Ok State Tax Refund

Tax refunds are an important aspect of personal finance, providing individuals and families with a potential boost to their financial health. In Oklahoma, residents eagerly await their Oklahoma State Tax Refunds, which can offer much-needed relief and an opportunity to plan for the future. This comprehensive guide delves into the intricacies of Oklahoma's tax refund process, exploring how residents can maximize their returns and navigate the system efficiently.

Understanding the Oklahoma Tax System

Oklahoma operates under a progressive income tax system, which means that as your income increases, so does your tax rate. This approach aims to ensure that those with higher incomes contribute a larger proportion of their earnings to the state's revenue. The state levies taxes on various income sources, including wages, salaries, investments, and business profits. However, it's important to note that Oklahoma does not impose an estate or inheritance tax.

The Oklahoma Tax Commission is the primary authority responsible for collecting and administering state taxes. They provide resources and guidelines to help taxpayers understand their obligations and navigate the complex world of tax filings. Understanding the tax system is crucial, as it forms the basis for claiming refunds accurately and efficiently.

Income Tax Brackets in Oklahoma

Oklahoma's income tax system is divided into six tax brackets, each with its own tax rate. These brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0% - $10,000 | 0% |

| $10,001 - $20,000 | 1.25% |

| $20,001 - $30,000 | 2.5% |

| $30,001 - $50,000 | 3.5% |

| $50,001 - $75,000 | 4.75% |

| $75,001 and above | 5% |

These tax rates are applied to your taxable income, which is your total income minus any applicable deductions and exemptions.

Tax Credits and Deductions

Oklahoma offers a range of tax credits and deductions to help reduce the tax burden on its residents. These include deductions for medical expenses, charitable contributions, and mortgage interest. Additionally, Oklahoma provides tax credits for various expenses, such as education costs, dependent care, and even certain energy-efficient home improvements.

Understanding the eligibility criteria and claiming these credits can significantly impact your tax refund. It's crucial to stay informed about the latest tax laws and consult with tax professionals to ensure you're taking advantage of all available benefits.

Filing Your Oklahoma Tax Return

Filing your Oklahoma tax return is a crucial step in claiming your refund. The process can be completed online or through traditional paper filing. The Oklahoma Tax Commission provides a user-friendly online filing system, making it convenient for taxpayers to submit their returns electronically.

Online Filing

The online filing system, known as OK.gov, offers a secure and efficient way to file your taxes. Here's a step-by-step guide to help you navigate the process:

- Visit the OK.gov website and create an account if you haven't already.

- Gather all the necessary documents, including your W-2 forms, 1099s, and any other relevant tax documents.

- Log in to your account and select the "File Taxes" option.

- Follow the step-by-step instructions to enter your personal information, income details, and deductions.

- Review your return carefully before submitting. The system will calculate your refund amount based on the information provided.

- Choose your preferred refund method: direct deposit or check.

- Submit your return, and you'll receive a confirmation number.

Online filing is not only convenient but also provides real-time updates on the status of your refund. You can check the progress of your refund through your OK.gov account or by using the Oklahoma Tax Commission's refund status tool.

Paper Filing

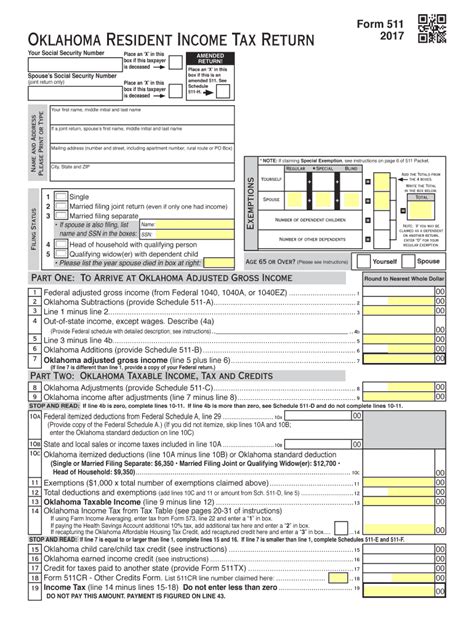

If you prefer a more traditional approach or have complex tax situations, you can opt for paper filing. The Oklahoma Tax Commission provides paper tax forms that you can download or request by mail. Here's a brief overview of the process:

- Download the appropriate tax forms from the Oklahoma Tax Commission website or request them by mail.

- Fill out the forms accurately, ensuring you include all necessary documentation.

- Mail your completed forms to the address specified on the tax return instructions.

- Keep a copy of your filed return for your records.

Paper filing may take longer to process, and you won't have access to real-time refund status updates. However, it provides a more tangible record of your tax return.

