Real Estate Tax Attorney

In the complex world of real estate transactions, one aspect that often requires expert guidance is navigating the intricate web of taxes. This is where the role of a Real Estate Tax Attorney becomes indispensable. These legal professionals are not just tax advisors but strategic partners, offering a comprehensive range of services to ensure that property owners, investors, and developers are compliant with the law and make the most of their real estate ventures. Let's delve into the vital role these attorneys play and how they contribute to the success and security of real estate endeavors.

The Crucial Role of Real Estate Tax Attorneys

A Real Estate Tax Attorney serves as a legal guardian of property rights and financial interests. They are equipped with the knowledge and expertise to handle a diverse array of tax-related matters, from straightforward property tax issues to complex transactions and disputes. Their services are invaluable at every stage of a real estate journey, from the initial acquisition or development phase to ongoing ownership and eventual sale.

Tax Planning and Strategy

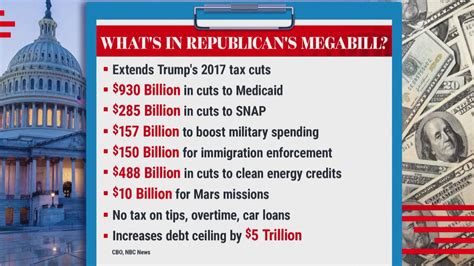

One of the primary roles of a Real Estate Tax Attorney is to provide strategic tax planning. This involves analyzing the tax implications of a property transaction and developing a plan to minimize tax liabilities. They advise on the most tax-efficient structures for property ownership, considering factors like entity formation, ownership transfers, and tax benefits associated with different ownership types.

For instance, an attorney might recommend forming a limited liability company (LLC) to shield personal assets from business liabilities and take advantage of pass-through taxation. In another scenario, they could advise on the optimal timing for a property sale to maximize capital gains tax benefits.

| Strategy | Tax Benefit |

|---|---|

| LLC Formation | Asset Protection, Pass-Through Taxation |

| Timing of Property Sale | Capital Gains Tax Minimization |

Property Tax Appeals

Real estate taxes can be a significant burden on property owners, and sometimes, these taxes are assessed unfairly or inaccurately. A Real Estate Tax Attorney steps in to protect the interests of their clients by challenging excessive or erroneous property tax assessments. They work with appraisers and tax assessors to ensure that property values are accurately reflected and that taxes are fair and equitable.

For instance, if a property has been damaged by a natural disaster or has lost value due to a change in zoning regulations, an attorney can advocate for a reduction in the property tax assessment, potentially saving the owner thousands of dollars.

Real Estate Transactions and Due Diligence

When it comes to buying or selling real estate, a Real Estate Tax Attorney is an essential partner. They conduct thorough due diligence, reviewing tax records, liens, and encumbrances to ensure a smooth and secure transaction. They also advise on the tax implications of the transaction, ensuring that the client is aware of any potential tax liabilities or benefits.

In a complex real estate deal, an attorney might uncover hidden tax liabilities, such as unpaid property taxes or transfer taxes, and negotiate with the other party to address these issues before closing the deal.

Estate Planning and Inheritance

Real estate often forms a significant part of an individual’s estate, and a Real Estate Tax Attorney can play a crucial role in estate planning. They advise on the most tax-efficient ways to transfer property to heirs, ensuring that the estate is protected and that beneficiaries receive the maximum benefit.

For example, an attorney might recommend the use of a Qualified Personal Residence Trust (QPRT) to reduce estate taxes on a primary residence, allowing the owner to retain use of the property during their lifetime while transferring ownership to their heirs.

The Expertise and Value of Real Estate Tax Attorneys

Real Estate Tax Attorneys bring a unique combination of legal and financial expertise to the table. They are well-versed in tax laws and regulations, real estate practices, and the intricacies of property ownership. Their value lies not only in their ability to navigate complex tax issues but also in their strategic approach to real estate transactions.

By working with a Real Estate Tax Attorney, clients can rest assured that their financial interests are protected and that they are making the most of the tax benefits available to them. Whether it’s minimizing tax liabilities, maximizing tax incentives, or ensuring a smooth and secure real estate transaction, these attorneys are an invaluable asset in the world of real estate.

What is the primary role of a Real Estate Tax Attorney?

+A Real Estate Tax Attorney’s primary role is to provide strategic tax planning and guidance to property owners, investors, and developers. They ensure compliance with tax laws and regulations, minimize tax liabilities, and maximize tax benefits associated with real estate transactions.

How can a Real Estate Tax Attorney help with property tax assessments?

+They can challenge excessive or erroneous property tax assessments, working with tax authorities to ensure that property values are accurately reflected and that taxes are fair and equitable. This can result in significant savings for property owners.

What are some common tax strategies employed by Real Estate Tax Attorneys?

+Strategies may include forming limited liability companies (LLCs) for asset protection and pass-through taxation, timing property sales to maximize capital gains tax benefits, and utilizing trusts like the Qualified Personal Residence Trust (QPRT) for estate planning and tax efficiency.