Tax Stamp On Suppressor

In the world of firearms, the use of suppressors, or silencers, is a topic of interest and debate. While the idea of reducing the noise associated with firearms may seem appealing, the legalities and regulations surrounding suppressors are complex and vary greatly by jurisdiction. One crucial aspect of suppressor ownership is the requirement of a tax stamp from the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF). This article aims to delve into the intricacies of the tax stamp process for suppressors, providing a comprehensive guide for firearms enthusiasts and those seeking a better understanding of this unique aspect of firearms regulation.

Understanding the Tax Stamp for Suppressors

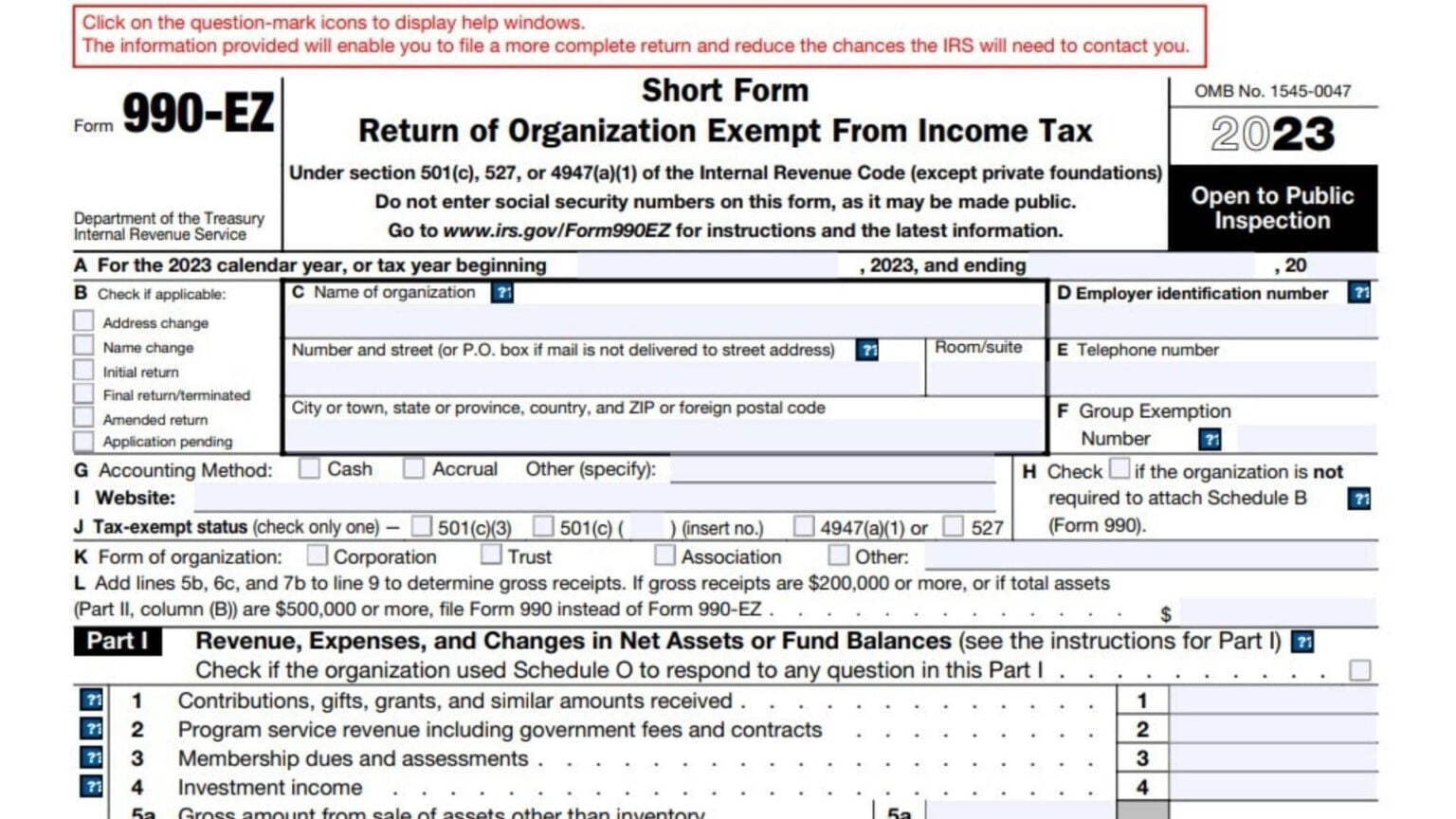

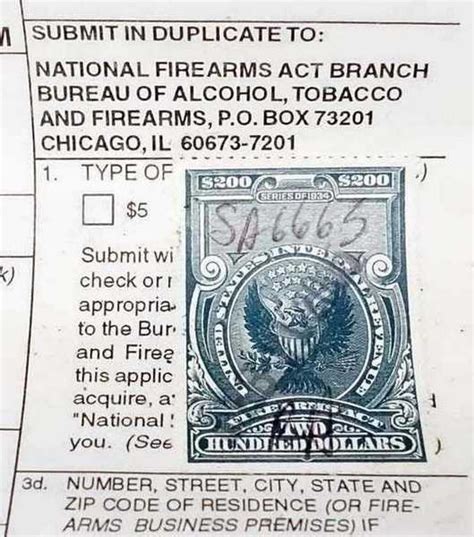

The National Firearms Act (NFA) of 1934, a landmark piece of legislation in the United States, imposes strict regulations on the manufacture, transfer, and possession of certain types of firearms, including suppressors. At the heart of these regulations is the requirement for a tax stamp, a vital document that signifies the lawful acquisition and ownership of an NFA-regulated item.

A tax stamp for a suppressor serves as a proof of payment of the $200 transfer tax, as mandated by the NFA. This tax is a significant aspect of the process, adding a financial component to the already intricate legalities surrounding suppressor ownership. The tax stamp is a physical representation of the lawful transaction and is a critical element in the suppressor's chain of custody.

The Application Process

The journey towards obtaining a tax stamp for a suppressor begins with a detailed application process. The applicant must complete ATF Form 4, which is a comprehensive document requiring specific information about the suppressor, the transferee, and the transferor. This form is a critical component of the NFA process and must be completed accurately to avoid delays or potential legal issues.

