State Of Nevada Sales Tax

In the vast landscape of commerce, understanding the intricacies of sales tax is crucial for businesses and consumers alike. This article delves into the specific case of the State of Nevada's sales tax system, exploring its unique characteristics, rates, exemptions, and the impact it has on the local economy.

Nevada’s Sales Tax Structure

The State of Nevada, known for its vibrant cities, diverse landscapes, and thriving tourism industry, has a sales tax system that plays a significant role in its economic landscape. Nevada’s sales tax is a consumption tax levied on the sale of tangible personal property and certain services within the state.

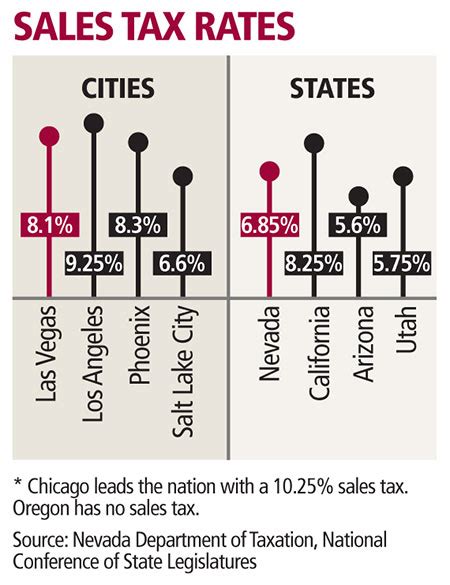

One of the key features of Nevada's sales tax is its uniformity across the state. Unlike some other states with varying tax rates in different counties or municipalities, Nevada maintains a consistent sales tax rate, making it easier for businesses and consumers to navigate.

As of the latest information available, the statewide sales tax rate in Nevada is 6.85%, which includes the base state rate and the local rate. This rate is applicable to most transactions, but there are certain exemptions and special considerations that businesses and consumers should be aware of.

Taxable Items and Services

Nevada’s sales tax applies to a wide range of goods and services. Tangible personal property, such as clothing, electronics, furniture, and vehicles, are generally subject to sales tax. Additionally, certain services like repair and maintenance, entertainment services, and some professional services fall under the sales tax umbrella.

For instance, when you purchase a new laptop in Nevada, the sales tax is calculated based on the purchase price and added to the total cost. Similarly, when you hire a local contractor for home repairs, the service fee may be subject to sales tax, depending on the nature of the work.

| Category | Sales Tax Rate |

|---|---|

| Tangible Personal Property | 6.85% |

| Select Services | 6.85% |

Exemptions and Special Considerations

While Nevada’s sales tax is comprehensive, there are specific exemptions and special provisions that businesses and consumers should be aware of. Some common exemptions include:

- Grocery Items: Most food items for home consumption are exempt from sales tax in Nevada, providing relief to households on essential grocery purchases.

- Prescription Medications: Sales tax does not apply to the sale of prescription drugs, making healthcare more affordable for Nevadans.

- Educational Materials: Textbooks, school supplies, and certain educational services are exempt, encouraging investment in education.

- Manufacturing Equipment: Sales tax exemptions are often provided for the purchase of machinery and equipment used in manufacturing, fostering industrial growth.

Furthermore, Nevada offers special tax rates for specific industries, such as the lodging industry, which has a separate tax structure. Lodging providers are required to collect and remit a 13.35% tax on room charges, which includes the sales tax and additional lodging taxes.

Impact on Local Economy

Nevada’s sales tax system has a profound impact on the state’s economy, influencing consumer behavior, business operations, and revenue generation.

Revenue Generation

Sales tax is a significant source of revenue for the state government, local authorities, and special districts. The collected funds are utilized for various public services and infrastructure development, ensuring the state’s continued growth and prosperity.

Consumer Behavior

The sales tax rate can influence consumer purchasing decisions. In Nevada, the consistent and moderate sales tax rate may encourage consumers to make local purchases, supporting local businesses and the state’s economy.

Additionally, the exemptions for essential items like groceries and healthcare can provide financial relief to households, making these necessities more affordable.

Business Operations

For businesses operating in Nevada, understanding and complying with the sales tax regulations is crucial. Accurate tax collection and remittance ensure businesses maintain good standing with the state and avoid penalties.

Nevada's sales tax system provides businesses with a clear and straightforward framework, making it easier to manage tax obligations. However, businesses should stay updated with any changes or special provisions to ensure compliance.

Future Outlook

As Nevada continues to evolve, its sales tax system is likely to adapt to meet the changing needs of the state and its residents. Here are some potential future developments and considerations:

- Online Sales Tax: With the growth of e-commerce, the collection of sales tax on online purchases may become a more significant focus for Nevada, ensuring fair competition between online and brick-and-mortar businesses.

- Tax Rate Adjustments: While Nevada's current sales tax rate is relatively moderate, future economic conditions or fiscal needs may prompt adjustments to the rate, impacting both businesses and consumers.

- Special Tax Initiatives: Nevada may explore targeted tax initiatives to support specific industries or communities, such as providing tax incentives for renewable energy projects or small business development.

Nevada's sales tax system is a dynamic component of the state's economic framework, constantly evolving to meet the needs of its residents and businesses. By understanding and adapting to these changes, individuals and businesses can navigate the tax landscape effectively, contributing to Nevada's economic prosperity.

How often does Nevada revise its sales tax rates and regulations?

+Nevada’s sales tax rates and regulations are subject to periodic reviews and updates. The state legislature typically revisits these matters during regular legislative sessions, which occur biennially. Any changes to the sales tax structure are carefully considered to balance the needs of the state’s economy and its residents.

Are there any remote seller laws in Nevada for online businesses?

+Yes, Nevada has implemented remote seller laws to ensure the collection of sales tax on online transactions. These laws require out-of-state sellers who meet certain thresholds to register with the state and collect sales tax on their Nevada sales. This ensures a level playing field for local businesses and generates revenue for the state.

How can businesses stay updated with Nevada’s sales tax regulations?

+Businesses can stay informed by regularly checking the official website of the Nevada Department of Taxation. This website provides the latest updates, guidance, and resources for businesses to understand and comply with sales tax regulations. Additionally, businesses can subscribe to tax newsletters and attend educational workshops to stay informed.