York Adams Tax Bureau

The York Adams Tax Bureau is a vital entity within the Pennsylvania Department of Revenue, playing a crucial role in the tax administration and enforcement processes for the York and Adams counties. With a rich history dating back to the establishment of these counties, the bureau has evolved to meet the changing tax landscape and the diverse needs of its taxpayers.

A Legacy of Service: The York Adams Tax Bureau’s History

The York Adams Tax Bureau’s story began with the formation of York County in 1749 and Adams County in 1800. As these counties grew, so did the need for a dedicated tax administration body. The bureau’s early years were marked by the challenges of a burgeoning population and a rapidly evolving tax system. Through the decades, the York Adams Tax Bureau has adapted to various economic shifts, tax reforms, and technological advancements, ensuring efficient tax collection and compliance.

One notable reform that significantly impacted the bureau's operations was the Tax Reform Code of 1971. This comprehensive legislation overhauled Pennsylvania's tax system, introducing a new set of rules and regulations. The York Adams Tax Bureau played a pivotal role in implementing these changes, ensuring a smooth transition for taxpayers and businesses in York and Adams counties.

Key Milestones and Achievements

Over the years, the York Adams Tax Bureau has achieved several milestones, contributing to the economic stability and growth of the region. One significant achievement was the successful implementation of the Pennsylvania Personal Income Tax, a crucial revenue source for the state. The bureau’s expertise and dedication were instrumental in ensuring the fair and efficient collection of this tax, which has since become a cornerstone of Pennsylvania’s fiscal policy.

In addition, the York Adams Tax Bureau has been at the forefront of adopting innovative technologies to enhance its services. The introduction of online filing systems and digital payment platforms has not only streamlined tax processes but also improved accessibility for taxpayers. These initiatives have earned the bureau recognition for its commitment to technological advancement and taxpayer convenience.

| Milestone | Impact |

|---|---|

| Adoption of Online Filing | Enhanced efficiency and accessibility for taxpayers |

| Implementation of Pennsylvania Personal Income Tax | Provided a stable revenue source for the state |

| Tax Reform Code of 1971 | Overhauled tax system, introducing modern regulations |

Services and Expertise: Navigating the Tax Landscape

The York Adams Tax Bureau offers a comprehensive suite of services designed to assist taxpayers and businesses with their tax obligations. From providing guidance on tax laws and regulations to facilitating the filing process, the bureau is a trusted resource for all tax-related matters.

Taxpayer Assistance and Education

The bureau recognizes the importance of taxpayer education in fostering a culture of compliance. Its team of experts conducts regular outreach programs and workshops, ensuring that taxpayers are well-informed about their rights and responsibilities. These initiatives cover a wide range of topics, from basic tax filing to complex business tax scenarios.

For instance, the bureau's annual Taxpayer Awareness Week is a highlight, offering a series of educational events and seminars. These events provide an opportunity for taxpayers to interact with tax professionals, ask questions, and gain a deeper understanding of the tax system. The bureau's commitment to taxpayer education has been instrumental in reducing compliance issues and fostering a cooperative environment.

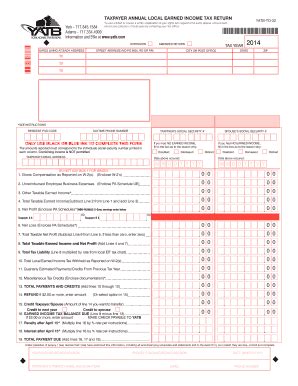

Efficient Tax Administration

At the core of the York Adams Tax Bureau’s operations is efficient tax administration. The bureau employs advanced technologies and processes to ensure timely and accurate tax collection. Its online platforms, such as the e-File system, enable taxpayers to file their returns quickly and securely, reducing the risk of errors and ensuring compliance.

In addition, the bureau's data analytics capabilities play a crucial role in identifying non-compliance and potential fraud. By leveraging data-driven insights, the bureau can focus its resources effectively, ensuring a fair and equitable tax system. This approach has not only improved tax collection rates but also enhanced the bureau's ability to combat tax evasion.

| Service | Description |

|---|---|

| Taxpayer Education Programs | Regular workshops and events to educate taxpayers on tax laws and regulations |

| Online Filing Systems | Secure and efficient platforms for taxpayers to file their returns |

| Data Analytics | Utilizing data-driven insights to improve tax collection and identify non-compliance |

A Focus on the Future: Continuous Improvement and Growth

As the tax landscape continues to evolve, the York Adams Tax Bureau remains committed to continuous improvement and innovation. The bureau recognizes the need to adapt to changing economic conditions and technological advancements to provide the best possible service to its taxpayers.

Strategic Planning and Future Initiatives

The York Adams Tax Bureau has a robust strategic planning process in place to guide its future initiatives. This process involves a comprehensive analysis of the current tax environment, emerging trends, and taxpayer needs. Based on this analysis, the bureau develops strategies to enhance its services, improve efficiency, and meet the evolving demands of taxpayers.

One key area of focus for the bureau is the adoption of emerging technologies. The bureau is exploring the potential of blockchain and artificial intelligence to further enhance its tax administration processes. These technologies offer the promise of increased security, improved data analysis capabilities, and enhanced taxpayer services.

Community Engagement and Outreach

Community engagement is a vital component of the York Adams Tax Bureau’s strategy. The bureau actively participates in community events, provides educational resources to local schools and universities, and collaborates with local businesses and organizations. These efforts not only foster a sense of trust and cooperation but also provide valuable feedback and insights to improve the bureau’s services.

Furthermore, the bureau's community engagement initiatives extend to assisting vulnerable populations. Through partnerships with local charities and community organizations, the bureau ensures that everyone, regardless of their background or financial situation, has access to the resources and support they need to meet their tax obligations.

| Future Initiative | Description |

|---|---|

| Blockchain and AI Integration | Exploring the use of emerging technologies to enhance security and data analysis |

| Community Engagement | Collaborating with local entities to provide education and support to taxpayers |

| Vulnerable Population Assistance | Partnering with charities to ensure equitable access to tax services and resources |

Conclusion: A Trusted Partner for Taxpayers

The York Adams Tax Bureau stands as a beacon of reliability and expertise in the complex world of tax administration. Through its commitment to education, innovation, and community engagement, the bureau has earned the trust and respect of taxpayers and businesses across York and Adams counties. As it continues to adapt and grow, the York Adams Tax Bureau will remain an essential partner in the economic development and stability of the region.

What are the primary services offered by the York Adams Tax Bureau?

+The York Adams Tax Bureau provides a range of services, including taxpayer education and assistance, tax filing support, and efficient tax administration. It also offers guidance on tax laws and regulations, helping taxpayers and businesses navigate their tax obligations.

How does the bureau ensure efficient tax administration?

+The bureau utilizes advanced technologies such as online filing systems and data analytics to streamline tax processes and improve compliance. These tools enable faster, more accurate tax collection and help identify potential issues or non-compliance.

What future initiatives is the York Adams Tax Bureau exploring?

+The bureau is focused on adopting emerging technologies like blockchain and AI to enhance security and data analysis. It is also committed to community engagement, aiming to provide education and support to taxpayers and collaborate with local entities for a more inclusive tax system.