Sale Tax In California

Welcome to an in-depth exploration of the intricate world of sales tax in the Golden State. California, with its diverse economy and dynamic business landscape, has a sales tax system that is both complex and vital to its fiscal health. This article aims to shed light on the intricacies of sales tax in California, offering a comprehensive guide for businesses and consumers alike.

Understanding Sales Tax in California

Sales tax in California is a critical component of the state’s revenue stream, playing a pivotal role in funding essential public services and infrastructure projects. It is a consumption tax levied on the sale of goods and certain services within the state. The tax is collected by businesses at the point of sale and then remitted to the California Department of Tax and Fee Administration (CDTFA), which oversees tax collection and enforcement.

The sales tax rate in California is not a uniform percentage across the state. Instead, it is a combination of state, county, and city rates, which can vary significantly depending on the location of the transaction. This complex structure is designed to allow local governments to raise additional revenue for their specific needs, such as local projects and services.

Key Features of California’s Sales Tax System

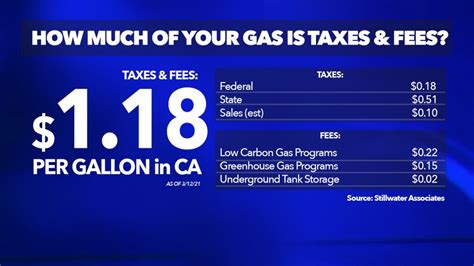

One unique aspect of California’s sales tax system is the use tax, which is often overlooked by consumers. Use tax applies to purchases made outside of California but used or stored within the state. This includes online purchases from out-of-state retailers. It is the consumer’s responsibility to report and pay use tax on these transactions. This system ensures that all purchases, regardless of where they are made, contribute to the state’s revenue.

California also imposes a sales and use tax on certain digital products and services, including cloud computing services, software-as-a-service (SaaS), and digital content. This has become increasingly important as the state's economy shifts towards a more digital and service-based model.

Furthermore, California's sales tax system includes a resale certificate process, which allows businesses to purchase goods tax-free when those goods will be resold. This certificate is a crucial tool for businesses to manage their tax obligations effectively.

| Tax Type | Description |

|---|---|

| Sales Tax | Tax on retail sales of tangible personal property and certain services. |

| Use Tax | Tax on goods purchased outside the state and brought into California for use. |

| Digital Services Tax | Tax on cloud services, SaaS, and digital content. |

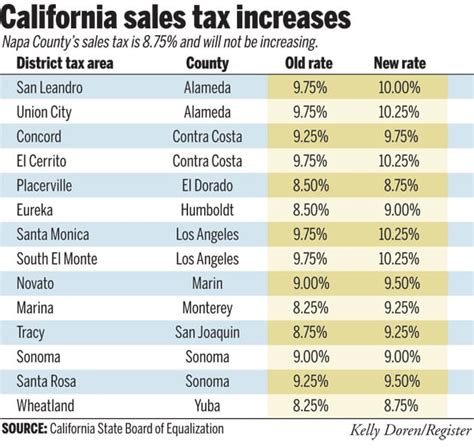

Sales Tax Rates Across California

As mentioned earlier, sales tax rates in California are not uniform. The state sales tax rate is currently 7.25%, but when combined with local rates, the total sales tax can range from approximately 7.25% to over 10% in certain areas. This variation is due to the addition of county and city-specific tax rates.

Examples of Local Sales Tax Rates

Here are a few examples of total sales tax rates in different parts of California:

- Los Angeles: The combined sales tax rate in LA is 10.25%, which includes the state rate of 7.25% plus a county rate of 0.25% and a city rate of 2.75%.

- San Francisco: In San Francisco, the total sales tax is 8.75%, comprising the state rate and a local rate of 1.5%.

- San Diego: San Diego's sales tax rate is 7.75%, which is the state rate plus an additional 0.5% county rate.

- Sacramento: The sales tax in Sacramento is 8.25%, including a 1% city rate.

