Hamden Town Ct Tax Collector

The Hamden Town Tax Collector's Office is a vital administrative hub within the municipality of Hamden, Connecticut, playing a crucial role in the town's financial operations and contributing significantly to its overall governance and development.

Overview of Hamden Town Tax Collector’s Office

The Hamden Town Tax Collector’s Office is responsible for the efficient and effective management of various taxes and related financial obligations for the residents and businesses of Hamden. This includes the collection of property taxes, which are a primary source of revenue for the town, as well as handling delinquent tax payments, tax liens, and tax abatement processes.

Located at 2750 Dixwell Avenue, Hamden, CT 06518, the office operates under the supervision of the Town of Hamden, with a commitment to providing excellent customer service and ensuring compliance with state and local tax regulations.

The Tax Collector's Office is open to the public on Mondays to Fridays, from 8:30 a.m. to 4:30 p.m., except on observed holidays. They can be reached by phone at (203) 287-7040 or by email at taxcollector@hamden.com for inquiries and assistance.

Key Responsibilities and Services

The primary responsibilities of the Hamden Town Tax Collector’s Office include:

- Property Tax Management: This involves the collection of real estate taxes, personal property taxes, and motor vehicle taxes. The office sends out tax bills, processes payments, and maintains records for all taxable properties within Hamden.

- Delinquent Tax Enforcement: The office is responsible for enforcing tax compliance by pursuing delinquent taxpayers. This includes sending notices, imposing penalties, and potentially initiating tax lien procedures.

- Tax Abatement and Exemptions: The Tax Collector’s Office processes applications for tax abatement and exemptions, which can provide relief to certain taxpayers under specific circumstances.

- Online Services: The office offers an online payment portal, allowing taxpayers to make payments conveniently and securely from their homes or offices.

- Community Engagement: The Tax Collector’s Office actively engages with the Hamden community, providing educational resources and assistance to help residents understand their tax obligations and navigate the tax payment process.

Tax Payment Options and Due Dates

The Hamden Town Tax Collector’s Office offers a range of payment options to accommodate different taxpayer needs and preferences. These include:

- Online Payments: Taxpayers can make secure payments through the town’s website using a credit card or e-check. There is a convenience fee for this service.

- Mail-in Payments: Tax bills can be paid by mailing a check or money order to the Tax Collector’s Office. It is essential to include the payment coupon and write the property address and parcel number on the check.

- In-Person Payments: Payments can be made in person at the Tax Collector’s Office during regular business hours. Accepted forms of payment include cash, check, money order, and credit/debit cards (with a processing fee).

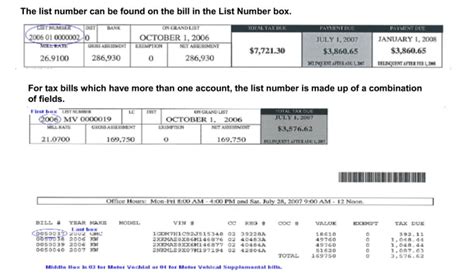

The due dates for property tax payments in Hamden are typically as follows:

| Installment | Due Date |

|---|---|

| First Installment | July 1st |

| Second Installment | January 1st |

| Third Installment (if applicable) | July 1st |

It is important to note that failure to pay property taxes by the due date may result in penalties and interest, and could potentially lead to a tax lien being placed on the property.

Late Payment and Delinquency Procedures

If a taxpayer misses a property tax payment, the Hamden Town Tax Collector’s Office will send out a delinquency notice within 30 days of the due date. This notice will include information on the outstanding balance, applicable penalties, and the options available to the taxpayer.

If the delinquency remains unresolved, the Tax Collector's Office may initiate the following steps:

- Tax Lien Certificate Sale: After 30 days of delinquency, the Tax Collector may issue a certificate of debt to the town, which is then offered for sale to investors. The sale of the tax lien certificate gives the investor the right to collect the debt from the taxpayer with additional interest and penalties.

- Tax Foreclosure: If the tax lien certificate remains unpaid, the town may initiate foreclosure proceedings, which can ultimately result in the loss of ownership of the property.

To avoid these consequences, taxpayers are encouraged to contact the Tax Collector's Office as soon as possible if they anticipate difficulties in meeting their tax obligations.

Tax Abatement and Exemptions

The Hamden Town Tax Collector’s Office handles applications for tax abatement and exemptions, which can provide relief to certain taxpayers under specific circumstances. These include:

- Senior Citizen Tax Relief: Hamden residents who are aged 65 or older and meet certain income requirements may be eligible for a partial or full exemption from property taxes.

- Veteran’s Exemption: Qualified veterans and their surviving spouses may be entitled to an exemption from property taxes on their primary residence.

- Low-Income Tax Abatement: Hamden residents with low incomes may be eligible for a partial abatement of their property taxes.

- Other Exemptions: There are additional exemptions available for certain types of properties, such as religious institutions, nonprofit organizations, and open space lands.

Applications for tax abatement and exemptions must be submitted to the Tax Collector's Office by the specified deadlines, which typically fall within the first quarter of the year. It is important to note that these exemptions and abatements are subject to approval and may have specific eligibility criteria and limitations.

Frequently Asked Questions

What happens if I miss a property tax payment deadline in Hamden, CT?

+

If you miss a property tax payment deadline in Hamden, the Tax Collector’s Office will send a delinquency notice. If the delinquency remains unresolved, the town may issue a tax lien certificate and ultimately initiate foreclosure proceedings.

Are there any tax relief programs available for senior citizens in Hamden, CT?

+

Yes, Hamden offers a Senior Citizen Tax Relief program. Residents aged 65 or older who meet certain income requirements may be eligible for a partial or full exemption from property taxes.

How can I make a property tax payment in Hamden, CT?

+

You can make a property tax payment in Hamden through online, mail-in, or in-person methods. Online payments can be made through the town’s website, mail-in payments can be sent by check or money order, and in-person payments can be made at the Tax Collector’s Office during regular business hours.

What are the due dates for property tax payments in Hamden, CT?

+

The due dates for property tax payments in Hamden are typically July 1st for the first and third installments, and January 1st for the second installment. It is important to note that failure to pay by these due dates may result in penalties and interest.

How can I apply for a tax abatement or exemption in Hamden, CT?

+

Applications for tax abatement and exemptions in Hamden must be submitted to the Tax Collector’s Office by the specified deadlines, which typically fall within the first quarter of the year. There are specific eligibility criteria and limitations for each type of abatement or exemption.