401K Distribution Tax Calculator

In the realm of personal finance, understanding the tax implications of your 401(k) distributions is crucial for effective financial planning. This article aims to provide an in-depth guide on calculating the taxes associated with 401(k) withdrawals, offering a comprehensive understanding of the process and its potential impact on your financial decisions.

Navigating the World of 401(k) Distribution Taxes

The 401(k) plan is a popular retirement savings vehicle in the United States, offering tax advantages during the accumulation phase. However, when it comes to withdrawals, the tax landscape becomes more complex. Understanding the tax implications of 401(k) distributions is essential for maximizing the benefits of your retirement savings.

Key Considerations for Tax Calculation

When calculating taxes on 401(k) distributions, several factors come into play. Firstly, it’s important to distinguish between two primary types of distributions: qualified and early withdrawals. Qualified distributions occur after the age of 59½, while early withdrawals carry additional penalties and tax implications.

Additionally, the tax calculation depends on the composition of your 401(k) funds. If your 401(k) includes both pre-tax and post-tax contributions, as well as any employer-matched funds, the tax treatment of each component may differ. Understanding the breakdown of your 401(k) balance is crucial for an accurate tax calculation.

Step-by-Step Guide to Calculating 401(k) Distribution Taxes

Calculating the taxes on your 401(k) distribution involves a systematic process. Here’s a detailed breakdown of the steps involved:

-

Determine Distribution Type: Identify whether your distribution is qualified (post-59½) or an early withdrawal. This distinction is crucial as it sets the foundation for the tax calculation.

-

Assess Your 401(k) Composition: Analyze the breakdown of your 401(k) balance. Identify the portions attributed to pre-tax contributions, post-tax contributions, and any employer-matched funds. This information is vital for accurate tax assessment.

-

Calculate Taxable Amount: For qualified distributions, the entire distribution is taxable. However, for early withdrawals, only a portion may be taxable. Determine the taxable amount by considering factors such as early withdrawal penalties and any applicable exceptions.

-

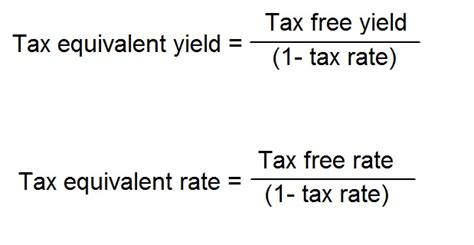

Apply Tax Rates: The taxable amount is then subjected to federal and state income tax rates. The specific rates depend on your tax bracket and the tax laws applicable in your state. Ensure you consider both federal and state tax implications.

-

Consider Additional Factors: In certain cases, additional factors may influence the tax calculation. For instance, if you have multiple 401(k) accounts, the order of withdrawals and the tax treatment of each account must be considered. Consult with a tax professional to navigate these complexities.

Tax Treatment of Different 401(k) Components

The tax treatment of 401(k) distributions varies based on the composition of your retirement savings. Here’s a breakdown of the tax implications for each component:

| 401(k) Component | Tax Treatment |

|---|---|

| Pre-Tax Contributions | These contributions are made with pre-tax dollars, so they are taxed as ordinary income when withdrawn. The tax rate applied depends on your tax bracket. |

| Post-Tax Contributions | Contributions made with after-tax dollars are typically not taxed again upon withdrawal. However, earnings on these contributions are taxable. |

| Employer-Matched Funds | Employer contributions are typically considered pre-tax and are taxed as ordinary income upon withdrawal. However, the tax treatment can vary based on the specific plan rules. |

Strategies for Minimizing Tax Impact

While 401(k) distributions carry tax implications, there are strategies to minimize the tax burden. Here are some approaches to consider:

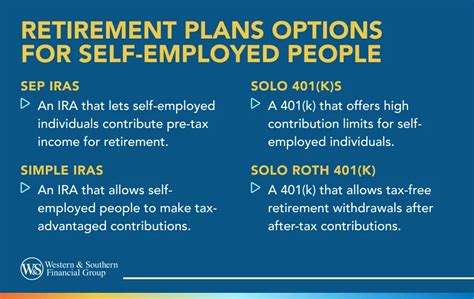

- Rollover to an IRA: If you have multiple 401(k) accounts or are changing jobs, consider rolling over your 401(k) into an Individual Retirement Account (IRA). This can provide more flexibility in managing your retirement savings and potentially reduce tax complications.

- Roth Conversion: Converting a portion of your 401(k) to a Roth account can offer tax benefits. While a Roth conversion triggers a tax event, it allows for tax-free withdrawals in retirement, providing a potential long-term advantage.

- Understand Early Withdrawal Penalties: Early withdrawals come with penalties and higher tax rates. Understanding the rules and exceptions can help you make informed decisions to minimize the impact of early withdrawals.

The Role of Professional Guidance

Calculating 401(k) distribution taxes can be complex, especially when considering the various components and potential strategies. Consulting with a financial advisor or tax professional is highly recommended. They can provide personalized advice based on your specific circumstances, helping you navigate the tax landscape effectively.

Future Implications and Planning

Understanding the tax implications of 401(k) distributions is not only crucial for the present but also for long-term financial planning. By considering the tax impact of your retirement savings, you can make informed decisions that align with your financial goals. Effective tax planning can help optimize your retirement income and ensure a secure financial future.

Frequently Asked Questions

How are early withdrawals from a 401(k) taxed?

+Early withdrawals from a 401(k) are subject to additional taxes and penalties. Typically, you’ll pay ordinary income tax on the distribution, plus a 10% early withdrawal penalty if you’re under the age of 59½. However, there are exceptions and strategies to mitigate these penalties, such as using the funds for certain qualified expenses.

Can I avoid taxes on my 401(k) distribution if I roll it over to an IRA?

+Yes, rolling over your 401(k) to an IRA can help you avoid taxes on the distribution. A direct rollover allows you to transfer the funds from your 401(k) to an IRA without triggering a taxable event. This provides more flexibility in managing your retirement savings and can simplify the tax calculation process.

Are there any strategies to minimize the tax impact of 401(k) distributions?

+Absolutely! One strategy is to consider a Roth conversion. By converting a portion of your 401(k) to a Roth account, you can pay taxes on the conversion amount upfront but enjoy tax-free withdrawals in retirement. This can provide significant long-term tax benefits. Additionally, understanding early withdrawal exceptions and planning your distributions strategically can help minimize tax impact.

How do I calculate the taxable amount of my 401(k) distribution?

+The taxable amount of your 401(k) distribution depends on its composition. For qualified distributions, the entire amount is taxable. For early withdrawals, you’ll need to calculate the taxable portion, which includes pre-tax contributions and any applicable penalties. Consult with a tax professional to accurately determine the taxable amount based on your specific circumstances.