Ma Excise Tax

Welcome to this in-depth exploration of the Ma Excise Tax, a crucial component of the tax system in various jurisdictions, especially in the context of business operations and economic policies. This article aims to provide a comprehensive understanding of the Ma Excise Tax, its implications, and its role in shaping the financial landscape for businesses and individuals alike.

Understanding the Ma Excise Tax

The Ma Excise Tax, an acronym for Manufacturing Excise Tax, is a type of indirect tax levied on the production, sale, or distribution of specific goods or services within a defined geographic area. Unlike income taxes or sales taxes, which are more direct and often apply to individuals and a broader range of transactions, excise taxes are typically imposed on a narrower set of goods and activities, making them an essential yet often complex component of a nation’s tax structure.

Ma Excise Taxes are designed to generate revenue for the governing body, whether it's a national government, state, or local authority. They are often used to fund specific programs, infrastructure, or services, making them a critical tool for economic policy and fiscal management. The taxes are usually levied on manufacturers, producers, or distributors, who then pass on the cost to consumers through higher prices, thereby indirectly impacting the end user.

Key Characteristics and Applications

The Ma Excise Tax regime varies significantly across jurisdictions, with each region implementing its own set of rules and regulations. Here are some key aspects and common applications of Ma Excise Taxes:

Goods Subject to Ma Excise Tax

The goods or services subject to Ma Excise Tax are often those considered luxury items, harmful to health (e.g., tobacco, alcohol), or those that generate significant environmental impact (e.g., fuel, carbon emissions). The specific items taxed can vary widely, from luxury cars and yachts to airline tickets and telecommunications services. Each jurisdiction decides which goods or services fall under this category based on its economic and social policies.

| Goods/Services | Tax Rate |

|---|---|

| Alcoholic Beverages | 15% |

| Tobacco Products | 20% |

| Fuel | 8% |

The table above provides a simplified example of goods subject to Ma Excise Tax and their respective tax rates. In reality, the list of taxable items and their rates can be extensive and subject to frequent revisions.

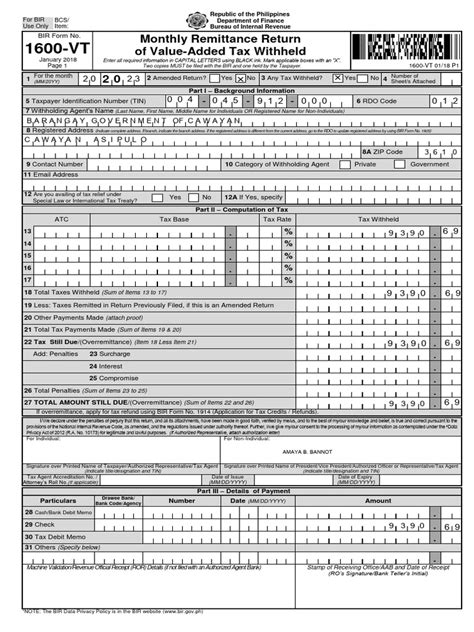

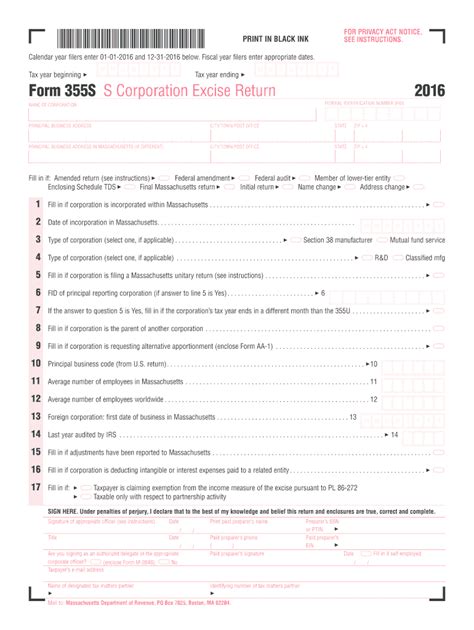

Calculation and Collection

Ma Excise Taxes are typically calculated as a percentage of the value of the goods or services. The tax rate can vary based on the type of good or service and is often set by the governing body. The tax is collected by the business or entity involved in the production, sale, or distribution of the taxable item. This could be a manufacturer, wholesaler, retailer, or even a service provider.

