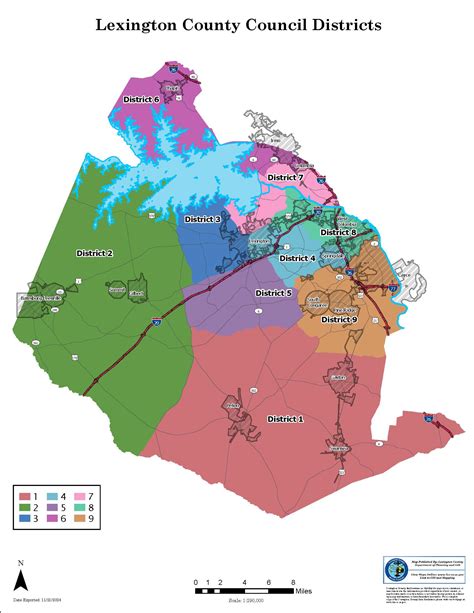

Lexington County Tax Records

Welcome to a comprehensive exploration of the Lexington County Tax Records, an essential resource for homeowners, businesses, and anyone interested in the financial landscape of this vibrant South Carolina county. In this detailed guide, we will delve into the intricacies of Lexington County's tax system, providing valuable insights, historical context, and practical information. From property assessments to tax rates, we aim to demystify the process and offer a clear understanding of the county's fiscal responsibilities.

Understanding Lexington County’s Tax Landscape

Lexington County, nestled in the heart of South Carolina, boasts a rich history and a thriving economy. As one of the state’s most populous counties, it presents a diverse range of tax considerations. This section offers an overview of the county’s tax structure, shedding light on the key players, processes, and regulations that govern its fiscal operations.

Historical Context and Tax Evolution

The story of Lexington County’s tax system is intertwined with its historical growth. Since its establishment, the county has undergone significant changes, adapting its tax policies to meet the needs of a dynamic population. Early records indicate a reliance on property taxes, a tradition that continues to this day. However, the introduction of modern tax reforms has brought about a more comprehensive and fair assessment process.

A notable milestone in Lexington County's tax history was the implementation of the Fair Market Value Assessment system in the late 20th century. This reform aimed to ensure equitable property taxation, basing assessments on the true value of properties rather than outdated or arbitrary measures. As a result, the county experienced a more balanced distribution of tax burdens, fostering a sense of fairness among residents and businesses.

| Tax Reform | Impact |

|---|---|

| Fair Market Value Assessment | Increased tax equity, reduced tax disparities |

| Online Tax Services | Enhanced accessibility, streamlined processes |

| Tax Relief Programs | Supported vulnerable populations, encouraged homeownership |

Key Players and Responsibilities

The administration of Lexington County’s tax system involves a collaborative effort among various entities. The Lexington County Assessor’s Office plays a pivotal role, responsible for the annual assessment of all properties within the county. This includes residential, commercial, and industrial properties, each requiring a detailed evaluation to determine its taxable value.

The Lexington County Auditor is another critical player, tasked with maintaining accurate records of all taxable properties. This office ensures that assessments are correctly applied and that taxpayers receive the appropriate bills. Additionally, the Auditor's Office handles appeals and provides guidance to taxpayers, ensuring a fair and transparent process.

The Lexington County Treasurer is responsible for collecting taxes and managing the county's finances. This office receives tax payments, distributes funds to various county departments and agencies, and ensures that taxpayers' contributions are utilized efficiently and effectively.

Property Assessment and Taxation Process

The process of assessing and taxing properties in Lexington County is a meticulous and well-regulated endeavor. This section will provide an in-depth look at each step, offering a clear understanding of how properties are valued and how taxes are calculated.

Assessment Methodology

Lexington County employs a comprehensive assessment methodology to ensure accuracy and fairness. Assessors use a combination of techniques, including physical inspections, market analysis, and data-driven models. Here’s a breakdown of the key assessment steps:

- Physical Inspection: Assessors conduct on-site visits to properties, evaluating their condition, size, and any recent improvements. This step is crucial for capturing the true value of a property.

- Market Analysis: By studying recent sales of similar properties in the area, assessors can determine the fair market value. This data-driven approach ensures that assessments are in line with the current real estate market.

- Data Verification: Assessors cross-reference property records with other county departments to ensure the accuracy of ownership, zoning, and other relevant information.

- Adjustment for Unique Features: Certain properties may have unique features that affect their value, such as historical significance or environmental factors. Assessors account for these factors to provide a fair assessment.

Tax Calculation and Billing

Once properties are assessed, the taxable value is determined by applying the county’s millage rate, which is set annually by the Lexington County Council. This rate, expressed in mills (a mill is equal to one-tenth of a cent), determines the tax liability for each property. Here’s a simplified breakdown of the tax calculation process:

- Step 1: Multiply the assessed value of the property by the millage rate.

- Step 2: The result is the tax amount owed for the year.

- Step 3: Tax bills are typically sent out in the fall, with payment due by a specified deadline.

Lexington County offers a range of payment options, including online payment portals, mail-in payments, and in-person payments at the Treasurer's Office. Taxpayers can also set up installment plans to make payments more manageable.

Appeals and Grievance Process

Lexington County recognizes that taxpayers may have concerns or disagreements with their property assessments. To address these issues, the county has established a fair and accessible appeals process. Taxpayers can initiate an appeal by submitting a formal request to the Lexington County Assessor’s Office within a specified timeframe.

The appeals process typically involves a review by an independent board, ensuring impartiality. Taxpayers have the opportunity to present their case, providing evidence and expert opinions if necessary. The board's decision is final, and taxpayers are informed of the outcome. In cases where the assessment is adjusted, taxpayers may receive a refund or a credit on their next tax bill.

