Ca Sales Tax San Jose

Welcome to our comprehensive guide on the sales tax landscape in San Jose, California. Understanding the intricacies of sales tax is crucial for businesses and individuals alike, as it directly impacts financial planning and compliance. In this article, we delve into the specifics of sales tax in San Jose, offering expert insights and practical information to navigate this essential aspect of commerce.

The Complex Nature of Sales Tax in San Jose

Sales tax in San Jose, like in many regions, is a multifaceted system that evolves with economic trends and legislative changes. The city's proximity to Silicon Valley and its vibrant tech industry adds a layer of complexity to the sales tax structure. This guide aims to demystify these complexities, providing a clear roadmap for compliance and strategic planning.

For businesses operating in San Jose, staying abreast of the latest sales tax regulations is imperative. Whether you're an established entity or a startup, a comprehensive understanding of these rules ensures accurate tax calculations, efficient operations, and avoidance of potential penalties. This guide is designed to be your trusted resource, offering in-depth knowledge and practical tips.

Understanding the San Jose Sales Tax Rate

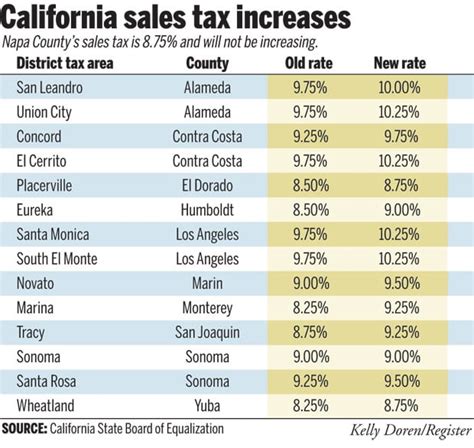

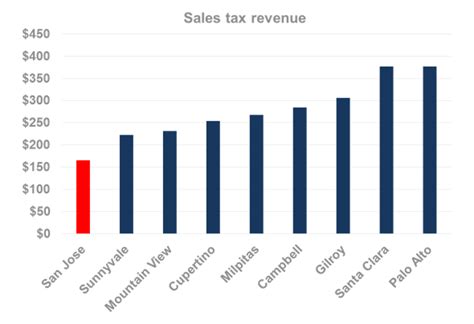

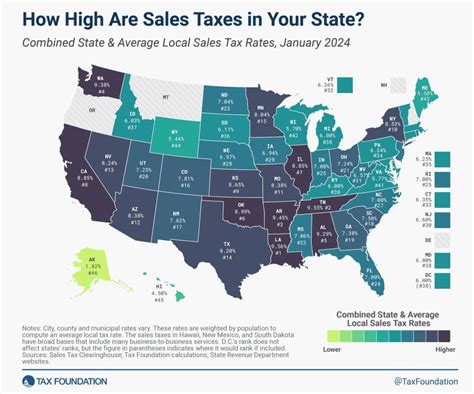

The sales tax rate in San Jose is a combination of state, county, and city taxes, each with its own purpose and rate. As of the latest available information, the total sales tax rate in San Jose is 8.75%. This rate is composed of:

- State Sales Tax: California imposes a state sales tax rate of 7.25%, which is a standard across the state. This tax contributes to the overall funding of state-wide services and infrastructure.

- County Sales Tax: Santa Clara County, where San Jose is located, adds a supplementary tax of 0.75%. This tax supports county-wide initiatives and programs, ensuring the county's continued development and maintenance.

- City Sales Tax: The city of San Jose imposes an additional sales tax of 0.75%. This tax is vital for the city's operations, funding essential services, and contributing to the local economy's growth.

It's important to note that these rates are subject to change. The California State Board of Equalization regularly reviews and adjusts tax rates based on economic conditions and legislative decisions. Therefore, businesses should stay updated on any changes to ensure compliance.

A Breakdown of the Sales Tax Distribution

Understanding how sales tax is distributed can provide valuable insights into the economic priorities and funding allocations of the state, county, and city. Here's a detailed breakdown of how the sales tax revenue is utilized:

| Taxing Entity | Rate | Purpose |

|---|---|---|

| State of California | 7.25% | Funds state-wide initiatives such as education, healthcare, transportation, and public safety. A portion also goes towards debt service and general fund reserves. |

| Santa Clara County | 0.75% | Supports county operations, including healthcare services, social services, public safety, and economic development initiatives. It also contributes to county-wide infrastructure projects. |

| City of San Jose | 0.75% | Provides funding for city operations, including police and fire services, parks and recreation, libraries, and other municipal services. The tax also contributes to economic development efforts within the city. |

Sales Tax Collection and Remittance

Sales tax collection and remittance is a critical aspect of business operations in San Jose. Understanding the process ensures compliance and efficient management of financial obligations. Here's an overview of the key steps involved:

- Registration: Businesses operating in San Jose are required to register with the California Department of Tax and Fee Administration (CDTFA). This registration process ensures that the business is officially recognized for tax purposes and can obtain a unique seller's permit.

