Paypal And Taxes

PayPal is a widely used online payment platform that offers convenient and secure transactions for individuals and businesses alike. With its global reach and user-friendly interface, PayPal has become an integral part of the digital economy. However, when it comes to taxes, the relationship between PayPal and its users can become a bit more complex. In this comprehensive guide, we will delve into the world of PayPal and taxes, exploring the various aspects that users should be aware of to ensure compliance and maximize their financial well-being.

Understanding PayPal’s Role in Taxation

PayPal acts as an intermediary for financial transactions, facilitating payments between buyers and sellers. While it simplifies the payment process, it also introduces certain complexities when it comes to tax obligations. As a platform that handles monetary transactions, PayPal plays a crucial role in helping users understand and meet their tax responsibilities.

One of the key aspects to understand is that PayPal is not a tax advisor or consultant. Its primary function is to provide a secure payment gateway, and it is up to the users to ensure they comply with the tax laws and regulations applicable to their transactions.

Tax Implications for Individuals and Businesses

The tax implications of using PayPal can vary depending on whether you are an individual user or a business entity. Let’s explore these differences and provide a comprehensive overview of the tax considerations for both.

Individuals and Personal Transactions

For individuals using PayPal to make personal purchases or receive payments for small-scale activities, such as selling second-hand items or offering freelance services, the tax obligations are generally simpler.

In most cases, individuals are not required to pay taxes on income earned through casual or sporadic activities. However, it is essential to understand the tax thresholds and regulations in your jurisdiction. Some countries have specific rules regarding the reporting of income from online activities, including PayPal transactions.

For instance, in the United States, the Internal Revenue Service (IRS) considers income from freelance work or online sales as taxable income. Individuals must report and pay taxes on such earnings if they exceed certain thresholds. The IRS provides guidelines and resources to help individuals understand their tax obligations, including the use of Schedule C for self-employment income.

It is crucial for individuals to maintain proper records of their PayPal transactions, including the dates, amounts, and purposes of each transaction. This documentation will be valuable when filing tax returns and can help in case of any audits or inquiries from tax authorities.

Businesses and Commercial Activities

Businesses that utilize PayPal for their commercial activities face more stringent tax obligations. PayPal provides businesses with tools and resources to manage their financial transactions efficiently, but it is the responsibility of the business owners to ensure tax compliance.

When a business receives payments through PayPal, it is considered income and must be reported accurately on the business's tax return. The specific tax treatment of this income depends on the business structure and the country's tax laws.

For example, in the United Kingdom, businesses are required to register for Value Added Tax (VAT) if their annual turnover exceeds a certain threshold. PayPal provides businesses with the option to collect VAT on their behalf, which simplifies the process but also introduces additional reporting requirements.

Businesses should consult with tax professionals or seek guidance from their local tax authorities to understand the specific tax obligations related to their PayPal transactions. This includes staying updated on any changes in tax laws and regulations that may impact their business.

PayPal’s Tax Reporting Features

PayPal recognizes the importance of tax compliance for its users and has implemented various features to assist with tax reporting and management.

Transaction History and Reporting Tools

PayPal provides a detailed transaction history for users, allowing them to track and organize their financial activities. This feature is particularly useful for tax purposes, as it provides a comprehensive record of all transactions, including dates, amounts, and recipient or sender details.

Users can download their transaction history in various formats, such as CSV or PDF, which can be easily imported into accounting software or tax preparation tools. This streamlined approach simplifies the process of compiling the necessary information for tax filings.

Tax Documents and Forms

Depending on the user’s location and transaction volume, PayPal may issue tax documents or forms to assist with tax reporting. These documents typically include information such as the total income received through PayPal, the number of transactions, and other relevant details.

For instance, in the United States, PayPal may issue a 1099-K form to certain users who meet specific criteria, such as having a high volume of transactions or exceeding a certain income threshold. This form is then used by the user to report their PayPal income on their tax return.

It is essential for users to review and understand the tax documents provided by PayPal and ensure they are accurately reflected in their tax filings. In some cases, additional information or clarification may be required from PayPal's support team.

Managing Tax Obligations with PayPal

To ensure a smooth and compliant tax experience, it is beneficial for PayPal users to adopt certain practices and leverage the platform’s features effectively.

Separate Business and Personal Accounts

If you operate a business and use PayPal for both personal and business transactions, it is advisable to maintain separate accounts. This segregation helps in accurately tracking business income and expenses, making tax reporting more straightforward.

By keeping personal and business transactions separate, you can easily identify which transactions are taxable and ensure proper record-keeping for tax purposes.

Regular Reconciliation and Record-Keeping

Reconciliation is a crucial practice for managing tax obligations. Regularly reconcile your PayPal transactions with your financial records to ensure accuracy and identify any discrepancies.