Among the essential details required on Form 4 are the suppressor's make, model, and serial number. The form also requires the applicant's personal information, including their name, address, and date of birth. Additionally, the transferor's details, such as their name, address, and ATF license number (if applicable), must be provided. This level of detail ensures a clear chain of custody and helps the ATF maintain accurate records.

Once the form is completed, it must be accompanied by the appropriate fee, which, as mentioned earlier, is $200. This fee covers the transfer tax and processing costs. The application, along with the fee, is then submitted to the ATF for review and approval.

Processing Times and Variables

The processing time for a tax stamp application can vary significantly. While the ATF aims to process applications within a certain timeframe, several variables can impact the speed of approval. These variables include the completeness of the application, the complexity of the transaction, and the current workload of the ATF’s NFA branch.

In some cases, applications may be approved within a matter of weeks, providing a relatively swift conclusion to the process. However, it's not uncommon for applications to take several months, especially if there are issues with the application or if the ATF requires additional information. It's crucial for applicants to remain patient and ensure they provide all the necessary details to avoid unnecessary delays.

Legal and Regulatory Considerations

Beyond the technical aspects of the tax stamp process, it’s essential to consider the legal and regulatory framework surrounding suppressor ownership. The NFA imposes strict regulations on who can possess a suppressor and under what circumstances. These regulations are in place to ensure public safety and prevent the misuse of suppressors.

At a federal level, the NFA requires individuals to be at least 21 years old and have no disqualifying criminal record or mental health issues to possess a suppressor. Additionally, the transferor and transferee must both be legally eligible to possess firearms under federal law. This ensures that suppressors are not falling into the hands of those who may misuse them.