- Tax Calculation: The sales tax rate applicable to a transaction is determined based on the location of the sale. For businesses with multiple locations or online sales, this can be complex. Utilizing a reliable sales tax calculator or software can simplify this process.

- Tax Collection: Businesses are responsible for collecting the applicable sales tax from customers at the point of sale. This is typically added to the purchase price and displayed as a separate line item on the sales receipt.

- Record-Keeping: Accurate record-keeping is essential. Businesses should maintain detailed records of all sales transactions, including the date, amount, and applicable tax rate. This ensures compliance and facilitates easy tax filing.

- Remittance: Sales tax collected is held in trust by the business until it is remitted to the appropriate tax authority. The frequency of remittance depends on the business's sales volume and tax liability. Some businesses may remit monthly, quarterly, or annually.

- Filing: Sales tax returns must be filed with the CDTFA within a specified timeframe. These returns detail the sales transactions and the corresponding tax amounts. Late filing or non-compliance can result in penalties and interest charges.

Tips for Efficient Sales Tax Management

Managing sales tax obligations effectively can save businesses time and resources. Here are some practical tips:

- Stay Informed: Regularly check the CDTFA website for updates and changes to sales tax regulations. Subscribing to their newsletter or following their social media accounts can provide timely notifications.

- Utilize Technology: Invest in reliable sales tax software or services that can automate tax calculations, record-keeping, and filing processes. This reduces the risk of errors and saves valuable time.

- Train Staff: Ensure that all staff involved in sales transactions are trained on sales tax procedures. This includes understanding the applicable tax rates and the proper way to collect and record sales tax.

- Regular Audits: Conduct internal audits to verify the accuracy of sales tax calculations and remittances. This can help identify any discrepancies early on and ensure ongoing compliance.

Sales Tax Exemptions and Special Considerations

While sales tax is generally applicable to most goods and services, there are certain exemptions and special considerations in San Jose. These can vary based on the nature of the transaction and the type of business involved. Understanding these exemptions is crucial to avoid over-collection of tax and potential penalties.

Common Sales Tax Exemptions

- Resale Exemption: Goods purchased for resale are exempt from sales tax. This exemption applies to businesses that sell products, such as retailers and wholesalers. The key condition is that the goods must be purchased with the intention of being resold in an unchanged form.

- Manufacturing Exemption: Certain manufacturing processes are exempt from sales tax. This exemption applies to the purchase of raw materials and components that are incorporated into a final product. However, it's important to note that not all manufacturing activities qualify, and the specific criteria can be complex.

- Governmental Entities: Sales to governmental entities, such as federal, state, and local governments, are generally exempt from sales tax. This exemption also extends to certain non-profit organizations and educational institutions.

Special Considerations in San Jose

- Technology Sector: San Jose's thriving tech industry has led to some unique sales tax considerations. For instance, sales of certain software and digital products may be subject to different tax rates or exemptions. Businesses in this sector should stay informed about the latest regulations to ensure compliance.

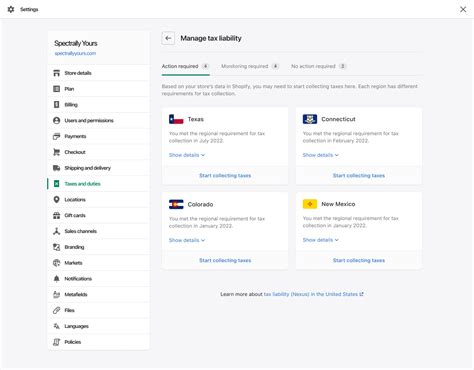

- E-commerce: With the rise of online shopping, San Jose businesses engaged in e-commerce must consider sales tax obligations across state lines. The concept of "nexus" comes into play, where a business may be required to collect sales tax in states where it has a physical presence or significant economic activity.

- Construction and Real Estate: The construction and real estate sectors in San Jose have their own set of sales tax considerations. For instance, the sale of a newly constructed home may be subject to a different tax rate compared to the sale of an existing home. Understanding these nuances is crucial for businesses in these industries.

The Impact of Sales Tax on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in San Jose. For businesses, sales tax obligations can influence pricing strategies, operational costs, and overall profitability. Understanding these impacts is crucial for strategic decision-making.