Maintain a detailed record of all transactions, including any fees, refunds, or adjustments made through PayPal. This practice will not only assist with tax reporting but also help in identifying any potential errors or fraudulent activities.

Utilize PayPal’s Business Tools

PayPal offers a range of business tools and features designed to streamline financial management. These tools can assist businesses in managing their tax obligations more efficiently.

For example, PayPal's invoicing feature allows businesses to create and send professional invoices to their clients. This not only simplifies the payment process but also provides a clear record of transactions, making tax reporting easier.

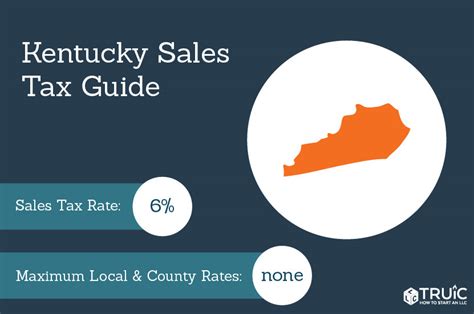

Tax Considerations for International Transactions

PayPal’s global presence opens up opportunities for international transactions, but it also introduces additional tax considerations.

Cross-Border Transactions and VAT

When conducting cross-border transactions, businesses and individuals must consider the Value Added Tax (VAT) implications. Depending on the country and the nature of the transaction, VAT may be applicable and must be properly accounted for.

PayPal provides options for businesses to collect and remit VAT on their behalf, simplifying the process. However, it is crucial to understand the VAT regulations in the relevant jurisdictions and ensure compliance.

Foreign Exchange and Currency Conversion

International transactions often involve currency conversion, which can have tax implications. PayPal automatically converts currencies using market rates, but it is essential to understand the tax treatment of such conversions.

Businesses should consult with tax advisors to determine the appropriate accounting methods for currency conversions and ensure compliance with tax regulations. This includes understanding the treatment of gains or losses arising from currency fluctuations.

Staying Informed and Seeking Professional Advice

Tax laws and regulations can be complex and often evolve over time. It is crucial for PayPal users to stay informed about any changes that may impact their tax obligations.

Tax Updates and Resources

PayPal provides resources and updates related to tax obligations on its website. Users should regularly check these resources to stay updated on any new developments or changes in tax laws that may affect their transactions.

Additionally, PayPal's support team can provide guidance and assistance regarding tax-related matters. They can offer insights into specific features or tools that may help with tax compliance.

Consulting Tax Professionals

For more complex tax situations or to ensure comprehensive compliance, consulting a tax professional or accountant is highly recommended. They can provide personalized advice and guidance based on your specific circumstances.

Tax professionals can help you navigate the intricacies of tax laws, especially when dealing with international transactions or complex business structures. They can also assist in preparing tax returns and ensuring you maximize any available tax benefits or deductions.

Conclusion: Navigating PayPal and Taxes with Confidence

Understanding the tax implications of using PayPal is essential for both individuals and businesses. By being aware of their tax obligations and leveraging the tools provided by PayPal, users can navigate the tax landscape with confidence.

Whether it's maintaining proper records, staying updated on tax regulations, or seeking professional advice, taking a proactive approach to tax management can ensure a smooth and compliant experience. PayPal's role as a trusted payment platform extends beyond facilitating transactions, and its tax-related features and resources contribute to a positive user experience.

As you continue to utilize PayPal for your financial transactions, remember to stay informed, seek guidance when needed, and embrace the benefits of a well-managed tax strategy. With a solid understanding of PayPal and taxes, you can focus on growing your personal finances or business ventures while remaining compliant with tax laws.

What tax documents does PayPal provide to users?

+PayPal provides various tax documents depending on the user’s location and transaction volume. For example, in the United States, PayPal may issue a 1099-K form to certain users who meet specific criteria. It is essential to review and understand these documents and include them in your tax filings accurately.

How can I manage tax obligations when using PayPal for both personal and business transactions?

+It is recommended to maintain separate PayPal accounts for personal and business transactions. This segregation simplifies record-keeping and tax reporting. Additionally, regularly reconcile your transactions and keep detailed records to ensure accuracy and compliance.

Are there any tax benefits or deductions available for businesses using PayPal?

+Yes, businesses may be eligible for certain tax benefits or deductions related to their PayPal transactions. Consulting with a tax professional can help identify these opportunities and ensure you maximize any available tax savings.

What should I do if I receive a tax notice or inquiry related to my PayPal transactions?

+If you receive a tax notice or inquiry, it is crucial to respond promptly and accurately. Gather all relevant documentation, including your PayPal transaction history and any tax documents provided by PayPal. Seek guidance from a tax professional to ensure a proper response and resolve any issues effectively.