New Jersey Sales Tax For Cars

When it comes to purchasing a vehicle, understanding the sales tax implications is crucial for making informed financial decisions. In the state of New Jersey, sales tax for cars is an important consideration for both residents and out-of-state buyers. This article will delve into the specifics of New Jersey's sales tax for cars, providing a comprehensive guide to help navigate this aspect of the car-buying process.

Understanding New Jersey’s Sales Tax for Cars

New Jersey imposes a sales tax on the purchase of vehicles, which contributes to the state’s revenue and helps fund various public services. The sales tax rate is uniform across the state, ensuring consistency for all buyers. However, it’s essential to note that there are certain nuances and exemptions that can impact the overall tax liability.

The standard sales tax rate for vehicles in New Jersey is 7%, which applies to the total purchase price of the car. This rate is applied to both new and used vehicles, making it a straightforward calculation for buyers. However, there are a few key factors that can influence the final tax amount, including any applicable fees and the method of payment.

Calculating Sales Tax for Car Purchases

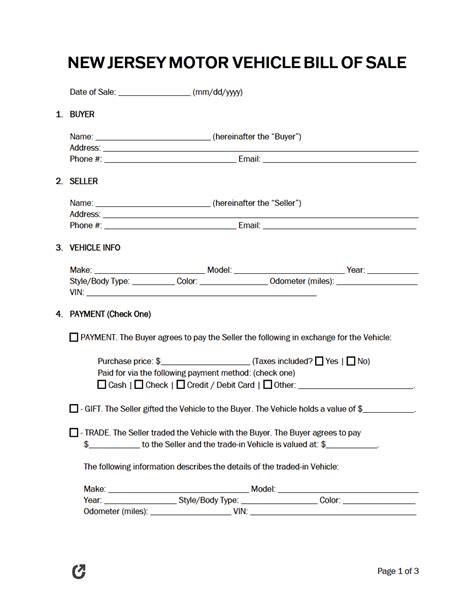

To calculate the sales tax on a car purchase in New Jersey, one must first determine the total purchase price. This includes not only the base price of the vehicle but also any additional fees and charges, such as destination fees, dealer preparation fees, and optional equipment.

For instance, if you're purchasing a new car with a base price of $30,000 and it includes a $1,000 destination fee and $2,500 worth of optional upgrades, the total purchase price would be $33,500. The sales tax would then be calculated as 7% of this amount, resulting in a tax liability of $2,345 for this particular purchase.

It's important to note that certain fees, such as documentation fees or title transfer fees, are not included in the taxable amount. These fees are typically added separately and do not impact the sales tax calculation.

| Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $25,000 | 7% | $1,750 |

| $35,000 | 7% | $2,450 |

| $50,000 | 7% | $3,500 |

Exemptions and Discounts

While the standard sales tax rate applies to most vehicle purchases in New Jersey, there are certain exemptions and discounts that can reduce the overall tax liability. These exemptions are designed to support specific groups or situations, providing financial relief to eligible buyers.

One notable exemption is for military personnel. Active-duty military members and their spouses who are New Jersey residents are exempt from paying sales tax on the purchase of a vehicle. This exemption is a way to show appreciation for their service and can result in significant savings.

Additionally, New Jersey offers a Veterans Exemption Program for veterans who have been honorably discharged. This program provides a sales tax exemption on the purchase of a new or used vehicle, up to a certain value. To be eligible, veterans must meet specific criteria and provide the necessary documentation.

Furthermore, individuals with disabilities may also qualify for sales tax exemptions or reductions when purchasing a vehicle. This includes adaptive equipment and modifications necessary for safe operation. It's crucial to research and understand the specific requirements and processes for applying for these exemptions.

Out-of-State Buyers and Sales Tax

For out-of-state buyers, navigating New Jersey’s sales tax laws can be a bit more complex. When purchasing a vehicle from a New Jersey dealership, out-of-state buyers are typically responsible for paying sales tax in their home state, as well as any applicable fees and taxes in New Jersey.

Dealers will often assist out-of-state buyers in understanding the necessary steps and documentation required for their specific situation. It's important for buyers to be transparent about their residency and intentions to ensure compliance with both states' laws.

In some cases, out-of-state buyers may choose to register their vehicle in New Jersey to take advantage of the state's relatively low sales tax rate. This decision should be carefully considered, as it may impact insurance rates and other registration-related costs.

The Impact of Sales Tax on Car Buying

Understanding the sales tax implications for car purchases is crucial for making financially sound decisions. The sales tax rate in New Jersey, while uniform, can significantly impact the overall cost of a vehicle, especially for higher-priced models.

