Garden Grove Sales Tax

Welcome to our comprehensive guide on the Garden Grove Sales Tax. In this article, we will delve into the intricacies of sales tax in the vibrant city of Garden Grove, California. With a focus on providing expert insights and up-to-date information, we aim to equip you with a thorough understanding of how sales tax works in this bustling municipality. Whether you're a local business owner, a resident, or a visitor planning a shopping spree, this guide will serve as your trusted resource.

Understanding the Garden Grove Sales Tax Landscape

Garden Grove, a city known for its vibrant culture and diverse attractions, also has a unique sales tax structure. Understanding this landscape is crucial for both businesses and consumers alike. Let’s break it down and explore the key components.

State and Local Sales Tax Rates

Garden Grove, like many cities in California, operates within a multi-tiered sales tax system. The state of California imposes a base sales tax rate, which is then supplemented by additional local taxes. This dual system ensures that a portion of the sales tax revenue benefits the state, while the remaining amount supports local initiatives and infrastructure.

The current base sales tax rate in California stands at 7.25%, a rate that is applied uniformly across the state. However, Garden Grove, like many other cities, adds its own municipal sales tax on top of this, which is where things get interesting.

As of our last update, the Garden Grove municipal sales tax rate is 1.00%, bringing the total combined sales tax rate in Garden Grove to 8.25%. This additional tax is vital for funding local services and projects, ensuring the city's continued growth and development.

| Sales Tax Component | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| Garden Grove Municipal Sales Tax | 1.00% |

| Total Combined Sales Tax Rate | 8.25% |

How Sales Tax Works in Garden Grove

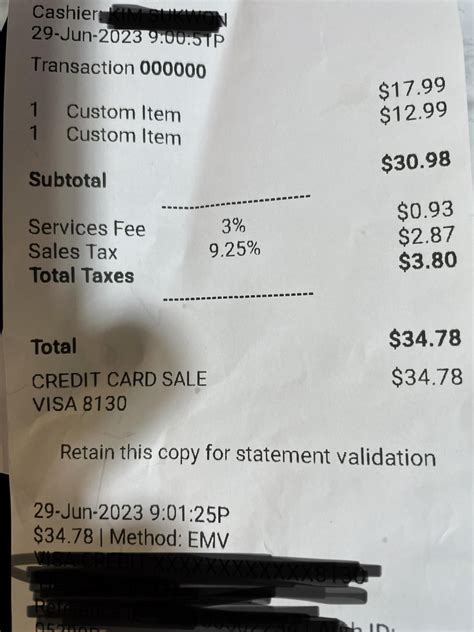

Sales tax in Garden Grove is applied to the sale of most goods and some services. This means that when you make a purchase at a local store, restaurant, or even online with a Garden Grove-based business, you’ll be paying this combined sales tax rate. The tax is calculated based on the purchase price, including any applicable discounts or promotions.

For instance, if you buy a new laptop for $1,000 in Garden Grove, the sales tax on that purchase would be $82.50 (8.25% of $1,000). This tax is collected by the business at the point of sale and is later remitted to the appropriate tax authorities.

Exemptions and Special Considerations

While the majority of sales are subject to tax, there are certain exemptions and special cases to be aware of. These can vary based on the type of item, the nature of the transaction, and even the buyer’s status.

- Certain groceries, such as unprocessed foods, are exempt from sales tax in California.

- Prescription medications are also typically exempt from sales tax.

- Nonprofit organizations may be eligible for sales tax exemptions on certain purchases.

- Online retailers with no physical presence in California may not charge sales tax to out-of-state customers.

It's crucial for both businesses and consumers to stay informed about these exemptions to ensure compliance and avoid potential penalties.

The Impact of Sales Tax on Local Businesses

Sales tax has a significant influence on the business landscape in Garden Grove. It affects not only how businesses operate and manage their finances but also their pricing strategies and competitiveness in the market.

Pricing Strategies and Competitiveness

With the sales tax rate in Garden Grove being higher than some neighboring areas, local businesses must carefully consider their pricing strategies. They need to ensure their prices are competitive while also accounting for the tax burden.

For instance, a local electronics store might offer its products at slightly lower prices compared to online retailers to compensate for the higher sales tax. This strategy can help attract local customers who value the convenience of in-store shopping and immediate gratification.

Managing Cash Flow and Tax Remittances

Sales tax collection and remittance can be a complex and time-consuming process for businesses. They must ensure they are collecting the correct amount of tax from customers and then remit it to the appropriate tax authorities on time.

To streamline this process, many businesses in Garden Grove utilize accounting software that integrates with their point-of-sale systems. This automation ensures accurate tax calculations and timely remittances, reducing the risk of errors and penalties.

Compliance and Audits

Compliance with sales tax regulations is non-negotiable for businesses in Garden Grove. The California Department of Tax and Fee Administration (CDTFA) regularly conducts audits to ensure businesses are adhering to the law.

During an audit, the CDTFA may examine a business's sales records, tax returns, and other financial documents to verify compliance. Non-compliance can result in substantial penalties and even criminal charges in severe cases. Therefore, businesses must maintain accurate records and stay informed about changing tax laws and regulations.

Sales Tax and Consumer Behavior

The sales tax rate can significantly influence consumer behavior, especially in a competitive market like Garden Grove. Understanding how consumers react to sales tax can help businesses and policymakers make informed decisions.

