Sales Tax For Online Sales

The landscape of e-commerce has evolved significantly, and with it, the complexities of tax obligations for online retailers. One of the most prominent challenges is the management of sales tax, a topic that demands a detailed understanding, especially for businesses aiming to expand their online presence.

Understanding Sales Tax in the Digital Realm

Sales tax is a critical component of doing business, and its intricacies become even more pronounced in the online environment. This is especially true in the context of cross-border transactions, where the application of sales tax can be influenced by various factors, including the nature of the goods, the jurisdiction of the buyer, and the policies of the seller's country.

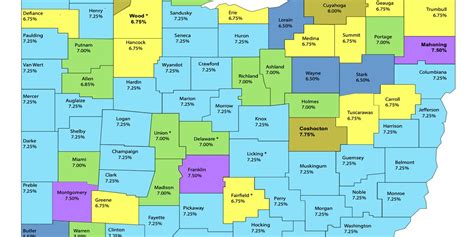

The challenge is further exacerbated by the varying tax rates and regulations across different states and countries. For instance, in the United States, sales tax is imposed at both the state and local levels, resulting in a complex web of tax obligations for online retailers. These obligations are not just limited to the collection of tax but also extend to the remittance of these taxes to the appropriate authorities.

The Nexus Challenge

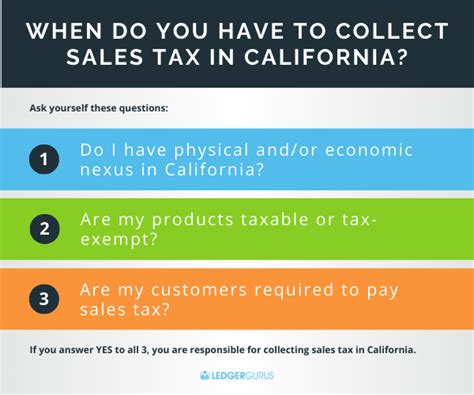

One of the pivotal concepts in understanding sales tax for online sales is the idea of economic nexus. This term refers to the minimum connection or presence a business must have with a state to be subject to its tax laws. In the context of online sales, this can be triggered by a certain level of sales or transactions within a state, even if the business does not have a physical presence there.

The concept of economic nexus has gained prominence with the advent of the Wayfair v. South Dakota Supreme Court decision in 2018. This landmark ruling established that states can require out-of-state sellers to collect and remit sales tax, even without a physical presence in the state. This decision has significantly broadened the tax obligations of many online businesses, especially those with substantial sales across state lines.

Navigating Sales Tax Obligations for Online Sales

Compliance with sales tax regulations for online sales is a complex process that requires careful planning and a robust system for tax management. Here's a comprehensive guide to help online retailers navigate these obligations effectively:

1. Determining Taxability

The first step in managing sales tax for online sales is to determine whether your products or services are taxable. This can vary significantly based on the jurisdiction and the nature of the goods or services being sold. For instance, certain items like groceries or prescription medications might be exempt from sales tax in some states.

It's crucial to stay updated with the tax laws in your jurisdiction and any applicable exemptions. This information is often available on state or country-specific tax websites. For example, in the U.S., the California State Board of Equalization provides detailed guidelines on sales tax applicability and exemptions.

2. Establishing Nexus

Understanding your nexus obligations is critical for online retailers. As mentioned earlier, economic nexus can trigger tax obligations in states where you might not have a physical presence. This can include states where you have substantial sales, affiliates, or even certain types of remote employees.

Online retailers should regularly review their sales data and stay updated with the nexus thresholds of different states. Failing to comply with nexus obligations can result in significant penalties and interest charges. It's also worth noting that some states offer voluntary disclosure agreements, which can help businesses come into compliance without facing penalties.

3. Collecting and Remitting Sales Tax

Once you've determined your taxability and established your nexus obligations, the next step is to collect and remit sales tax. This process involves several critical steps:

- Tax Calculation: This step involves determining the appropriate tax rate for each transaction based on the buyer's location. Many e-commerce platforms offer built-in tax calculation tools, but it's essential to verify these calculations to ensure accuracy.

- Tax Collection: Online retailers must collect the calculated tax amount from the buyer at the time of purchase. This tax is typically included in the total purchase price.

- Tax Remittance: The collected tax must then be remitted to the appropriate tax authority. The frequency of remittance can vary based on your sales volume and the requirements of the jurisdiction. Some states may require monthly or quarterly remittances, while others might allow for annual filings.

4. Simplifying Sales Tax Management

Managing sales tax for online sales can be a complex and time-consuming process. Fortunately, there are several tools and software solutions available to simplify this task. These tools can help with tax calculation, compliance with changing tax rates and regulations, and even with filing and remittance.

Some popular sales tax management solutions include Avalara, TaxJar, and Vertex. These platforms integrate seamlessly with many e-commerce platforms and can help ensure compliance and accuracy in sales tax management.

The Future of Sales Tax for Online Sales

The landscape of sales tax for online sales is constantly evolving, and several trends are shaping the future of this domain. One of the most significant developments is the ongoing debate around a national sales tax, which, if implemented, could significantly simplify the current complex system.

Another trend is the increasing use of automation and artificial intelligence in sales tax management. These technologies can help online retailers stay compliant with changing tax laws and regulations, ensuring they remain up-to-date with the latest tax obligations.

Furthermore, the rise of the gig economy and the increasing popularity of online marketplaces are also influencing the sales tax landscape. As more businesses operate in these spaces, the tax obligations become more complex, and a comprehensive understanding of these obligations is crucial for compliance.

| Metric | Description |

|---|---|

| Sales Tax Rate | Varies by state and jurisdiction, with some states having multiple tax rates depending on the location of the sale. |

| Nexus Thresholds | The amount of sales or transactions that trigger tax obligations in a state. These thresholds vary by state and are often subject to change. |

| Taxable Items | Varies based on jurisdiction and the nature of the goods or services. Some items, like groceries or prescription medications, might be exempt from sales tax. |

Frequently Asked Questions

What is the difference between economic nexus and physical presence nexus?

+Economic nexus refers to the minimum connection a business must have with a state to be subject to its tax laws, often triggered by a certain level of sales or transactions. Physical presence nexus, on the other hand, requires a business to have a physical presence in a state, such as a warehouse or office, to trigger tax obligations.

<div class="faq-item">

<div class="faq-question">

<h3>How often should I register for sales tax and remit payments?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The frequency of registration and remittance can vary based on your sales volume and the requirements of the jurisdiction. Some states may require monthly or quarterly filings, while others might allow for annual filings. It's essential to stay updated with the regulations in your specific jurisdiction.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I don't comply with sales tax obligations for online sales?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Non-compliance with sales tax obligations can result in significant penalties and interest charges. In some cases, businesses might also be required to pay back taxes with interest. It's crucial to stay informed about your tax obligations to avoid these consequences.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any exemptions or special considerations for certain types of online sales?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are various exemptions and special considerations for certain types of online sales. For instance, some states offer exemptions for specific items like groceries or prescription medications. It's essential to stay updated with the latest tax laws and consult with a tax professional if needed.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I simplify the process of managing sales tax for my online business?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Simplifying sales tax management often involves the use of specialized software or tools. These solutions can help with tax calculation, compliance with changing tax rates and regulations, and even with filing and remittance. Some popular options include Avalara, TaxJar, and Vertex.</p>

</div>

</div>