Www Va Tax Virginia Gov

Welcome to an in-depth exploration of the Virginia Department of Taxation, a vital governmental entity responsible for managing the state's revenue system. This department plays a pivotal role in Virginia's economic landscape, ensuring the efficient collection and management of taxes to support various public services and infrastructure. This article aims to provide a comprehensive guide to the www.tax.virginia.gov platform, shedding light on its features, functionalities, and importance to both residents and businesses within the state.

Understanding the Role of Virginia’s Department of Taxation

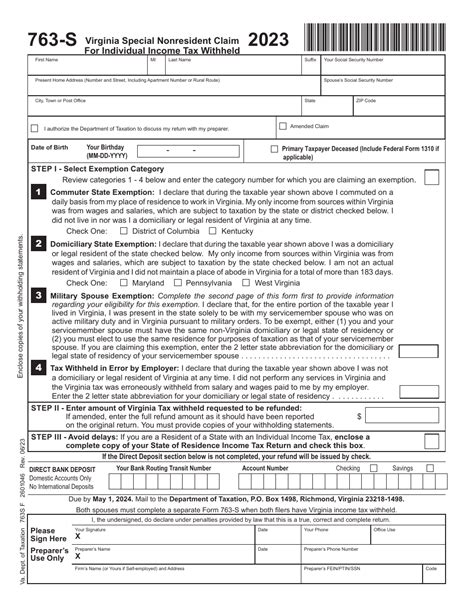

The Virginia Department of Taxation is a cornerstone of the state’s governance, tasked with administering a wide array of taxes, including personal income tax, corporate income tax, sales and use tax, and more. Its primary objectives are to ensure tax compliance, provide convenient services to taxpayers, and facilitate a fair and efficient tax system. The department’s operations are guided by a commitment to transparency, accountability, and the effective utilization of technology to streamline tax processes.

A key aspect of the department's work involves managing the Virginia Tax Online System, an online platform accessible at www.tax.virginia.gov. This system serves as a digital gateway for taxpayers to interact with the department, offering a range of services and information that are integral to Virginia's tax ecosystem.

Features and Services of www.tax.virginia.gov

The www.tax.virginia.gov platform is a comprehensive resource for taxpayers, providing an array of features and services that enhance the tax filing and payment process. Here’s a detailed breakdown of its key offerings:

Tax Filing and Payment

The platform facilitates the electronic filing of various tax returns, including individual income tax, corporate income tax, sales and use tax, and more. Taxpayers can access secure forms, input their information, and submit returns directly through the website. Additionally, the system allows for online payments, offering a convenient and secure method to settle tax liabilities.

For instance, individual taxpayers can utilize the Virginia eFile service to file their state income tax returns quickly and securely. This service is compatible with most tax preparation software and offers a step-by-step guide to ensure accurate filing. Corporate entities, on the other hand, can leverage the eForms section to access and submit necessary tax forms electronically, saving time and resources.

| Tax Type | Online Filing Service |

|---|---|

| Individual Income Tax | Virginia eFile |

| Corporate Income Tax | eForms |

| Sales and Use Tax | Sales and Use Tax eForms |

Tax Research and Information

The website serves as a repository of tax-related information, offering detailed guides, FAQs, and resources to assist taxpayers in understanding their tax obligations. This section covers a wide range of topics, from tax rates and brackets to specific tax credits and deductions.

One notable feature is the Tax Topics section, which provides in-depth articles and explanations on various tax-related subjects. For instance, it offers comprehensive guides on topics like estate tax, local tax rates, and tax exemptions, ensuring taxpayers have the knowledge they need to navigate Virginia's tax landscape effectively.

Account Management and Notifications

Registered users can manage their tax accounts online, including viewing their tax history, tracking the status of refunds, and receiving important notifications and updates. The system also allows users to update their personal information, such as address changes, ensuring accurate record-keeping.

The My Tax Account feature is particularly useful, providing a centralized dashboard for users to access and manage all their tax-related information. This includes real-time updates on tax payments, pending returns, and any outstanding balances, helping taxpayers stay on top of their tax obligations.

Tax Professional Resources

The platform also caters to tax professionals, offering resources and tools to assist them in providing services to their clients. This includes access to tax forms, regulations, and guidance documents, ensuring tax professionals have the latest information at their fingertips.

One such resource is the Tax Practitioner Portal, which provides a dedicated space for tax professionals to manage their clients' tax matters. This portal includes features like bulk filing, e-signature capabilities, and the ability to track the status of returns, streamlining the tax preparation process for professionals.