Maximizing Your Oklahoma Tax Refund

Maximizing your Oklahoma tax refund involves more than just accurate filing. It requires a strategic approach to take advantage of all the deductions, credits, and exemptions available to you.

Deductions and Exemptions

Oklahoma allows various deductions and exemptions that can reduce your taxable income. Some common deductions include:

- Standard Deduction: A fixed amount that reduces your taxable income. The standard deduction amount varies based on your filing status.

- Itemized Deductions: These are specific expenses that you can deduct from your taxable income, such as medical expenses, state and local taxes, and mortgage interest.

- Exemptions: Oklahoma allows personal exemptions for yourself, your spouse, and your dependents. These exemptions further reduce your taxable income.

By claiming all applicable deductions and exemptions, you can significantly lower your tax liability and increase your refund.

Tax Credits

Tax credits are powerful tools that can directly reduce the amount of tax you owe. Oklahoma offers a range of tax credits, including:

- Child and Dependent Care Credit: This credit helps offset the costs of childcare or dependent care expenses while you work or attend school.

- Education Credits: Oklahoma provides credits for qualifying education expenses, such as tuition and fees for higher education.

- Earned Income Tax Credit (EITC): The EITC is a refundable credit for low- to moderate-income workers. It can provide a significant boost to your refund if you qualify.

Understanding which tax credits you're eligible for and claiming them correctly can have a substantial impact on your refund amount.

Tax Planning Strategies

Effective tax planning can help you optimize your tax refund and potentially reduce your tax liability for future years. Here are some strategies to consider:

- Maximize Retirement Contributions: Contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can reduce your taxable income and potentially increase your refund.

- Review Investment Strategies: Consider the tax implications of your investment choices. Capital gains and losses can impact your tax liability and refund.

- Claim Business Expenses: If you're self-employed or have a side business, make sure to claim all legitimate business expenses to reduce your taxable income.

- Educational Planning: Take advantage of education credits and deductions for yourself or your dependents to reduce your tax burden.

Working with a tax professional or financial advisor can help you develop a tailored tax planning strategy that aligns with your financial goals.

Tracking Your Oklahoma Tax Refund

Once you've filed your tax return, the waiting game begins. It's important to track your refund status to ensure everything is processing smoothly and to estimate when you can expect your refund.

Refund Status Tools

The Oklahoma Tax Commission provides online tools to help you track the status of your refund. You can use the Where's My Refund tool on the OK.gov website or the Oklahoma Tax Commission's official website. Here's how to use it:

- Visit the Where's My Refund page on the OK.gov website.

- Enter your Social Security Number, filing status, and the exact amount of your expected refund.

- Click "Submit," and the tool will provide you with the current status of your refund.

The tool will update regularly, giving you an estimate of when your refund will be processed and issued.

Direct Deposit or Check

When filing your tax return, you'll have the option to choose between direct deposit and a check for your refund. Direct deposit is typically the faster option, as it eliminates the time it takes for a check to be mailed and processed.

If you opt for direct deposit, make sure your bank account information is accurate and up-to-date. Any errors in account details can delay your refund.

Refund Timelines

The timeline for receiving your Oklahoma tax refund can vary depending on several factors, including the method of filing and the complexity of your tax return. On average, electronic filers can expect to receive their refund within 7-14 days, while paper filers may wait up to 6-8 weeks.

It's important to note that refunds may be delayed due to various reasons, such as errors on your tax return, additional reviews by the Oklahoma Tax Commission, or issues with your bank account information (in the case of direct deposit). Staying informed and tracking your refund status can help you anticipate any potential delays.

Common Questions and Concerns

What if I made a mistake on my tax return?

+If you discover a mistake on your tax return after filing, you can file an amended return using Form 511-A. It's important to correct any errors as soon as possible to avoid potential penalties or interest charges.

How can I avoid tax-related identity theft?

+To protect yourself from tax-related identity theft, consider using strong passwords for your online tax accounts, enabling two-factor authentication, and being cautious of phishing attempts. It's also a good idea to regularly monitor your credit reports and tax accounts for any suspicious activity.

Can I get a refund if I owe taxes?

+If you owe taxes but have overpaid during the year, you may be eligible for a refund. However, if you owe more than your overpayment, you will need to settle the remaining balance. It's essential to review your tax obligations carefully to avoid surprises.

What happens if I don't receive my refund within the estimated timeframe?

+If you don't receive your refund within the estimated timeframe, it's recommended to contact the Oklahoma Tax Commission. They can help you investigate the delay and provide updates on the status of your refund.

Understanding the Oklahoma tax system, filing your return accurately, and maximizing your refund can make a significant difference in your financial well-being. By staying informed and taking advantage of available resources, you can navigate the tax refund process with confidence and make the most of your hard-earned money.