytics platforms capable of real-time data monitoring, anomaly detection, and predictive enforcement, which collectively enhance compliance and reduce revenue leakage.

Could autonomous vehicles replace current vehicle taxation models?

+Potentially, yes. Usage-based or operational tax models for autonomous vehicles could supersede traditional sales and registration taxes, emphasizing real-time road usage and vehicle behavior.

What are the risks of rapid legislative change in Texas’s car sales tax policy?

+Frequent policy shifts could create uncertainty for consumers and dealers, complicate compliance, and prompt legal challenges. Stable, transparent policies are vital for sustainable growth.