San Jose Property Tax

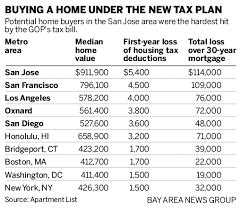

San Jose, the heart of Silicon Valley, is renowned for its thriving tech industry and vibrant culture. However, amidst the bustling cityscape, property owners often grapple with the intricacies of the local property tax system. This comprehensive guide aims to demystify the process, providing an in-depth analysis of San Jose property taxes, complete with real-world examples and industry insights.

Understanding San Jose Property Taxes: A Comprehensive Overview

Property taxes in San Jose, California, are an essential component of the city’s revenue system, playing a pivotal role in funding vital public services and infrastructure. The San Jose Property Tax regime is governed by a set of regulations and processes that can be complex for homeowners and investors alike. By delving into these intricacies, we aim to provide a clear roadmap for understanding and managing your property tax obligations effectively.

How Are San Jose Property Taxes Calculated?

The calculation of property taxes in San Jose involves a multi-step process. It begins with the assessment of the property’s value by the Santa Clara County Assessor’s Office. This value, known as the assessed value, is then used as the basis for tax calculations. The assessed value is determined by considering various factors, including the property’s size, location, and recent sales data of comparable properties.

Once the assessed value is established, it is subjected to a tax rate determined by the local government. This rate is applied to the assessed value to arrive at the property tax amount. The tax rate is typically a combination of the general tax rate set by the city and additional rates for specific services or districts, such as school districts or special assessment districts.

For instance, let's consider a hypothetical property in San Jose with an assessed value of $800,000. If the tax rate for the area is 1.25%, the property tax calculation would be: $800,000 x 0.0125 = $10,000. Thus, the owner of this property would owe $10,000 in property taxes for the year.

| Property Value | Tax Rate | Annual Property Tax |

|---|---|---|

| $500,000 | 1.1% | $5,500 |

| $750,000 | 1.2% | $9,000 |

| $1,000,000 | 1.3% | $13,000 |

Property Tax Payment Schedule and Due Dates

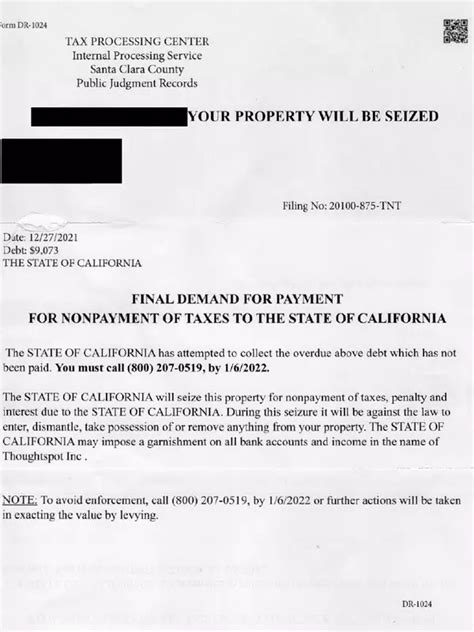

Property taxes in San Jose are typically due in two installments, with the first installment falling due on November 1st and the second on February 1st of the following year. However, it’s crucial to be aware of the delinquency dates, as late payments can incur penalties and interest charges.

For instance, if the first installment is not paid by December 10th, a 10% penalty is applied to the outstanding amount. If the second installment is missed and not paid by April 10th, another 10% penalty is added. It's advisable to mark these dates on your calendar to avoid unnecessary financial burdens.

The Impact of Proposition 13: A Historical Perspective

San Jose’s property tax landscape is deeply influenced by Proposition 13, a landmark legislation passed in California in 1978. This proposition introduced significant reforms, including a cap on the annual increase in assessed property values for tax purposes. Specifically, it limits the annual increase to 2% or the inflation rate, whichever is lower, ensuring that property taxes do not skyrocket overnight.

This provision provides stability for property owners, especially in a city like San Jose where property values have historically been on an upward trajectory. It allows homeowners to plan their finances more predictably and protects them from sudden, drastic increases in their tax obligations.

Managing Property Tax Obligations: Tips and Strategies

Effectively managing your property tax obligations is crucial for financial stability and peace of mind. Here are some strategies and tips to help you navigate the process:

- Stay Informed: Keep yourself updated on any changes to tax rates, assessment procedures, or relevant legislation. The San Jose city website often provides valuable resources and notifications regarding property taxes.

- Explore Exemptions: Research and understand the various property tax exemptions and deductions offered by the city. These can include exemptions for senior citizens, veterans, and certain types of properties. Consulting with a tax professional can help you identify applicable exemptions.

- Review Your Assessment: Regularly review your property assessment to ensure its accuracy. If you believe the assessed value is too high, you can appeal the assessment. The Santa Clara County Assessor's Office provides guidelines and resources for filing an appeal.

- Utilize Online Tools: San Jose offers an online Property Tax Estimator tool that can provide a rough estimate of your property taxes based on your assessed value and the current tax rate. This can be a helpful starting point for financial planning.

- Consider Escrow Accounts: If you have a mortgage, discuss with your lender the option of including property taxes in your monthly payments. This can simplify your financial management and ensure timely tax payments.