Consumer Perceptions and Spending Habits

Consumers are often sensitive to sales tax rates, particularly when they are high. A higher sales tax rate can deter consumers from making purchases, especially for discretionary items. In Garden Grove, where the sales tax rate is above the state average, businesses may need to offer more attractive deals or promotions to encourage spending.

On the other hand, some consumers may be willing to pay a premium for the convenience of shopping locally, especially if they value supporting local businesses. This perception can help offset the higher sales tax rate to some extent.

Online Shopping vs. Brick-and-Mortar

The rise of e-commerce has provided consumers with an alternative to traditional brick-and-mortar stores. With online shopping, consumers can often avoid sales tax, especially if the online retailer does not have a physical presence in their state.

This trend has led to a shift in consumer behavior, with some shoppers preferring to purchase online to save on taxes. However, Garden Grove businesses can counter this by offering unique in-store experiences, personalized services, or exclusive products that cannot be found online.

Impact on Tourism and Visitor Spending

Garden Grove, known for its attractions and hospitality industry, attracts visitors from near and far. The sales tax rate can influence how much tourists spend during their stay, particularly on shopping and dining.

A higher sales tax rate might deter visitors from making certain purchases, especially if they are conscious of their spending. However, Garden Grove's vibrant culture, entertainment options, and unique attractions can offset this, encouraging visitors to spend more on experiences rather than just goods.

Sales Tax and Local Government Revenue

The sales tax collected in Garden Grove is a significant source of revenue for the local government. This revenue is vital for funding essential services, infrastructure development, and community projects.

Revenue Allocation and Usage

The sales tax revenue generated in Garden Grove is allocated to various departments and initiatives. A portion goes towards funding public safety services like police and fire departments, while another part supports public works projects such as road maintenance and infrastructure upgrades.

Sales tax revenue also contributes to community development initiatives, including affordable housing programs, youth programs, and cultural events. Additionally, it helps fund local schools and education programs, ensuring the city's future generations have access to quality education.

Budgeting and Economic Development

The sales tax revenue plays a critical role in the city’s annual budgeting process. Garden Grove’s financial planners and economists carefully analyze the sales tax data to forecast future revenue and plan for budget allocations.

A stable and growing sales tax revenue can signal a healthy local economy, encouraging further investment and development. This positive feedback loop can lead to more job opportunities, improved infrastructure, and a higher quality of life for residents.

Economic Stimulus and Relief Programs

During challenging economic times, such as the COVID-19 pandemic, sales tax revenue can be used to implement stimulus and relief programs. Garden Grove, like many cities, may have utilized a portion of its sales tax revenue to support local businesses and residents impacted by economic downturns.

These relief programs can include grants, low-interest loans, or tax incentives to help businesses stay afloat and retain employees. They can also provide direct financial assistance to residents who have lost their jobs or are facing financial hardships.

Future Implications and Trends

As we look ahead, several factors and trends may influence the future of sales tax in Garden Grove.

Technological Advances and E-Commerce

The continued growth of e-commerce and online shopping platforms may present both challenges and opportunities for Garden Grove’s sales tax system. On one hand, it could lead to a decrease in traditional brick-and-mortar sales, potentially impacting sales tax revenue.

However, technological advancements also offer solutions. For instance, online retailers can utilize software to accurately calculate and remit sales tax based on the buyer's location, ensuring compliance and fair competition with local businesses.

Changing Consumer Preferences and Behavior

Consumer preferences and behavior are constantly evolving, influenced by factors like social trends, economic conditions, and technological advancements. Garden Grove businesses and policymakers must stay attuned to these changes to ensure they are meeting consumer needs and maintaining a competitive edge.

Policy and Regulatory Changes

Sales tax regulations and policies are subject to change, often at the state or local level. Garden Grove may face future challenges or opportunities due to legislative actions, ballot measures, or changes in state-level tax policies.

Businesses and residents should stay informed about these potential changes to understand how they might impact their operations or purchasing decisions. Staying ahead of these shifts can help mitigate potential risks and take advantage of new opportunities.

Conclusion

Understanding the intricacies of sales tax in Garden Grove is essential for businesses, consumers, and policymakers alike. From pricing strategies to consumer behavior and revenue allocation, sales tax plays a pivotal role in the city’s economy and development.

As we've explored in this guide, the sales tax system in Garden Grove is a dynamic and complex mechanism, influenced by a myriad of factors. By staying informed and adapting to changing conditions, Garden Grove can continue to thrive, offering a vibrant and sustainable environment for businesses and residents.

How often do sales tax rates change in Garden Grove?

+

Sales tax rates can change periodically, typically as a result of legislative actions or ballot measures. While these changes are not frequent, it’s important to stay updated through official sources to ensure compliance.

Are there any online resources to help calculate sales tax in Garden Grove?

+

Yes, there are several online calculators and tools available that can assist in calculating sales tax based on the Garden Grove rate. These tools are especially useful for businesses and consumers who frequently make transactions involving sales tax.

How does Garden Grove compare to other cities in terms of sales tax rates?

+

Garden Grove’s sales tax rate is relatively higher compared to some neighboring cities in California. However, it’s important to note that sales tax rates can vary significantly across different states and even within the same state, depending on local tax jurisdictions.

What are the penalties for non-compliance with sales tax regulations in Garden Grove?

+

Penalties for non-compliance can be severe and may include fines, interest, and even criminal charges in extreme cases. It’s crucial for businesses to stay informed about sales tax regulations and consult with tax professionals to ensure compliance.