Sc Car Taxes

Understanding the vehicle registration and taxation process is crucial for vehicle owners in South Carolina, as it directly impacts their wallet and ensures compliance with state regulations. The South Carolina Department of Motor Vehicles (SCDMV) manages vehicle registration and taxation, and its processes can be intricate and unique to the state.

Vehicle Registration and Taxes in South Carolina

In South Carolina, vehicle registration and taxes are integral parts of vehicle ownership. The state’s approach to vehicle taxation and registration is designed to fund road maintenance, infrastructure development, and various other transportation-related initiatives. Let’s delve into the specifics of this process.

Vehicle Registration

The South Carolina Department of Motor Vehicles requires all vehicle owners to register their vehicles within 45 days of becoming a resident or purchasing a vehicle. The registration process involves submitting the necessary documentation, including proof of insurance, vehicle title, and identification. Once registered, vehicle owners receive a license plate and a registration card, which must be renewed annually.

| Document Required | Purpose |

|---|---|

| Vehicle Title | Proves ownership |

| Proof of Insurance | Ensures compliance with state liability coverage laws |

| Valid ID | Verifies the owner's identity |

South Carolina offers a 15-day temporary registration for out-of-state residents who have recently moved to the state, allowing them time to complete the full registration process. This temporary registration permits vehicle use within the state during the transition period.

