Denver Colorado Real Estate Taxes

Understanding real estate taxes is crucial for anyone investing in property, and the city of Denver, Colorado, offers a unique landscape for investors and homeowners alike. Denver's vibrant real estate market, characterized by steady growth and diverse neighborhoods, provides an intriguing setting to explore the intricacies of property taxation.

Unraveling Denver’s Real Estate Tax Structure

The real estate tax system in Denver, as in many other cities, is a complex interplay of various factors, including property value, location, and the city’s budget needs. This section aims to demystify this intricate system, offering a comprehensive guide to navigating Denver’s real estate tax landscape.

Assessed Value and Tax Rates

The journey towards understanding Denver’s real estate taxes begins with the assessment process. In Denver, the assessed value of a property is typically 7.15% of its actual value, as determined by the Assessor’s Office. This assessed value forms the basis for calculating property taxes.

The tax rate in Denver is expressed as a mill levy, which represents the number of dollars owed per $1,000 of assessed value. For instance, if the mill levy is set at 70 mills, homeowners would pay $70 for every $1,000 of their property's assessed value. This mill levy is a product of the budgets set by various tax districts, including the city, county, and school district.

To illustrate, consider a property in Denver with an actual value of $500,000. Its assessed value, calculated at 7.15%, would be $35,750. If the mill levy for that area is 70 mills, the property owner would pay $2,502.50 in annual property taxes ($35,750 x 0.070 = $2,502.50). This calculation showcases how Denver's real estate tax system operates, with assessed value and mill levy as its key components.

| Tax District | Mill Levy (per $1,000) |

|---|---|

| Denver County | 35.75 |

| Denver City | 15.00 |

| Denver Public Schools | 16.00 |

| Other Districts (e.g., Parks, Library) | 3.20 |

This table provides a breakdown of the mill levies for different tax districts in Denver, offering a clearer picture of how these rates contribute to the overall property tax burden.

Exemptions and Abatements

Denver, like many other jurisdictions, offers certain exemptions and abatements to reduce the property tax burden for specific groups or under certain conditions. These can include exemptions for seniors, veterans, and people with disabilities, as well as abatements for new construction or renovation projects.

For instance, the Senior Homestead Exemption allows qualifying seniors to exempt a portion of their property's assessed value from taxation, providing significant savings on their annual property tax bill. Similarly, the Veterans Exemption provides a property tax reduction for eligible veterans, easing their financial burden.

Additionally, Denver offers Enterprise Zone Abatements to encourage economic development in specific areas. Properties located within these zones may be eligible for reduced property taxes, offering an incentive for investment and development in these targeted areas.

Tax Increases and Caps

Denver, like many other cities, employs mechanisms to control the growth of property taxes. One such measure is the Gallagher Amendment, which adjusts the assessment rates for residential and non-residential properties to ensure a balance in the tax burden between these two groups.

Furthermore, Denver has implemented tax increase limits, capping the maximum amount by which property taxes can increase in a given year. This cap, typically tied to the rate of inflation, ensures that property owners are not faced with sudden and drastic increases in their tax bills.

Payment Options and Due Dates

Denver offers various payment options for property taxes, including online payments, direct debit, and traditional methods like check or money order. The city provides a convenient Tax Payment Portal, accessible through its official website, offering a user-friendly platform for taxpayers to manage their accounts and make payments.

Property taxes in Denver are typically due in two installments, with the first installment due in February and the second in June. However, taxpayers have the option to pay their entire annual tax bill by the first due date, providing some flexibility in managing their finances.

Impact of Real Estate Taxes on the Denver Market

Real estate taxes play a significant role in shaping the dynamics of Denver’s property market. This section explores the various ways in which these taxes influence investment decisions, market trends, and the overall economic health of the city.

Influence on Investment Decisions

For investors, real estate taxes are a critical factor in determining the viability and profitability of a potential investment. In Denver, where the real estate market is competitive, the tax structure can significantly impact investment strategies.

High property taxes can deter investors, especially those looking for short-term gains, as they eat into potential profits. On the other hand, investors focused on long-term holds might see these taxes as a necessary cost, particularly if they believe in Denver's potential for sustained growth.

Furthermore, the availability of tax exemptions and abatements can sway investment decisions. For instance, an investor might be more inclined to consider a property located in an Enterprise Zone, knowing that they could benefit from tax abatements over the long term.

