State Of Tennessee Tax Free Weekend

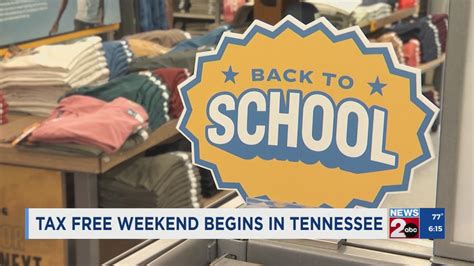

Welcome to our comprehensive guide on the State of Tennessee's Tax-Free Weekend! This annual event is a much-anticipated occasion for residents, offering a unique opportunity to save on various essential items. In this article, we delve into the specifics of this tax holiday, providing you with all the information you need to make the most of this exciting shopping experience.

Unraveling Tennessee’s Tax-Free Weekend: A Comprehensive Guide

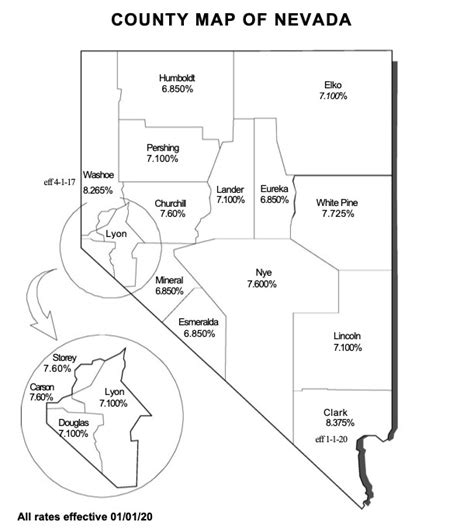

The Tax-Free Weekend, a concept popularized by various states across the nation, is an initiative aimed at boosting local economies and providing a financial break to consumers. Tennessee’s participation in this tradition has become a highlight for residents, offering a chance to purchase necessary items without incurring state sales tax.

This event, which typically spans a weekend, has gained popularity due to the significant savings it offers. It encourages consumers to make larger purchases, knowing they can avoid the added tax burden. In this guide, we'll explore the ins and outs of Tennessee's Tax-Free Weekend, including the eligible items, exclusions, and strategies to make the most of this tax-free period.

Eligible Items and Categories

The Tennessee Tax-Free Weekend targets specific categories of items, focusing on essentials that are frequently purchased by families and individuals. Here’s a breakdown of the key categories that are included in this tax holiday:

- Clothing and Footwear: One of the primary focuses of this tax-free weekend is clothing. This category includes a wide range of apparel items, from casual wear to formal attire. Whether you're looking for a new wardrobe for the upcoming season or need to stock up on essentials, this is the perfect time to do so without the added sales tax.

- School Supplies: With the back-to-school season approaching, the Tax-Free Weekend is a boon for parents and students. School supplies, including notebooks, stationery, backpacks, and even computers, are typically included in the tax-free category. This allows families to prepare for the new academic year without the financial strain of additional taxes.

- Sports Equipment: Whether you're an athlete or just looking to stay active, the Tax-Free Weekend extends to sports equipment. This category covers a wide range of items, from gym gear to outdoor sports essentials. It's an excellent opportunity to invest in quality equipment without the usual tax markup.

- Books: Books, both educational and recreational, are also included in the tax-free category. This is great news for bookworms and students alike, as it encourages reading and provides an opportunity to build a personal library without the added cost.

These categories are subject to certain limits and specifications, ensuring that the tax-free benefit is directed towards essential items. For instance, clothing items with a single price tag of $100 or less per item are eligible, providing a clear guideline for shoppers.

| Category | Eligible Price Range |

|---|---|

| Clothing | $100 or less per item |

| Footwear | $100 or less per item |

| School Supplies | No specific limit |

| Sports Equipment | $1,000 or less per item |

| Books | No specific limit |

Exclusions and Limitations

While the Tax-Free Weekend is a fantastic opportunity to save, it’s not applicable to all items. Certain exclusions and limitations are in place to ensure the tax holiday remains focused on essential items. Here’s a look at some of the key exclusions:

- Electronics and Technology: While school supplies and computers are often included, other electronics like smartphones, tablets, and gaming consoles are typically excluded. This ensures that the focus remains on essential educational tools rather than luxury items.