Tax Relief Programs and Initiatives

Lexington County is committed to supporting its residents and businesses through various tax relief programs and initiatives. These programs aim to ease the tax burden on vulnerable populations and promote economic growth. Here’s an overview of some key initiatives:

Homestead Exemption

The Homestead Exemption is a valuable program that provides tax relief to homeowners who use their property as their primary residence. To qualify, homeowners must meet certain criteria, such as age, disability, or income limits. The exemption reduces the taxable value of the property, resulting in lower tax bills.

| Homestead Exemption Types | Eligibility |

|---|---|

| Standard Homestead | Age 65 or older, permanently disabled, or surviving spouse |

| Additional Homestead | Additional income limits apply for low-income homeowners |

| Veteran's Homestead | Honorably discharged veterans or their surviving spouses |

Senior Citizen Tax Relief

Lexington County offers additional tax relief to senior citizens through the Senior Citizen Tax Relief Program. This program provides a credit on property taxes for eligible seniors, helping them maintain their homes as they age. To qualify, seniors must meet age and income requirements and must have owned and occupied their property for a specified period.

Business Incentives and Tax Abatements

To attract and support businesses, Lexington County provides a range of incentives and tax abatements. These initiatives aim to foster economic growth and job creation. Some common incentives include:

- Job Tax Credits: Businesses that create a certain number of jobs may be eligible for tax credits.

- Investment Tax Credits: Companies that make significant investments in the county's infrastructure or technology may receive tax credits.

- Property Tax Abatements: New businesses or those expanding their operations may be offered temporary property tax abatements to encourage growth.

Online Services and Taxpayer Convenience

In today’s digital age, Lexington County recognizes the importance of providing efficient and accessible online services. The county’s official website offers a wealth of resources and tools to enhance the taxpayer experience.

Online Tax Payment Portal

Taxpayers can conveniently pay their taxes online through the Lexington County Tax Payment Portal. This secure platform allows users to make payments using various methods, including credit cards, debit cards, and e-checks. The portal provides real-time updates on payment status and offers a history of past transactions.

Property Search and Assessment Information

The Lexington County website provides a powerful Property Search Tool that allows users to access detailed information about any property in the county. This tool displays assessment data, tax bills, and ownership information. It’s a valuable resource for homeowners, buyers, and real estate professionals seeking accurate and up-to-date property details.

Tax Calendar and Important Dates

Staying informed about tax deadlines is crucial for timely payments and avoiding penalties. The Lexington County website features a comprehensive Tax Calendar, highlighting important dates for property tax assessments, billing, and payment. This calendar ensures that taxpayers can plan their financial obligations effectively.

Community Engagement and Tax Transparency

Lexington County places a strong emphasis on community engagement and tax transparency. The county organizes regular town hall meetings and public forums to address taxpayer concerns and provide updates on fiscal matters. These events foster a sense of trust and involvement in the tax process.

Public Meetings and Budget Hearings

Lexington County holds annual Budget Hearings where residents can provide input on the county’s fiscal plans. These meetings are an opportunity for taxpayers to voice their opinions on proposed budgets, tax rates, and spending priorities. The county takes these inputs seriously, ensuring that taxpayer voices are heard in the decision-making process.

Taxpayer Education and Outreach

The county understands that tax-related matters can be complex and confusing. To address this, Lexington County offers taxpayer education programs and workshops. These initiatives aim to demystify the tax process, providing residents with the knowledge and tools to navigate the system effectively. Topics covered include property assessments, tax appeals, and available relief programs.

Future Outlook and Innovations

As Lexington County continues to thrive and evolve, its tax system is poised for further enhancements. The county is committed to staying at the forefront of technological advancements and best practices in taxation.

Digital Transformation

Lexington County is exploring ways to further digitize its tax processes, reducing paperwork and streamlining operations. The implementation of electronic filing systems and automated data processing could enhance efficiency and reduce errors.

Data Analytics and Tax Equity

The county recognizes the potential of data analytics to ensure tax equity and fairness. By leveraging advanced analytics, Lexington County can identify patterns and trends, detect potential issues, and make data-driven decisions to improve the tax system.

Sustainable Tax Policies

As the county grows, it remains dedicated to sustainable tax policies. This includes exploring alternative revenue streams, such as eco-friendly initiatives and green energy projects, to reduce the reliance on traditional property taxes. By diversifying its revenue sources, Lexington County can maintain a balanced and resilient fiscal landscape.

How often are properties reassessed in Lexington County?

+Properties in Lexington County are typically reassessed every five years. However, certain changes, such as significant improvements or damage, may trigger an early reassessment.

Can I appeal my property assessment if I disagree with the value?

+Yes, Lexington County provides a fair appeals process. You can initiate an appeal by contacting the Assessor’s Office and providing evidence to support your case. The appeal process ensures a thorough review of your assessment.

What payment options are available for property taxes in Lexington County?

+Lexington County offers a range of payment options, including online payments, mail-in payments, and in-person payments at the Treasurer’s Office. You can also set up installment plans for more flexible payment arrangements.

Are there any tax incentives for renewable energy projects in Lexington County?

+Yes, Lexington County supports renewable energy initiatives through tax incentives. These incentives can include property tax abatements and exemptions for qualifying renewable energy projects, encouraging sustainable development.

How can I stay informed about tax-related events and updates in Lexington County?

+Lexington County provides various resources for staying informed. You can visit the official county website, follow social media accounts, and attend public meetings and budget hearings. Additionally, the county offers email updates and newsletters to keep taxpayers informed about important tax-related matters.