Tax News and Updates

The website features a dedicated news section, keeping taxpayers informed about the latest tax-related news, legislative changes, and department updates. This ensures taxpayers are aware of any new developments that may impact their tax obligations or refund status.

For instance, during tax season, the Tax News section provides regular updates on filing deadlines, any changes to tax laws, and tips to help taxpayers prepare and file their returns accurately. This proactive approach ensures taxpayers can plan their finances effectively and avoid potential penalties.

Benefits and Impact of the Online System

The implementation of the www.tax.virginia.gov platform has brought about several notable benefits and improvements to Virginia’s tax system. These include:

- Enhanced Convenience and Accessibility: The online system offers taxpayers the flexibility to file and pay taxes from the comfort of their homes or offices, eliminating the need for in-person visits to tax offices.

- Improved Efficiency: Electronic filing and payment processes are faster and more accurate, reducing the time and resources required for tax administration. This efficiency translates to quicker refunds and improved overall tax management.

- Better Taxpayer Experience: The platform's user-friendly design and comprehensive resources make it easier for taxpayers to understand and fulfill their tax obligations. This enhances taxpayer satisfaction and trust in the tax system.

- Cost Savings: By shifting to digital processes, the department reduces its reliance on physical infrastructure and staffing, leading to significant cost savings. These savings can be reinvested into other public services, benefiting the community at large.

- Enhanced Compliance: The online system, with its automated processes and real-time updates, helps ensure greater tax compliance. Taxpayers are more likely to stay on top of their obligations, leading to a more fair and equitable tax system.

Future Prospects and Innovations

Looking ahead, the Virginia Department of Taxation continues to innovate and improve its online services. Some of the potential future developments and enhancements include:

- Mobile Optimization: With the increasing reliance on mobile devices, the department may consider optimizing the platform for mobile use, allowing taxpayers to access services on-the-go.

- AI and Machine Learning Integration: Incorporating AI technologies could enhance the platform's capabilities, such as providing personalized tax recommendations or automating certain routine tasks.

- Enhanced Security Measures: As digital threats evolve, the department will likely continue to invest in robust security measures to protect taxpayer data and maintain the integrity of the system.

- Real-time Data Analytics: Leveraging real-time data analytics could provide valuable insights into taxpayer behavior and trends, allowing the department to make data-driven decisions and further improve its services.

- Expanded Payment Options: To cater to a wider range of taxpayers, the department may introduce additional payment methods, such as digital wallets or cryptocurrency, providing more flexibility in tax payment options.

Conclusion: A Digital Revolution in Tax Management

The www.tax.virginia.gov platform represents a significant step forward in Virginia’s tax management, offering a user-friendly, efficient, and secure system for taxpayers. By leveraging technology, the Virginia Department of Taxation has not only streamlined tax processes but also enhanced taxpayer engagement and satisfaction. As the department continues to innovate, the future of Virginia’s tax system looks bright, promising continued improvements and a more efficient, equitable tax landscape.

Frequently Asked Questions (FAQ)

How do I register for an account on the Virginia Tax Online System?

+

To register for an account, visit the www.tax.virginia.gov website and navigate to the “Register” section. You’ll need to provide basic personal information and create a secure login. Once registered, you can access a range of tax services and manage your tax obligations online.

What are the benefits of electronic filing and payment of taxes in Virginia?

+

Electronic filing and payment offer several advantages, including faster processing times, reduced errors, and the convenience of filing from anywhere with an internet connection. Additionally, electronic filing often results in quicker refunds and provides a more secure and private method of sharing tax information.

Can I check the status of my tax refund online?

+

Yes, you can check the status of your tax refund online through the “My Tax Account” section on the www.tax.virginia.gov website. This feature provides real-time updates on the status of your refund, helping you track its progress and anticipate its arrival.

Are there any security measures in place to protect my personal information on the online system?

+

Absolutely. The Virginia Tax Online System employs robust security measures, including encryption protocols and secure servers, to protect your personal and financial information. Additionally, the system requires strong passwords and offers two-factor authentication for added security.

What resources are available for tax professionals on the platform?

+

The platform offers a dedicated Tax Practitioner Portal, providing tax professionals with access to bulk filing capabilities, e-signature features, and real-time updates on their clients’ tax returns. This portal streamlines the tax preparation process and enhances efficiency for tax professionals.