- Vehicles and Large Appliances: The Tax-Free Weekend does not extend to the purchase of vehicles, including cars, motorcycles, and boats. Similarly, large appliances like refrigerators, washing machines, and air conditioners are usually not included in the tax-free category.

- Grocery Items: Everyday grocery items, despite being essential, are generally not part of the tax-free weekend. This includes food, beverages, and household staples like cleaning supplies.

- Custom Orders and Special Orders: Items that are custom-made or specially ordered might be excluded from the tax-free benefit. This ensures that the initiative focuses on readily available essentials rather than tailored or bespoke items.

These exclusions are in place to maintain the integrity of the tax holiday and ensure that it remains a beneficial event for residents without creating a loophole for significant tax avoidance.

Maximizing Your Tax-Free Weekend

Now that we’ve covered the basics, let’s explore some strategies to make the most of your Tax-Free Weekend shopping experience:

- Plan Your Shopping List: Before the tax-free weekend, create a comprehensive shopping list. Identify the items you need or want, ensuring they fall within the eligible categories. This will help you stay focused and avoid impulse purchases.

- Research Prices and Stores: Compare prices for the items on your list across different stores. Some retailers might offer additional discounts or promotions during this time, so it's worth researching to find the best deals.

- Consider Online Shopping: If you prefer the convenience of online shopping, many retailers offer online sales during the Tax-Free Weekend. Check their websites for digital coupons or exclusive online deals.

- Shop Early: To avoid crowds and ensure availability, consider shopping early in the tax-free period. This way, you can secure the items you want without the stress of last-minute rushes.

- Combine with Other Offers: Look for stores that offer additional discounts or promotions during the Tax-Free Weekend. Combining these offers with the tax-free benefit can result in significant savings.

Remember, the Tax-Free Weekend is a unique opportunity to save on essential items. By planning and staying informed, you can make the most of this event and enjoy substantial savings on your purchases.

The Impact and Future of Tennessee’s Tax-Free Weekend

Tennessee’s Tax-Free Weekend has become an integral part of the state’s economic landscape, offering both consumers and local businesses a mutually beneficial opportunity. The event’s popularity has grown over the years, with residents eagerly anticipating the annual savings.

The economic impact of this tax holiday is significant. It stimulates local economies, encouraging residents to spend more on essential items. This, in turn, benefits local businesses, particularly those in the retail sector. The event also serves as a boost for tourism, as people from neighboring states often travel to Tennessee to take advantage of the tax-free shopping.

Looking to the future, the continuation and evolution of Tennessee's Tax-Free Weekend will be an exciting prospect. As the state's economy and consumer trends evolve, the event might adapt to include new categories or offer additional benefits. The potential for expanding the eligible items or extending the duration of the tax-free period could be on the horizon, providing even greater savings for residents.

Furthermore, the success of this initiative could inspire other states to adopt similar tax holidays, fostering a culture of consumer-friendly policies and economic stimulation. As the state continues to thrive economically, the Tax-Free Weekend will remain a cherished tradition, offering a much-needed financial break to Tennesseans.

FAQs

When is Tennessee’s Tax-Free Weekend in 2024?

+Tennessee’s Tax-Free Weekend for 2024 is scheduled for July 26-27, offering two full days of tax-free shopping.

Are there any specific rules for purchasing online during the Tax-Free Weekend?

+Yes, online purchases are eligible for the tax-free benefit, provided the retailer is located in Tennessee and the items meet the eligible criteria. Always check with the retailer’s terms and conditions for online orders.

Can I combine the Tax-Free Weekend with other discounts or promotions?

+Absolutely! Many retailers offer additional discounts or promotions during the Tax-Free Weekend, allowing you to combine the tax-free benefit with other deals for maximum savings.