Sales Tax and Business Operations

- Pricing Strategies: Businesses often incorporate sales tax into their pricing strategies. This can be done by including tax in the displayed price or by showing it as a separate line item. The choice of strategy can impact consumer perception and purchasing behavior.

- Operational Costs: Sales tax collection and remittance processes add to a business's operational costs. The time and resources dedicated to these tasks should be factored into overall operational expenses.

- Profitability: Sales tax obligations can directly impact a business's bottom line. Accurate tax calculations and efficient remittance processes are essential to ensure that profits are not eroded by tax liabilities.

Consumer Perspective

- Purchasing Decisions: Sales tax can influence consumer purchasing decisions. Consumers may opt for lower-tax jurisdictions or online retailers to reduce their overall costs. Understanding these behaviors can help businesses tailor their strategies to remain competitive.

- Price Transparency: Consumers appreciate price transparency, especially when it comes to sales tax. Clearly displaying tax amounts on sales receipts and product listings can enhance consumer trust and satisfaction.

- Tax Burden: In some cases, consumers may view sales tax as an additional cost burden. Businesses can mitigate this perception by offering value-added services or by highlighting the benefits that sales tax revenues provide to the community.

Future Trends and Developments in San Jose's Sales Tax Landscape

The sales tax landscape in San Jose is dynamic and continues to evolve. As the city's economy and demographics change, so do the tax policies and regulations. Staying informed about these future trends and developments is essential for businesses and individuals to adapt their strategies and ensure ongoing compliance.

Potential Changes to Sales Tax Rates

Sales tax rates in San Jose are subject to change based on various factors, including economic conditions, legislative decisions, and voter-approved initiatives. While it's challenging to predict exact rate changes, staying informed about local and state-wide economic trends can provide valuable insights. For instance, during economic downturns, there may be calls for tax rate increases to bolster government revenues. Conversely, in periods of strong economic growth, there may be opportunities for tax rate decreases or exemptions to stimulate the economy further.

Impact of Technological Advancements

The rapid advancement of technology, particularly in the e-commerce and software sectors, has had a significant impact on San Jose's sales tax landscape. As more businesses move online and offer digital products and services, the tax authorities have had to adapt their regulations to keep pace. This includes the development of specific tax rules for digital goods and services, as well as the concept of "nexus," which determines a business's tax obligations across different jurisdictions.

Businesses in San Jose should stay abreast of these technological trends and their associated tax implications. This includes staying informed about the latest tax regulations for digital products, as well as understanding how the concept of nexus may impact their tax obligations in other states.

The Role of Voter Initiatives

In San Jose and California more broadly, voter initiatives play a significant role in shaping sales tax policies. Voters have the power to approve or reject tax increases or changes, which can have a direct impact on the sales tax rates and how the revenues are allocated. For instance, voter-approved initiatives may direct sales tax revenues towards specific causes or projects, such as education, infrastructure, or environmental initiatives.

Businesses and individuals should stay informed about upcoming voter initiatives and their potential implications. This can help in strategic planning and budgeting, ensuring that businesses are prepared for any changes and can adapt their operations accordingly.

Conclusion

Understanding the sales tax landscape in San Jose is a crucial aspect of doing business in the city. From the complex structure of the tax rates to the impact on businesses and consumers, every facet has significant implications. This guide has aimed to provide a comprehensive overview, offering insights and practical tips for compliance and strategic decision-making.

As the sales tax landscape continues to evolve, businesses must stay informed and adaptable. This includes staying abreast of potential rate changes, technological advancements, and voter initiatives. By doing so, businesses can ensure they remain compliant, competitive, and able to leverage the opportunities presented by the ever-changing tax environment.

What is the current sales tax rate in San Jose, California?

+The current sales tax rate in San Jose is 8.75%, which includes the state, county, and city sales tax rates.

How often do sales tax rates change in San Jose?

+Sales tax rates can change periodically, typically based on economic conditions and legislative decisions. It’s important to stay updated with the California State Board of Equalization for any changes.

Are there any sales tax exemptions or special considerations in San Jose?

+Yes, there are certain exemptions and special considerations, such as the resale exemption, manufacturing exemption, and exemptions for governmental entities. It’s important to understand these to avoid over-collection of tax.

How can I efficiently manage my sales tax obligations in San Jose?

+Utilize reliable sales tax software, train your staff on sales tax procedures, and conduct regular internal audits. Staying informed about the latest regulations and utilizing technology can simplify the process.

What impact does sales tax have on businesses and consumers in San Jose?

+Sales tax impacts businesses through pricing strategies, operational costs, and profitability. For consumers, it can influence purchasing decisions and price transparency. Understanding these impacts is crucial for strategic planning.