State and Local Regulations

While the NFA provides a federal framework for suppressor ownership, it’s important to note that state and local laws can vary significantly. Some states have additional requirements or restrictions on suppressor ownership, while others may prohibit their use altogether. It’s crucial for individuals to research and understand the specific laws in their jurisdiction before pursuing suppressor ownership.

For instance, while some states allow suppressor ownership with a simple tax stamp and background check, others may require additional permits or licenses. In certain cases, local jurisdictions may have noise ordinances that indirectly impact the use of suppressors. These variations in regulations highlight the importance of thorough research and understanding of the legal landscape before acquiring a suppressor.

The Role of Tax Stamps in Suppressing Firearm Noise

The tax stamp requirement for suppressors is a critical component of the NFA’s strategy to regulate these devices. By imposing a tax and a rigorous application process, the NFA aims to deter illegal acquisition and misuse of suppressors. The tax stamp serves as a deterrent, making it less likely for individuals to acquire suppressors through illegal means.

Furthermore, the tax stamp process provides a vital record-keeping system. The ATF can track the transfer and ownership of suppressors, ensuring that they remain within the legal framework. This system helps prevent the diversion of suppressors into illegal markets and provides a level of accountability for suppressor owners.

The Impact on Firearm Noise Levels

While the primary focus of the NFA and the tax stamp process is on regulation and legality, there is also a significant impact on firearm noise levels. Suppressors, when used responsibly and legally, can significantly reduce the noise associated with firearm discharge. This reduction in noise can benefit both the shooter and those in the vicinity.

For shooters, the use of a suppressor can lead to a more pleasant shooting experience. It reduces the noise signature, making it more comfortable for the shooter's ears and potentially reducing the risk of hearing damage. Additionally, suppressors can reduce the recoil and muzzle blast, making shooting more controlled and accurate.

From a broader perspective, the reduction in firearm noise can have positive implications for the shooting sports community. It can help alleviate concerns from nearby residents and landowners, fostering better relationships and understanding between shooters and their communities. This, in turn, can lead to more acceptance and understanding of the shooting sports.

The Future of Suppressors and Tax Stamps

As with any aspect of firearms regulation, the landscape surrounding suppressors and tax stamps is subject to change. The ongoing dialogue around firearms and their regulations can lead to shifts in policy and law. While the current framework provides a robust system for regulating suppressors, there are ongoing discussions and proposals that could impact this landscape.

Some proponents argue for a more streamlined and accessible process for acquiring suppressors, citing the potential benefits for hearing health and safety. Others advocate for a complete overhaul of the NFA, seeking to eliminate the tax stamp requirement altogether. These debates highlight the complex nature of firearms regulation and the ongoing need for balanced policies that consider both public safety and individual rights.

| NFA Transfer Tax | $200 |

|---|---|

| Application Form | ATF Form 4 |

| Minimum Age for Ownership | 21 Years |

What is the purpose of the tax stamp for suppressors?

+

The tax stamp serves as proof of payment of the $200 transfer tax mandated by the National Firearms Act (NFA). It is a crucial document that signifies lawful acquisition and ownership of an NFA-regulated item like a suppressor.

How long does it typically take to receive a tax stamp for a suppressor?

+

Processing times can vary, but it’s not uncommon for applications to take several months. The completeness of the application and the ATF’s workload can impact the approval time.

Are there any state-specific regulations I should be aware of when considering a suppressor purchase?

+

Yes, state laws can vary significantly. Some states may have additional requirements or even prohibit suppressor ownership. It’s crucial to research and understand the laws in your specific state or jurisdiction before pursuing a suppressor purchase.

How does the tax stamp process impact the use of suppressors in shooting sports?

+

The tax stamp process provides a legal framework for suppressor ownership, which can benefit the shooting sports community. It allows for the responsible and lawful use of suppressors, potentially improving the shooting experience and fostering better relationships with local communities.