Montgomery County Tax

Understanding and managing your tax obligations is an essential aspect of financial responsibility, especially when it comes to local taxes such as those in Montgomery County. This article aims to provide a comprehensive guide to Montgomery County Tax, covering everything from the tax structure to strategies for effective tax management. By delving into the intricacies of local taxation, we aim to empower residents and businesses alike with the knowledge needed to navigate this complex yet crucial domain.

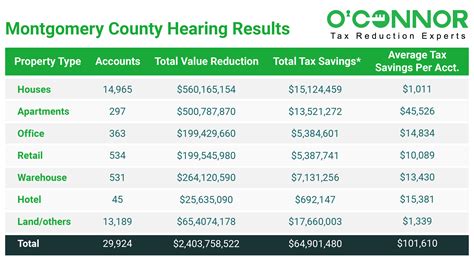

Montgomery County Tax: A Comprehensive Overview

Montgomery County, known for its vibrant communities and thriving businesses, has a robust tax system that contributes significantly to the county’s economic vitality. This section provides an in-depth look at the various facets of Montgomery County Tax, offering a clear understanding of the tax landscape for both residents and businesses.

Tax Structure in Montgomery County

Montgomery County’s tax structure is characterized by a diverse range of taxes, each serving a specific purpose in funding the county’s operations and development. These taxes include:

- Property Tax: One of the primary sources of revenue, property tax is levied on real estate properties within the county. The tax rate is determined by the assessed value of the property and varies depending on its location and type.

- Income Tax: Residents and businesses earning income within Montgomery County are subject to an income tax. The rate is progressive, meaning it increases with higher income levels, providing a fair taxation system.

- Sales and Use Tax: A sales tax is applied to most goods and services sold within the county, while a use tax is charged on items purchased outside the county but used within Montgomery County. This tax contributes to the county’s general fund.

- Hotel/Motel Tax: Accommodations within Montgomery County are subject to an additional tax, providing revenue for tourism development and promotion.

- Business and Occupation Tax (B&O Tax): This tax is levied on businesses operating within the county, with rates varying based on the type of business and its gross receipts.

The tax structure in Montgomery County is designed to ensure a balanced approach, catering to the needs of both residents and businesses while promoting economic growth and development.

Tax Rates and Assessment

Montgomery County’s tax rates are subject to annual adjustments, with the county commissioners playing a crucial role in determining these rates. The assessment process involves evaluating the value of properties and income levels to ensure fair and accurate taxation. The county employs a team of professionals to conduct regular assessments, ensuring that tax obligations are based on up-to-date and accurate information.

| Tax Type | Rate |

|---|---|

| Property Tax | Varies by location and property type (e.g., residential, commercial) |

| Income Tax | Progressive rates ranging from 1% to 3.5% |

| Sales and Use Tax | 6% for sales tax, 6% for use tax |

| Hotel/Motel Tax | 7% for accommodations |

| Business and Occupation Tax | Rates vary based on business type and gross receipts |

Tax Payment Options and Deadlines

Montgomery County offers a range of convenient payment options for taxpayers, including online payments, direct debit, and traditional mail-in payments. The county’s website provides a user-friendly platform for taxpayers to manage their accounts, view tax bills, and make payments. Additionally, the county accepts credit and debit card payments, offering flexibility for taxpayers.

Tax deadlines are strictly enforced, with penalties applied for late payments. The county typically sends out tax bills with clear due dates, allowing taxpayers sufficient time to make their payments. It is crucial for taxpayers to stay informed about these deadlines to avoid unnecessary penalties and interest charges.

Tax Relief and Incentives

Montgomery County recognizes the importance of providing tax relief and incentives to promote economic development and support its residents. The county offers various programs and initiatives aimed at reducing tax burdens and attracting businesses.

- Tax Abatement Programs: These programs offer temporary reductions in property taxes for businesses investing in the county. The abatements provide an incentive for companies to establish or expand their operations, fostering economic growth.

- Senior Citizen Tax Relief: Montgomery County provides tax relief to senior citizens, reducing their property tax obligations based on income and property value. This initiative aims to support the county's elderly population and make homeownership more affordable.

- Tax Credits: The county offers tax credits to businesses that meet specific criteria, such as creating new jobs or investing in energy-efficient technologies. These credits can significantly reduce a business's tax liability, encouraging sustainable practices and economic development.

Navigating Montgomery County Tax: Strategies and Best Practices

Effectively managing Montgomery County Tax requires a strategic approach. Here are some key strategies and best practices to consider:

- Stay Informed: Keep yourself updated on tax rates, deadlines, and any changes to the tax structure. The Montgomery County Tax Office provides regular updates and resources to ensure taxpayers are well-informed.

- Seek Professional Advice: Engaging the services of a tax professional or accountant can provide valuable insights and guidance tailored to your specific circumstances. They can help optimize your tax strategy and ensure compliance.

- Explore Tax Relief Options: Take advantage of the tax relief programs and incentives offered by the county. Whether you're a business owner looking to expand or a resident seeking assistance, these programs can provide significant benefits.

- Utilize Online Resources: The Montgomery County website offers a wealth of information and tools to assist taxpayers. From tax calculators to payment portals, these resources can simplify the tax management process.

- Plan for the Future: Effective tax planning involves looking ahead. Consider your long-term financial goals and how tax obligations fit into your overall strategy. This proactive approach can help minimize tax burdens and maximize savings.

Conclusion

Montgomery County Tax is a complex yet crucial aspect of the county’s financial landscape. By understanding the tax structure, rates, and available resources, taxpayers can navigate this domain with confidence and make informed decisions. Whether you’re a resident or a business owner, staying informed, seeking professional advice, and exploring tax relief options are key to effective tax management. With a strategic approach, taxpayers can ensure compliance, optimize their tax obligations, and contribute to the vibrant economic ecosystem of Montgomery County.

What is the tax rate for residential properties in Montgomery County?

+The tax rate for residential properties varies depending on the location and type of property. On average, the rate ranges from 1% to 2% of the assessed value. However, it’s essential to check with the Montgomery County Tax Office for specific rates in your area.

Are there any tax breaks or incentives for businesses in Montgomery County?

+Yes, Montgomery County offers a range of tax incentives and breaks to attract and support businesses. These include tax abatement programs, tax credits for job creation, and incentives for investing in energy-efficient technologies. Businesses can benefit from these initiatives by exploring the county’s economic development programs.

How can I estimate my tax liability for the current year?

+Estimating your tax liability involves considering various factors such as income, property value, and applicable taxes. The Montgomery County Tax Office provides online tools and calculators to help taxpayers estimate their obligations. Consulting with a tax professional can also provide a more accurate estimate based on your specific circumstances.