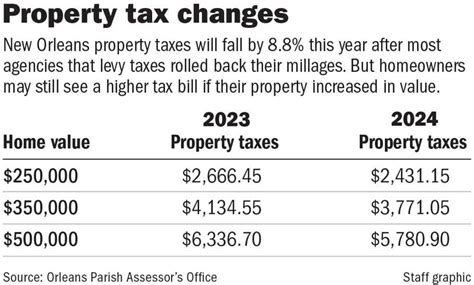

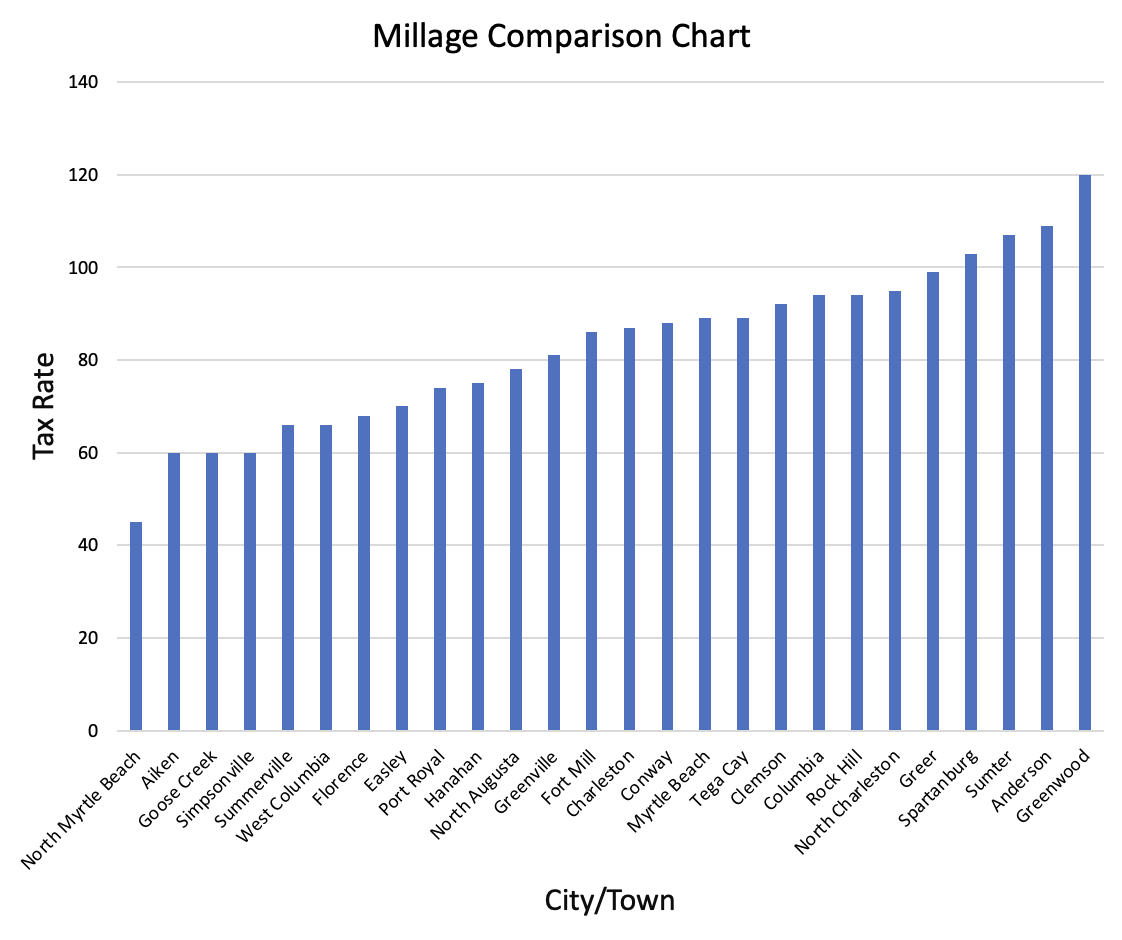

Vehicle Taxes

South Carolina imposes a vehicle property tax, which is collected by the county assessor’s office and varies depending on the vehicle’s value and the county of residence. The tax is based on the vehicle’s assessed value, which is determined by the county assessor and can differ from the purchase price or trade-in value.

Vehicle owners typically receive a property tax bill annually. The bill is mailed to the address on file with the South Carolina Department of Motor Vehicles, and payment is due by a specified deadline. Late payments incur penalties and interest.

| Tax Type | Description |

|---|---|

| Vehicle Property Tax | Based on the vehicle's assessed value and county of residence |

| Sales Tax | Paid at the time of purchase; rate varies by county |

| Registration Fee | Paid annually; varies based on vehicle type and weight |

In addition to the property tax, South Carolina levies a sales tax on vehicle purchases, which varies depending on the county of purchase. This tax is typically paid at the time of purchase and is calculated based on the vehicle's purchase price.

Renewing Registration and Taxes

Vehicle registration renewal in South Carolina is a straightforward process. The SCDMV sends a renewal notice to vehicle owners approximately 60 days before their registration expires. The notice includes a renewal form and instructions for payment. Vehicle owners can renew their registration online, by mail, or in person at a local DMV office.

Renewal notices also include information about tax payments, which are typically due at the same time as registration renewal. Vehicle owners can pay their taxes online, by mail, or in person, using the provided tax bill. It's important to note that late payments may result in additional fees and penalties.

Conclusion: A Comprehensive Understanding

The intricacies of vehicle registration and taxation in South Carolina require a comprehensive understanding to ensure compliance and avoid penalties. From initial registration to annual renewals and tax payments, vehicle owners must navigate a series of steps and adhere to specific timelines.

By familiarizing themselves with the state's vehicle registration and taxation processes, South Carolina vehicle owners can stay informed, avoid surprises, and contribute to the state's transportation infrastructure and initiatives. This understanding is key to a seamless vehicle ownership experience in the Palmetto State.

What is the penalty for late vehicle registration renewal in South Carolina?

+South Carolina imposes a late fee of $10 for each month (or portion thereof) that the vehicle registration is overdue. This fee is in addition to the regular registration fee. It’s important to note that late payments may also result in the suspension of driving privileges and the assessment of additional penalties and interest.

How often do I need to renew my vehicle registration in South Carolina?

+Vehicle registrations in South Carolina must be renewed annually. The SCDMV sends a renewal notice approximately 60 days before the registration expiration date, which includes instructions for renewal and payment.

Can I renew my vehicle registration online in South Carolina?

+Yes, South Carolina offers online renewal for vehicle registrations. To renew online, you will need your SCDMV renewal notice, valid credit or debit card, and the vehicle’s current registration card. Visit the SCDMV website for detailed instructions and requirements.