These variations in sales tax rates can significantly impact businesses and consumers. For instance, a product priced at $100 in Los Angeles would have a total sales tax of $10.25, whereas the same product in Sacramento would have a sales tax of $8.25.

| City | Total Sales Tax Rate | Breakdown |

|---|---|---|

| Los Angeles | 10.25% | State: 7.25%, County: 0.25%, City: 2.75% |

| San Francisco | 8.75% | State: 7.25%, Local: 1.5% |

| San Diego | 7.75% | State: 7.25%, County: 0.5% |

| Sacramento | 8.25% | State: 7.25%, City: 1% |

Sales Tax Registration and Compliance

Registering for a Seller’s Permit is a crucial step for businesses operating in California. This permit, issued by the CDTFA, allows businesses to collect and remit sales tax. It is a legal requirement for most businesses selling tangible goods or certain services in the state.

The Registration Process

To register for a Seller’s Permit, businesses typically need to provide the following information:

- Business entity details, including legal name, address, and type of business.

- Owner or principal officer's information.

- A brief description of the business's activities.

- The date the business began or will begin selling in California.

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN) for sole proprietorships.

Once registered, businesses must collect sales tax at the applicable rate for their location and remit it to the CDTFA on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to annually.

Compliance Challenges

Compliance with California’s sales tax regulations can be complex, especially for businesses with multiple locations or those selling online. Keeping track of varying tax rates, reporting deadlines, and changing regulations requires a robust tax management system.

Businesses also need to stay informed about sales tax holidays, which are periods when certain items are exempt from sales tax. These holidays are often declared to boost consumer spending and can vary in duration and applicable items.

Impact on E-commerce and Online Sales

With the rise of e-commerce, California has implemented measures to ensure that online sales contribute to the state’s revenue. The Marketplace Facilitator Law, for instance, requires online marketplaces and third-party sellers to collect and remit sales tax on behalf of their vendors. This law has had a significant impact on the e-commerce landscape in California.

Challenges for Online Businesses

Online businesses, especially those with a physical presence in multiple states, face unique challenges in managing sales tax compliance. They must navigate the complexities of varying tax rates, nexus laws, and reporting requirements in each state they operate in or sell to. This often requires sophisticated tax management tools and legal expertise.

Additionally, the concept of economic nexus has become increasingly important. This is the idea that a business's economic presence in a state, rather than a physical presence, can trigger sales tax collection obligations. California has established economic nexus thresholds, which, if met, require out-of-state sellers to collect and remit sales tax.

Future Outlook and Potential Changes

The sales tax landscape in California is subject to ongoing changes and developments. Here are some potential future trends and changes:

- Expansion of Sales Tax Base: California may consider expanding the list of taxable services to generate additional revenue. This could include services currently exempt, such as some professional services or certain entertainment activities.

- Simplification of Tax Rates: While it is unlikely, there have been discussions about simplifying the sales tax system by reducing the number of tax rates or implementing a uniform rate across the state. This could streamline tax collection and reduce compliance challenges.

- Increased Focus on E-commerce: With the continued growth of online sales, California may implement further measures to ensure compliance and tax collection from online sellers. This could include stricter enforcement of economic nexus rules or the introduction of new laws targeting online marketplaces.

Staying informed about these potential changes is crucial for businesses operating in California. It allows them to adapt their tax strategies and ensure ongoing compliance with the state's tax regulations.

Conclusion

California’s sales tax system is a complex yet vital part of the state’s fiscal framework. It provides funding for essential services and infrastructure while also presenting unique challenges for businesses and consumers. Understanding the intricacies of this system, from varying tax rates to compliance requirements, is essential for anyone doing business in the Golden State.

By staying informed and utilizing the right tools and expertise, businesses can navigate the complexities of California's sales tax landscape and ensure they are contributing to the state's economic vitality while also maintaining compliance and financial health.

What is the current state sales tax rate in California?

+

The current state sales tax rate in California is 7.25%. This rate is consistent across the state, but when combined with local rates, the total sales tax can vary significantly.

How often do businesses need to remit sales tax in California?

+

The frequency of sales tax remittance depends on the business’s sales volume. Generally, businesses with higher sales volumes remit more frequently, while smaller businesses may remit on a quarterly or annual basis.

Are there any sales tax holidays in California?

+

Yes, California occasionally declares sales tax holidays. During these periods, certain items are exempt from sales tax. These holidays are typically short-term events aimed at boosting consumer spending.

How does California’s sales tax system affect online businesses?

+

California has implemented laws like the Marketplace Facilitator Law to ensure that online sales contribute to the state’s revenue. This requires online marketplaces and third-party sellers to collect and remit sales tax on behalf of their vendors. Additionally, the concept of economic nexus has made it more likely for out-of-state sellers to have sales tax collection obligations in California.