North Carolina Food Tax

In the state of North Carolina, the application of sales tax on food items has been a topic of interest and debate. The food tax, often referred to as the "grocery tax," is an important aspect of the state's revenue generation and has a significant impact on both consumers and businesses. Let's delve into the intricacies of the North Carolina Food Tax, exploring its history, current status, and its implications for various stakeholders.

The Evolution of North Carolina’s Food Tax

The history of the food tax in North Carolina dates back to the 1970s when the state first implemented a sales tax on certain food items. Initially, the tax was introduced as a means to generate additional revenue for the state’s budget, particularly during a period of economic uncertainty. Over the years, the tax has undergone several modifications and adjustments, reflecting the changing economic landscape and the evolving needs of the state.

One of the key turning points in the history of the North Carolina Food Tax was the year 2000. During this period, the state experienced a significant budget surplus, leading to a reevaluation of the tax structure. As a result, a temporary moratorium was placed on the food tax, allowing consumers a respite from the additional burden. However, this relief was short-lived, and the tax was reinstated a few years later to maintain the state's fiscal stability.

Understanding the Current Food Tax Landscape

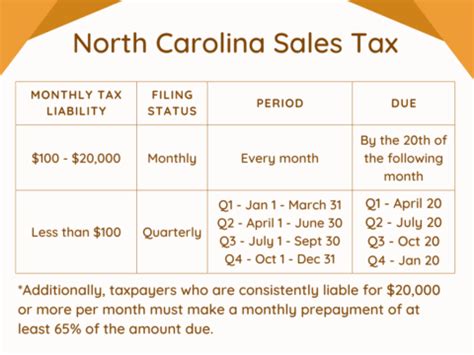

As of my last update in January 2023, the sales tax on food items in North Carolina stands at 6.75%, which includes both the state and local sales tax rates. However, it is important to note that the application of the tax is not uniform across all food categories. The state has implemented a system of exemptions and special provisions to cater to various consumer needs and industries.

Exemptions and Special Provisions

North Carolina has established a set of exemptions and special provisions for certain food items to alleviate the tax burden on specific consumer groups and industries. These exemptions are designed to promote social welfare and support local businesses.

- Prepared Food Exemptions: Certain prepared foods, such as restaurant meals, are exempt from the sales tax. This exemption aims to support the state's vibrant restaurant industry and encourage tourism.

- Groceries and Staples: Basic groceries and staple food items, including bread, milk, and eggs, are often exempt from the food tax. This provision ensures that essential food items remain affordable for low-income households.

- Farmers' Markets and Local Produce: To promote local agriculture and support small-scale farmers, sales tax exemptions are often applied to purchases made directly from farmers' markets or local producers.

Impact on Consumers

The North Carolina Food Tax has a direct impact on consumers, influencing their purchasing decisions and overall financial well-being. For many households, especially those with limited incomes, the tax on food items can be a significant burden. The tax adds an additional cost to essential groceries, potentially straining household budgets and impacting nutritional choices.

On the other hand, the tax exemptions and special provisions provide some relief to consumers. By exempting certain food categories, the state ensures that basic necessities remain affordable and accessible to a wider population. Additionally, the exemptions on prepared foods and local produce encourage consumers to support local businesses and indulge in culinary experiences without the added tax burden.

Businesses and the Food Tax

The food tax also plays a crucial role in the operations and profitability of businesses within the state. For grocery stores and food retailers, the tax is a significant consideration in their pricing strategies and overall business planning.

Businesses often have to navigate the complex tax system, ensuring compliance with the state's regulations. They must accurately calculate and remit the sales tax on taxable food items while also managing the exemptions and special provisions. This can be a challenging task, especially for smaller businesses with limited resources.

Performance Analysis and Future Implications

The performance of the North Carolina Food Tax has been a subject of ongoing analysis by economists and policymakers. The state government closely monitors the tax’s impact on revenue generation, consumer behavior, and business operations.

One key aspect of the analysis is the tax's effectiveness in generating revenue. While the food tax contributes to the state's overall tax revenue, its impact can vary depending on economic conditions and consumer spending patterns. During economic downturns, for instance, the tax may experience a decline in revenue as consumers reduce their spending on taxable food items.

Furthermore, the analysis also considers the tax's impact on consumer behavior and its potential effects on the state's economy. Studies have shown that tax exemptions on certain food items can encourage consumers to shift their purchasing habits, leading to increased spending in those categories. This, in turn, can have a positive impact on local businesses and the overall economy.

Looking ahead, the future of the North Carolina Food Tax is likely to be influenced by various factors. Economic trends, consumer preferences, and policy changes will all play a role in shaping the tax landscape. As the state continues to evolve and adapt to changing circumstances, the food tax will remain a crucial component of its fiscal strategy, requiring careful consideration and periodic adjustments.

| Tax Rate | Applicable To |

|---|---|

| 6.75% | Most food items |

| 0% | Prepared foods (e.g., restaurant meals) |

| 0% | Groceries and staple food items |

| Varies | Farmers' market and local produce (dependent on location) |

What is the purpose of the North Carolina Food Tax?

+The primary purpose of the North Carolina Food Tax is to generate revenue for the state’s budget. It contributes to the overall tax revenue, helping to fund various government programs and services.

Are there any alternatives to the food tax in North Carolina?

+Some alternative tax structures have been proposed, such as a value-added tax (VAT) or a flat sales tax. However, the current system with exemptions and provisions is designed to balance revenue generation with social welfare considerations.

How does the food tax affect the state’s economy?

+The food tax can have both positive and negative impacts on the state’s economy. While it generates revenue, it can also influence consumer spending patterns and affect certain industries, such as the restaurant and grocery sectors.

Are there any plans to reform the North Carolina Food Tax system?

+The state regularly reviews its tax structure, and reforms are proposed from time to time. However, any significant changes would require careful consideration of the potential impacts on revenue generation, consumer behavior, and business operations.