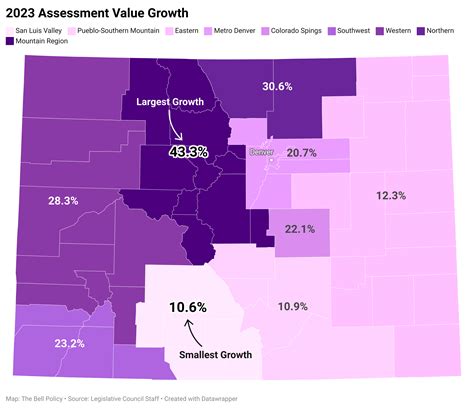

Market Trends and Tax Adjustments

Denver’s real estate market, known for its resilience and steady growth, often experiences shifts and adjustments influenced by various factors, including real estate taxes.

During periods of rapid market growth, property values can increase significantly, leading to higher assessed values and, consequently, higher property taxes. This can cause a ripple effect, influencing the affordability of homes and potentially slowing down the market's growth.

In response, Denver's tax authorities might implement measures to control these increases, such as adjusting mill levies or implementing tax caps, to ensure the market remains stable and accessible.

Economic Impact and Revenue Allocation

Real estate taxes are a significant source of revenue for Denver, funding various public services and infrastructure projects. This revenue stream plays a pivotal role in the city’s economic health and development.

The revenue generated from property taxes is allocated to a range of services, including education, public safety, transportation, and environmental initiatives. This allocation directly impacts the quality of life for Denver residents and the overall attractiveness of the city for potential investors and homeowners.

Moreover, the stability and predictability of Denver's real estate tax system contribute to the city's economic resilience, providing a reliable revenue stream for essential services and infrastructure improvements.

Navigating Denver’s Real Estate Tax Landscape

Understanding Denver’s real estate tax system is crucial for anyone considering investing in or owning property in the city. This section offers practical guidance on navigating this system, from calculating taxes to managing payments and exploring available resources.

Calculating Your Property Taxes

Calculating your property taxes in Denver involves a straightforward process. First, determine the assessed value of your property, which is typically 7.15% of its actual value. Then, multiply this assessed value by the mill levy applicable to your property’s location and tax districts.

For instance, if your property's actual value is $400,000, its assessed value would be $28,600 (7.15% of $400,000). If the mill levy in your area is 70 mills, your annual property tax would be $1,979 (28,600 x 0.070 = $1,979). This calculation provides a clear estimate of your tax liability.

Managing Property Tax Payments

Denver offers a range of convenient payment options for property taxes, including online payments, direct debit, and traditional methods like checks or money orders. The city’s Tax Payment Portal provides a user-friendly platform for taxpayers to manage their accounts, view bills, and make payments.

Taxpayers can choose to pay their taxes in two installments, due in February and June, or they can opt to pay the full annual amount by the first due date. This flexibility allows taxpayers to manage their finances according to their preferences and needs.

Resources and Assistance

For those seeking further assistance or detailed information, Denver provides a wealth of resources. The Denver Assessor’s Office offers detailed information on property assessments and tax calculations. The Denver Treasurer’s Office provides guidance on payment options and due dates, as well as assistance for taxpayers facing difficulties.

Additionally, the City and County of Denver website offers a comprehensive section dedicated to real estate taxes, providing valuable insights, tools, and resources for taxpayers. This includes information on exemptions, abatements, and the appeal process, ensuring taxpayers have the support they need to navigate the system effectively.

How often are property values reassessed in Denver?

+Property values in Denver are reassessed every odd-numbered year. This means that in years ending with an odd number (e.g., 2023, 2025), property owners can expect a new assessment of their property’s value.

Can I appeal my property’s assessed value?

+Yes, property owners in Denver have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting an appeal to the Assessor’s Office, providing evidence to support the appeal, and potentially attending a hearing.

What happens if I don’t pay my property taxes on time in Denver?

+Late payment of property taxes in Denver can result in penalties and interest charges. If the taxes remain unpaid, the property could be subject to a tax lien, which may ultimately lead to a tax sale if the taxes are not settled.

Are there any tax relief programs for low-income homeowners in Denver?

+Yes, Denver offers the Property Tax Exemption for Low-Income Homeowners program. This program provides a property tax reduction for eligible low-income homeowners, helping to ease their financial burden. To qualify, homeowners must meet certain income and residency requirements.

How can I stay informed about changes in Denver’s real estate tax system?

+To stay updated on changes and developments in Denver’s real estate tax system, you can subscribe to notifications from the Denver Assessor’s Office and the Denver Treasurer’s Office. Additionally, local news outlets and real estate blogs often cover significant tax-related updates and changes.