The Future of San Jose Property Taxes: A Speculative Outlook

As San Jose continues to evolve and adapt to changing economic and social landscapes, the future of property taxes is likely to be influenced by a range of factors. While it’s challenging to predict with absolute certainty, we can identify several trends and potential developments that may shape the property tax landscape in the years to come.

Potential Impact of Economic Shifts

The economic health of San Jose and the surrounding Silicon Valley region plays a significant role in property tax revenue. If the tech industry, which is a major driver of the local economy, experiences a downturn, it could potentially lead to a decrease in property values and, consequently, a reduction in property tax revenue.

On the other hand, if the tech sector continues its growth trajectory or if other industries gain prominence, it could drive property values upward, resulting in increased property tax revenue for the city. This dynamic underscores the need for a robust and flexible property tax system that can adapt to changing economic conditions.

Urban Development and Housing Trends

The ongoing development and transformation of San Jose’s urban landscape also have implications for property taxes. As the city continues to invest in infrastructure and attract new businesses and residents, property values in certain areas may increase. This could lead to a shift in the distribution of property tax revenue, with some neighborhoods experiencing higher tax burdens than others.

Additionally, the city's efforts to address the housing crisis, such as the construction of affordable housing units, may impact property taxes. While these initiatives are aimed at improving housing accessibility, they could also influence the overall property tax base and the distribution of tax burdens across different income levels.

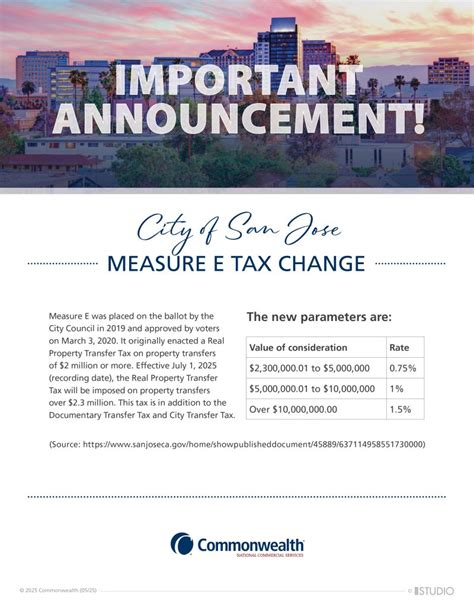

Potential Tax Reform and Legislative Changes

The political landscape and legislative environment in California are subject to change, and this can have a significant impact on property taxes. While Proposition 13 has provided a stable foundation for property tax assessments, there have been ongoing discussions and proposals for tax reform.

Any changes to the current property tax system, whether through new legislation or amendments to existing laws, could have far-reaching implications for property owners in San Jose. It's crucial for homeowners and investors to stay informed about these discussions and advocate for policies that align with their interests and the broader goals of the community.

Environmental Factors and Climate Change

The potential impact of climate change and environmental factors on San Jose’s property tax landscape cannot be overlooked. As the city implements measures to mitigate the effects of climate change, such as sea level rise and extreme weather events, these initiatives may lead to increased public spending and potentially higher property taxes.

Additionally, the adoption of sustainable practices and green infrastructure could influence property values, with eco-friendly homes and developments potentially commanding higher prices. This could, in turn, impact the property tax base and the distribution of tax obligations.

Community Engagement and Tax Policy

The role of community engagement in shaping tax policy is increasingly recognized. As San Jose residents become more involved in local governance, their input on tax issues could influence the direction of property tax policies. This could lead to a more equitable and responsive tax system that better aligns with the needs and priorities of the community.

Moreover, community engagement can foster a deeper understanding of the property tax system and its impact on residents' lives. This understanding can facilitate more informed discussions and decisions about tax policy, leading to a more transparent and accountable system.

Conclusion: Navigating the Complexities of San Jose Property Taxes

Understanding and managing property taxes in San Jose requires a nuanced approach that takes into account a wide range of factors. From the intricate calculation processes and payment schedules to the potential impacts of economic shifts, urban development, and legislative changes, property owners must stay informed and proactive.

By staying abreast of the latest developments, exploring available exemptions and deductions, and advocating for policies that align with their interests, property owners can effectively navigate the complexities of San Jose's property tax landscape. This comprehensive guide aims to provide a solid foundation for that journey, offering insights, strategies, and resources to help you make informed decisions about your property tax obligations.

Can I appeal my property tax assessment if I think it’s too high?

+Yes, you have the right to appeal your property tax assessment if you believe it is inaccurate or too high. The Santa Clara County Assessor’s Office provides a process for filing an appeal. It’s important to gather evidence, such as recent sales data of comparable properties, to support your case.

Are there any property tax exemptions or deductions available in San Jose?

+Yes, San Jose offers several property tax exemptions and deductions. These include exemptions for senior citizens, veterans, disabled persons, and homeowners with certain types of disabilities. Additionally, there are deductions for homeowners who make energy-efficient improvements to their properties.

What happens if I miss a property tax payment deadline?

+Missing a property tax payment deadline can result in penalties and interest charges. If you’re facing financial difficulties, it’s advisable to contact the San Jose Tax Collector’s Office to discuss payment plans or other options to avoid late fees and potential legal consequences.

How can I stay informed about changes to property tax rates and regulations in San Jose?

+Staying informed is crucial for property owners. You can subscribe to notifications and updates from the San Jose city website, which often provides information on tax rate changes, assessment procedures, and other relevant tax-related news. Additionally, local news outlets and community forums can be valuable sources of information.