Revenue Generation and Economic Impact

Ma Excise Taxes play a crucial role in government revenue generation. They provide a stable source of income for public services, infrastructure development, and social welfare programs. The taxes also influence consumer behavior, often discouraging the purchase of certain goods or services, which can have both positive and negative economic implications. For instance, taxing carbon emissions may reduce environmental impact but could also lead to higher energy prices.

Compliance and Administration

Compliance with Ma Excise Tax regulations is a critical aspect for businesses. Non-compliance can lead to significant fines and penalties. Many jurisdictions require businesses to register for excise tax purposes, maintain detailed records of taxable transactions, and file regular excise tax returns. The administrative burden can be substantial, especially for small businesses or those dealing with complex supply chains.

Case Studies and Real-World Examples

To illustrate the practical implications of Ma Excise Taxes, let’s examine a few case studies:

Tobacco Excise Tax in Country X

Country X has implemented a substantial excise tax on tobacco products, with the aim of reducing smoking rates and generating revenue for healthcare initiatives. The tax has been successful in curbing smoking, particularly among younger demographics, and has funded innovative healthcare programs. However, it has also led to a rise in illicit tobacco trade, highlighting the complex nature of excise taxes.

Carbon Excise Tax in Region Y

Region Y introduced a carbon excise tax to reduce carbon emissions and encourage a shift towards renewable energy sources. The tax is applied to fossil fuels and has successfully reduced carbon emissions. However, it has also increased energy costs for businesses and households, leading to economic challenges for certain industries and lower-income households.

Luxury Goods Excise Tax in City Z

City Z implemented an excise tax on luxury goods, including high-end fashion, jewelry, and yachts, to fund urban development projects. The tax has generated significant revenue and has not significantly impacted the local economy, as luxury goods are often purchased by high-net-worth individuals or tourists.

Future Trends and Implications

The future of Ma Excise Taxes is likely to be shaped by evolving economic and social policies, technological advancements, and changing consumer behaviors. Here are some potential trends and implications:

-

Digitalization of Excise Tax Systems: With the rise of e-commerce and digital platforms, there is a growing need for digital excise tax systems that can effectively track and tax online transactions. This trend is expected to continue, with more jurisdictions adopting digital tax systems to ensure compliance and efficient tax collection.

-

Environmental Focus: As environmental concerns continue to rise, we can expect to see more excise taxes targeted at environmentally harmful activities or products. This could include increased taxes on fossil fuels, single-use plastics, or even air travel.

-

Social Welfare and Equity: Excise taxes may increasingly be used to fund social welfare programs and address income inequality. This could involve taxes on luxury goods or financial transactions, with the revenue generated used to support social safety nets or affordable housing initiatives.

-

International Cooperation: With global supply chains and e-commerce, there is a growing need for international cooperation on excise tax policies. This could lead to harmonization of tax rates and regulations across borders, ensuring a level playing field for businesses and effective tax collection.

Conclusion

In conclusion, the Ma Excise Tax is a multifaceted tool that plays a critical role in the economic and social landscape of various jurisdictions. It influences consumer behavior, shapes fiscal policies, and generates revenue for essential services and initiatives. As we’ve explored, the design and implementation of Ma Excise Taxes can have significant implications, both positive and negative, and a deep understanding of this tax regime is crucial for businesses, policymakers, and individuals alike.

Stay tuned for further insights and updates on the evolving world of Ma Excise Taxes and their impact on our global economy.

What are the primary goals of Ma Excise Taxes?

+Ma Excise Taxes primarily aim to generate revenue for the governing body and influence consumer behavior by discouraging the consumption of certain goods or services. This revenue is often used to fund public services, infrastructure, and social welfare programs.

How do Ma Excise Taxes impact businesses?

+Ma Excise Taxes can significantly impact businesses, especially those involved in the production, sale, or distribution of taxable goods or services. They may face increased costs, administrative burdens, and compliance challenges. However, excise taxes can also create opportunities, such as market differentiation or reduced competition for non-taxable goods.

Are Ma Excise Taxes the same in every jurisdiction?

+No, Ma Excise Taxes vary significantly across jurisdictions. Each region has its own set of rules, regulations, and tax rates. This variation is influenced by economic, social, and political factors, leading to diverse tax systems and strategies.