What Is Personal Property Tax

Understanding the concept of personal property tax is crucial for individuals and businesses alike, as it forms a significant part of the revenue generated by local governments and municipalities. Personal property tax, often referred to as personal property tax assessment, is a type of ad valorem tax, which means it is levied based on the assessed value of the property.

The Basics of Personal Property Tax

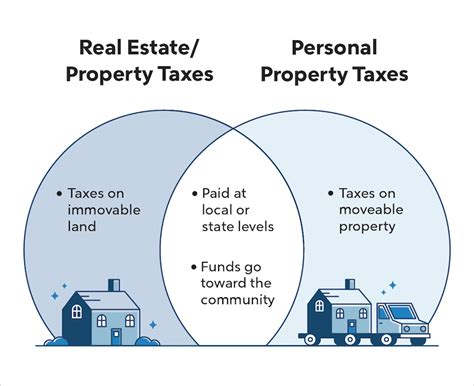

Personal property, in this context, refers to tangible assets that are not permanently affixed to real estate. These assets can be owned by individuals, businesses, or other entities. The tax is imposed on the value of these assets, and it is a crucial source of revenue for local governments, contributing to the funding of essential services like education, infrastructure, and public safety.

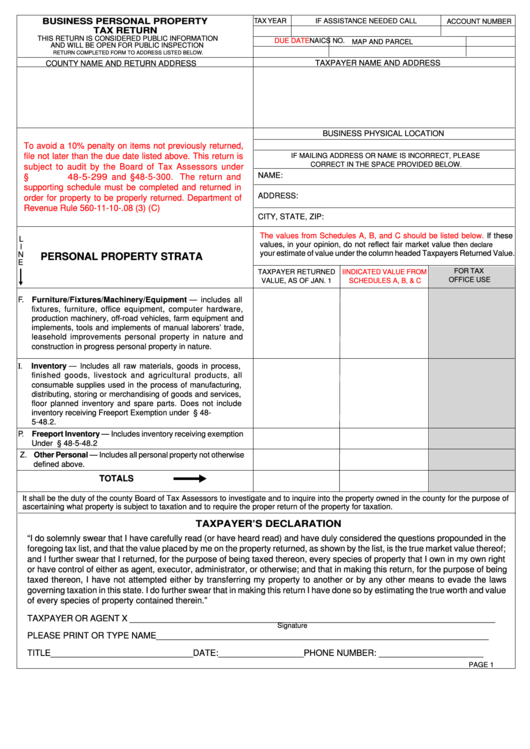

The assessment of personal property tax involves a thorough evaluation of the property's value, which is typically conducted by tax assessors employed by the local government. The assessment process varies across jurisdictions, but it generally involves an inspection of the property, consideration of its age, condition, and market value, and an application of an appropriate assessment rate.

Key Components of Personal Property Tax

Personal property tax consists of several key elements that determine the final tax amount. These include:

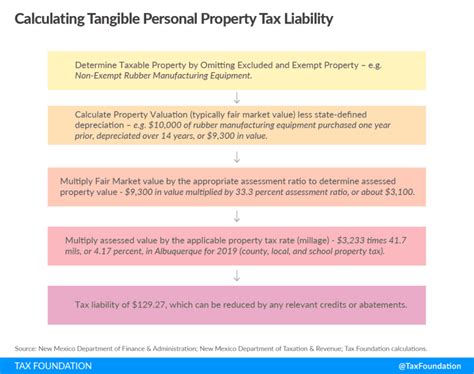

- Assessment Value: This is the value assigned to the personal property by the tax assessor. It is usually a percentage of the property’s fair market value, which is the price it would fetch in an open market.

- Assessment Rate: The assessment rate is a predetermined percentage applied to the assessed value to determine the tax liability. This rate is set by the local government and can vary based on the type of property and its location.

- Tax Rate: The tax rate is another percentage that is applied to the assessed value after the assessment rate. It represents the actual tax amount that the property owner will pay. This rate is typically set by the local taxing authority and is influenced by the budget needs of the municipality.

For instance, if a business owns machinery worth $100,000, and the assessment rate is 50%, the assessed value would be $50,000. If the tax rate is 1%, the business would owe $500 in personal property tax for that asset.

Types of Personal Property Subject to Taxation

Personal property that is typically subject to taxation includes a wide range of assets. For individuals, this can include vehicles such as cars, boats, and motorcycles, as well as furniture, appliances, jewelry, and other household items. For businesses, personal property tax often applies to machinery, equipment, inventory, and even certain types of software and intellectual property.

| Type of Personal Property | Examples |

|---|---|

| Vehicles | Cars, trucks, motorcycles, boats |

| