Wisconsin Sales Tax Rate

In the United States, sales tax is a crucial component of revenue generation for state and local governments. Each state has its own sales tax laws, rates, and regulations, and understanding these can be vital for businesses and individuals alike. This article delves into the specifics of the Wisconsin Sales Tax Rate, providing an in-depth analysis of its current status, historical context, and potential future implications.

Wisconsin Sales Tax Rate: A Comprehensive Overview

The Wisconsin Sales Tax is a consumption tax levied on the sale of tangible personal property and some services within the state. It is an essential source of revenue for the state government, contributing to the funding of various public services and infrastructure projects.

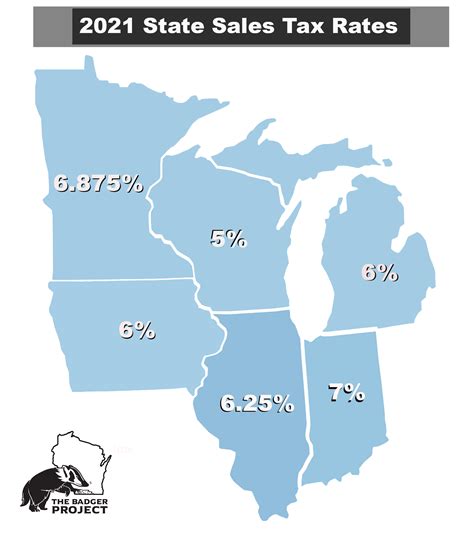

As of my last update in January 2023, the standard Wisconsin Sales Tax Rate is 5%, which is applied to most retail sales and certain services. However, it is important to note that there are additional sales tax rates and regulations that can vary based on location and the type of goods or services being sold.

Statewide Sales Tax Rate

The 5% statewide sales tax applies to a wide range of goods and services, including clothing, electronics, furniture, and many other retail items. This rate is consistent across the state, ensuring a level playing field for businesses and a straightforward calculation for consumers.

For instance, if you purchase a laptop for $1000 in Wisconsin, the sales tax amount would be calculated as follows: $1000 x 0.05 = $50. Thus, the total cost of the laptop would be $1050.

Local Sales Tax Rates

In addition to the statewide rate, Wisconsin allows local governments, such as counties and municipalities, to impose their own sales tax rates. These local sales tax rates can vary significantly, leading to a unique sales tax environment in each region of the state.

| County/Municipality | Local Sales Tax Rate |

|---|---|

| Milwaukee County | 0.5% |

| Dane County | 0.5% |

| Brown County | 0.5% |

| Racine County | 0.5% |

| Kenosha County | 0.5% |

When considering the total sales tax rate in these areas, the combined state and local rate would be 5.5%. This additional local sales tax is often used to fund specific projects or services within the community, such as infrastructure development or public safety initiatives.

Specific Taxable Items

While the Wisconsin Sales Tax generally applies to most tangible personal property, there are certain exceptions and exemptions. Some notable items that are taxable include:

- Alcoholic beverages

- Motor vehicle sales and rentals

- Lodging and room rentals

- Certain services, such as repairs and installations

On the other hand, there are certain items and services that are exempt from sales tax in Wisconsin. These exemptions can vary based on the type of item or the purpose for which it is purchased. Some common exemptions include:

- Prescription medications

- Certain food items for home consumption

- Educational materials and textbooks

- Agricultural equipment and supplies

Historical Context and Rate Changes

The Wisconsin Sales Tax has undergone several changes since its inception. The state first introduced a sales tax in 1962, with an initial rate of 3%. Over the years, the rate has been adjusted multiple times to meet the changing revenue needs of the state.

| Year | Sales Tax Rate |

|---|---|

| 1962 | 3% |

| 1969 | 4% |

| 1985 | 5% |

| 2018 | 5.5% (until 2021) |

| 2021 | 5% (current rate) |

The sales tax rate was temporarily increased to 5.5% in 2018 as part of the state's biennial budget, but it reverted to 5% in 2021. This fluctuation highlights the dynamic nature of sales tax rates and the need for businesses and consumers to stay informed about any changes.

Future Implications and Potential Rate Adjustments

Predicting future sales tax rate changes is challenging, as it depends on various economic and political factors. However, it’s worth noting that Wisconsin, like many other states, often considers sales tax adjustments as a means to balance budgets or fund specific initiatives.

In recent years, there have been discussions about the potential for a sales tax increase to fund infrastructure improvements or educational initiatives. While these discussions have not yet led to concrete changes, they highlight the ongoing debate around sales tax rates and their role in state revenue generation.

Conclusion: Navigating Wisconsin’s Sales Tax Landscape

Understanding the Wisconsin Sales Tax Rate is essential for both businesses and consumers operating within the state. With a combination of statewide and local rates, as well as various exemptions and taxable items, the sales tax landscape in Wisconsin can be complex. Staying informed about these rates and regulations is crucial to ensure compliance and avoid any unexpected financial burdens.

As we navigate the ever-changing world of taxation, keeping an eye on potential rate adjustments and staying updated on the latest regulations will be key for businesses and individuals alike. For now, the current Wisconsin Sales Tax Rate of 5% provides a stable framework for economic activities within the state.

How often are sales tax rates updated in Wisconsin?

+

Sales tax rates in Wisconsin are generally reviewed and updated as part of the state’s biennial budget process. While changes can occur at any time, significant rate adjustments often coincide with the budget cycle.

Are there any online resources to help calculate sales tax in Wisconsin?

+

Yes, the Wisconsin Department of Revenue provides an online sales tax calculator and various resources to assist businesses and individuals in calculating and understanding sales tax obligations. You can access these tools on their official website.

What happens if I don’t collect or remit sales tax correctly in Wisconsin?

+

Failure to collect and remit sales tax correctly can result in penalties and interest charges. It’s crucial to stay informed about your sales tax obligations and consult with tax professionals if needed to ensure compliance.