For instance, a luxury car with a purchase price of $100,000 would carry a sales tax liability of $7,000 in New Jersey. This tax amount can be a significant consideration when deciding between different vehicle options or financing strategies.

Additionally, the sales tax rate can influence the decision to purchase a new or used vehicle. While the tax rate is the same for both, the lower price point of a used car may make it a more attractive option, especially when considering the overall financial impact of the sales tax.

It's essential to consider sales tax as a fixed cost when budgeting for a car purchase. By understanding the sales tax rate and potential exemptions, buyers can make informed choices that align with their financial goals and preferences.

Strategies for Minimizing Sales Tax Impact

While the sales tax rate is set by the state, there are strategies that buyers can employ to minimize its impact on their car purchase. Here are a few approaches to consider:

- Negotiate the Purchase Price: Engaging in negotiations with the dealership can help lower the overall purchase price, thereby reducing the sales tax liability. Skilled negotiators may be able to secure significant discounts, especially on higher-priced vehicles.

- Explore Financing Options: Financing a car purchase can impact the overall tax liability. Some financing options, such as leasing, may offer tax advantages, while others may have higher upfront costs. It's essential to understand the tax implications of different financing strategies.

- Consider Alternative Registration: As mentioned earlier, out-of-state buyers have the option to register their vehicle in New Jersey to take advantage of the lower sales tax rate. However, this decision should be made carefully, as it may impact insurance rates and other costs.

- Research Exemptions and Discounts: Staying informed about any available exemptions or discounts is crucial. Active-duty military personnel, veterans, and individuals with disabilities may be eligible for significant tax savings. Understanding these programs and their requirements can lead to substantial financial benefits.

Future Implications and Considerations

As the automotive industry evolves and adapts to changing technologies and consumer preferences, the sales tax landscape for cars may also undergo transformations. Here are a few future considerations to keep in mind:

Electric Vehicles and Sales Tax

The rise of electric vehicles (EVs) presents an interesting dynamic when it comes to sales tax. While the standard sales tax rate applies to EVs, there may be additional incentives or tax credits offered by the state to encourage the adoption of environmentally friendly vehicles. These incentives can significantly impact the overall cost of an EV purchase, making them a more attractive option for environmentally conscious buyers.

Autonomous Vehicles and Sales Tax

As autonomous vehicle technology advances, the sales tax implications for these vehicles may become a topic of discussion. The unique nature of autonomous vehicles, with their advanced computing and safety features, could potentially lead to specific tax classifications or incentives. Staying informed about any potential changes in sales tax policies for autonomous vehicles is essential for buyers considering this emerging technology.

Online Car Sales and Sales Tax

The rise of online car sales platforms has disrupted traditional dealership models. While these platforms offer convenience and transparency, they also present complexities when it comes to sales tax. As online car sales continue to gain popularity, buyers should be aware of the potential sales tax implications and ensure they understand the tax obligations associated with these transactions.

Conclusion

Understanding New Jersey’s sales tax for cars is an essential aspect of the car-buying process. By familiarizing oneself with the standard sales tax rate, exemptions, and strategies for minimizing its impact, buyers can make informed decisions that align with their financial goals. As the automotive industry evolves, staying informed about future implications and potential changes in sales tax policies is crucial for staying ahead of the curve.

What is the standard sales tax rate for cars in New Jersey?

+

The standard sales tax rate for vehicles in New Jersey is 7%.

Are there any exemptions or discounts for sales tax on car purchases in New Jersey?

+

Yes, there are certain exemptions and discounts available. Active-duty military personnel and their spouses are exempt from sales tax, and veterans may qualify for the Veterans Exemption Program. Additionally, individuals with disabilities may be eligible for sales tax exemptions or reductions.

How does sales tax impact the decision to purchase a new or used car in New Jersey?

+

The sales tax rate is the same for both new and used vehicles in New Jersey. However, the lower price point of a used car can make it a more financially attractive option when considering the overall impact of sales tax.

What strategies can buyers employ to minimize the impact of sales tax on their car purchase in New Jersey?

+

Buyers can negotiate the purchase price, explore financing options, consider alternative registration (for out-of-state buyers), and research available exemptions and discounts to minimize the impact of sales tax on their car purchase.

Are there any potential future changes to sales tax policies for cars in New Jersey that buyers should be aware of?

+

As the automotive industry evolves, there may be changes in sales tax policies for electric and autonomous vehicles, as well as for online car sales. Staying informed about these potential developments is crucial for making informed decisions as a buyer.