Denton County Tax Records

Denton County, located in the heart of North Texas, is a thriving region known for its vibrant communities, diverse economy, and rich history. When it comes to property ownership and taxation, understanding Denton County tax records is crucial for residents, businesses, and anyone interested in the local real estate market. These tax records provide valuable insights into property values, ownership details, and the financial landscape of the county. In this comprehensive guide, we will delve into the intricacies of Denton County tax records, exploring their importance, accessibility, and the wealth of information they offer.

Unveiling Denton County Tax Records: A Comprehensive Overview

Denton County tax records serve as a vital resource for a multitude of purposes. Whether you're a homeowner looking to assess the value of your property, a real estate investor researching potential investments, or a business owner seeking information on commercial properties, these records offer a transparent window into the county's real estate dynamics.

The Denton County Tax Assessor-Collector's Office is responsible for maintaining and updating these records, ensuring accuracy and accessibility for the public. By leveraging these records, individuals and entities can make informed decisions regarding property purchases, investments, and even appeal property tax assessments if necessary.

A Deep Dive into Property Information

Denton County tax records provide a wealth of information about each property within the county. Here's a glimpse into the specific details you can expect to find:

- Property Address: The exact location of the property, including street name, number, and city.

- Owner Details: Information about the property owner, including name, mailing address, and contact details.

- Property Type: Classification of the property as residential, commercial, agricultural, or other types.

- Appraised Value: The assessed value of the property, determined by the Denton County Appraisal District.

- Taxable Value: The value used to calculate property taxes, which may differ from the appraised value due to exemptions.

- Tax Rate: The tax rate applied to the property, which is determined by various taxing entities within the county.

- Tax Amount: The total property tax owed for the current tax year.

- Exemptions: Details about any applicable exemptions, such as homestead exemptions or agricultural exemptions.

- Assessment History: A record of the property's appraised value over the years, allowing for historical analysis.

This comprehensive set of information empowers individuals and businesses to make informed decisions, evaluate property investments, and understand the financial obligations associated with property ownership in Denton County.

Exploring Online Access and Search Tools

Convenience is a key aspect of Denton County tax records. The county has embraced technology to provide easy access to these records through its official website. Residents and interested parties can utilize the online property search tool, which offers a user-friendly interface for retrieving specific property information.

By simply entering a property address or Parcel ID, users can quickly access detailed tax records. This online platform not only saves time but also ensures that the latest information is readily available, promoting transparency and accessibility for all.

Understanding the Assessment and Appeal Process

Denton County's tax assessment process is carried out by the Denton County Appraisal District (DCAD). Each year, DCAD assesses the value of properties based on various factors, including market conditions, improvements, and comparable sales.

If a property owner believes that the assessed value is inaccurate or unfair, they have the right to appeal the assessment. The appeal process involves submitting a formal protest to DCAD, providing evidence to support the claim, and potentially attending a hearing to present their case. It is important for property owners to understand this process and their rights to ensure fair taxation.

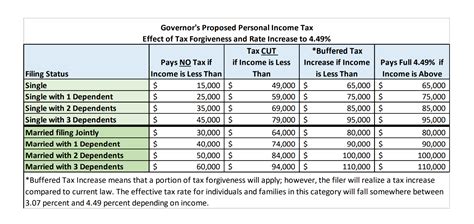

The Role of Taxing Entities and Rates

Denton County is served by multiple taxing entities, including the county itself, independent school districts, municipalities, and special districts. Each of these entities has the authority to levy taxes on properties within their jurisdiction. As a result, property owners may be subject to taxes from several different entities.

The tax rate, often expressed as dollars per $100 of property value, is set by each taxing entity. These rates can vary significantly between different areas of the county, impacting the overall tax burden for property owners. Understanding the tax rates and the entities responsible for them is crucial for budgeting and financial planning.

Analyzing Property Tax Trends and Forecasts

Denton County's tax records offer a historical perspective on property tax trends. By examining these records over time, analysts and researchers can identify patterns, such as the rate of property value appreciation or the impact of economic fluctuations on tax revenues.

Additionally, these records provide insights into the effectiveness of tax policies and initiatives implemented by the county and its taxing entities. By analyzing trends, stakeholders can make informed decisions regarding future tax strategies and allocate resources effectively.

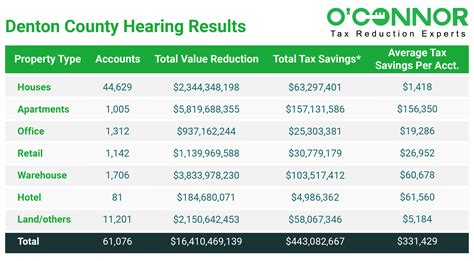

Commercial Property Insights

Denton County's tax records also shed light on the commercial real estate landscape. Businesses can leverage these records to assess potential locations, evaluate competitors' properties, and make informed decisions about expansion or relocation.

Commercial property tax records provide details on rental properties, office spaces, retail establishments, and industrial facilities. This information helps businesses understand the tax obligations and potential benefits associated with different commercial properties in the county.

| Property Type | Average Appraised Value | Average Tax Rate |

|---|---|---|

| Residential | $250,000 | 2.25% |

| Commercial | $500,000 | 2.5% |

| Agricultural | $150,000 | 1.8% |

The Impact of Exemptions and Special Programs

Denton County provides various exemptions and special programs to reduce the tax burden on certain property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, and agricultural exemptions for qualifying farmland.

Understanding these exemptions and their eligibility criteria is crucial for property owners to maximize their tax savings. The tax records often provide details about the types of exemptions applied to each property, allowing homeowners to assess their potential benefits.

Conclusion: Empowering Decisions with Denton County Tax Records

Denton County tax records serve as a powerful tool for individuals, businesses, and researchers seeking insights into the local real estate market. By providing detailed property information, historical data, and tax-related insights, these records empower decision-making processes.

Whether it's evaluating property investments, understanding tax obligations, or analyzing market trends, Denton County tax records offer a comprehensive and accessible resource. By leveraging these records, stakeholders can navigate the complex world of property taxation with confidence and make informed choices that align with their financial goals.

How often are Denton County tax records updated?

+Denton County tax records are typically updated annually, reflecting the changes in property values and tax rates for the current tax year. The updates are made after the appraisal process is completed by the Denton County Appraisal District.

Can I access Denton County tax records online for free?

+Yes, Denton County provides free online access to its tax records through the official county website. You can search for specific properties and view detailed information without any cost.

What if I disagree with the assessed value of my property?

+If you believe the assessed value of your property is inaccurate, you have the right to appeal. The process involves submitting a protest to the Denton County Appraisal Review Board, presenting evidence, and potentially attending a hearing. It’s advisable to consult with a tax professional or legal advisor for guidance.

Are there any tax incentives or programs for homeowners in Denton County?

+Yes, Denton County offers several tax incentives and programs for homeowners. These include homestead exemptions, which reduce the taxable value of your primary residence, and age-65 exemptions for qualified seniors. It’s important to review the eligibility criteria and apply for these programs to maximize your tax savings.