Ohio Sales Tax Calculator

Welcome to this comprehensive guide on the Ohio Sales Tax Calculator, an essential tool for businesses and individuals alike in the Buckeye State. Ohio's sales tax system can be complex, with varying rates and regulations, so having an accurate calculator is crucial for compliance and financial planning. In this article, we will delve into the intricacies of Ohio's sales tax, explore the features of the calculator, and provide practical insights to help you navigate this essential aspect of doing business in Ohio.

Understanding Ohio’s Sales Tax Landscape

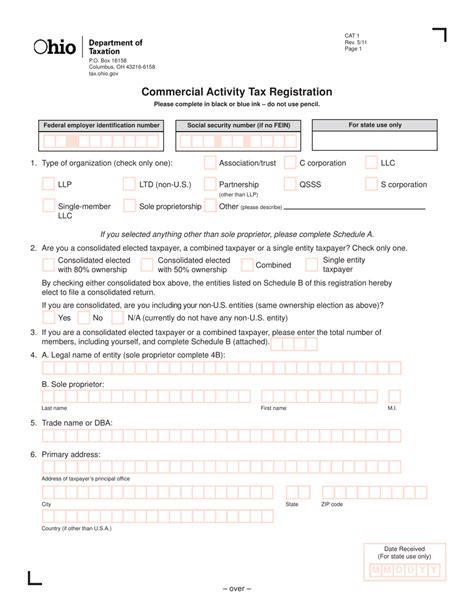

Ohio’s sales tax system is a vital component of the state’s revenue stream, contributing to essential services and infrastructure development. The state sales tax rate is currently set at 5.75%, but it’s important to note that local jurisdictions may impose additional taxes, resulting in a combined rate that varies across the state. These local taxes can significantly impact the total sales tax liability, making it essential for businesses to stay updated on the latest rates.

Ohio's sales tax is applied to a wide range of goods and services, including retail sales, rentals, and certain services. However, there are also specific exemptions and special provisions, such as the Ohio Sales Tax Holiday, which offers a tax-free period for certain items like school supplies and clothing. Understanding these nuances is crucial for accurate tax calculation and compliance.

The Ohio Sales Tax Calculator: A Powerful Tool

The Ohio Sales Tax Calculator is a sophisticated online tool designed to simplify the process of calculating sales tax for businesses and consumers in Ohio. Developed by tax experts with a deep understanding of Ohio’s tax laws, this calculator offers a user-friendly interface and accurate calculations, ensuring compliance and ease of use.

Key Features of the Calculator

- Customizable Tax Rates: The calculator allows users to input the applicable state and local tax rates for their specific location. This feature ensures that the calculated tax is precise and up-to-date, reflecting the latest tax regulations.

- Bulk Calculation: Businesses can input multiple transactions simultaneously, saving time and effort. This feature is particularly beneficial for retailers processing a high volume of sales.

- Tax Exemption Management: The calculator provides an option to exclude specific items from sales tax, accommodating Ohio’s various tax exemptions and special provisions. This ensures that businesses can accurately calculate tax liabilities for different product categories.

- Historical Data Analysis: Users can access historical sales data and analyze trends over time. This feature is invaluable for financial planning and identifying areas where tax strategies can be optimized.

- Error Prevention: The calculator incorporates built-in checks to prevent common errors, such as incorrect tax rate inputs or calculation mistakes. This ensures accurate results and minimizes the risk of compliance issues.

Real-World Application

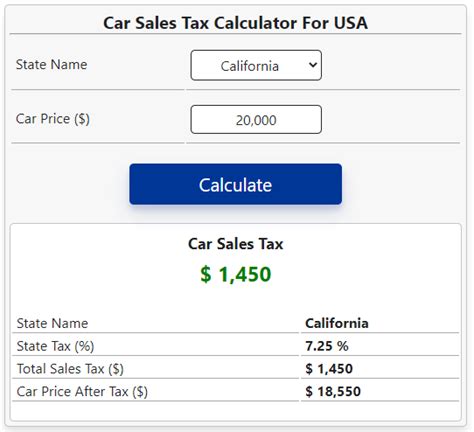

Let’s consider a scenario to illustrate the practical use of the Ohio Sales Tax Calculator. Imagine a retailer in Cleveland, Ohio, selling a range of goods, from electronics to clothing. With the calculator, they can easily input the state sales tax rate (5.75%) and the local tax rate for Cleveland (2.25%), resulting in a combined rate of 8% for their location. The calculator then applies this rate to each sale, providing an accurate breakdown of the tax component.

| Product | Price | Sales Tax |

|---|---|---|

| Smartphone | $500 | $40 |

| Jeans | $80 | $6.40 |

| Laptop | $1200 | $96 |

| Total Sales Tax | $142.40 |

In this example, the calculator not only provides the total sales tax but also breaks down the tax for each item, offering transparency and clarity for both the retailer and the customer. This level of detail is crucial for accurate record-keeping and tax reporting.

Performance and Accuracy

The Ohio Sales Tax Calculator has undergone rigorous testing and is continuously updated to ensure its performance and accuracy. Tax experts and developers collaborate to incorporate the latest tax law changes, ensuring that the calculator remains a reliable tool for businesses and individuals. The calculator’s user-friendly interface and intuitive design make it accessible to users with varying levels of tax knowledge.

Benefits of Accuracy

Accurate sales tax calculation offers several advantages:

- Compliance: By accurately calculating sales tax, businesses can ensure they meet their tax obligations, avoiding penalties and legal issues.

- Financial Planning: Precise tax calculations provide a clear picture of revenue and expenses, aiding in financial forecasting and business strategy development.

- Customer Satisfaction: Transparent and accurate tax information builds trust with customers, enhancing the overall shopping experience.

Future Implications and Updates

Ohio’s sales tax landscape is dynamic, with potential changes in tax rates, regulations, and exemptions. The Ohio Sales Tax Calculator is poised to adapt to these changes, ensuring users have access to the most current and accurate information. Regular updates and improvements will be made to accommodate new tax laws, ensuring the calculator remains a trusted resource for Ohio’s businesses and consumers.

Proactive Tax Planning

By staying informed about upcoming tax changes and utilizing tools like the calculator, businesses can proactively plan their tax strategies. This includes adjusting pricing, managing inventory, and optimizing tax liabilities to maintain a competitive edge in the market.

Conclusion

The Ohio Sales Tax Calculator is an indispensable tool for businesses and individuals navigating Ohio’s complex sales tax system. With its accurate calculations, user-friendly interface, and real-time updates, it empowers users to make informed financial decisions and ensures compliance with the state’s tax regulations. As Ohio’s tax landscape evolves, this calculator will continue to be a valuable resource, offering peace of mind and efficiency in tax management.

What is the state sales tax rate in Ohio?

+The state sales tax rate in Ohio is currently 5.75%.

Are there any local sales taxes in Ohio?

+Yes, local jurisdictions in Ohio may impose additional sales taxes, resulting in a combined rate that varies across the state.

How often are the tax rates updated in the calculator?

+The calculator is regularly updated to reflect the latest tax rates, ensuring users have access to accurate information.

Can the calculator handle bulk calculations for multiple transactions?

+Yes, the calculator is designed to accommodate bulk calculations, making it efficient for businesses with high sales volumes.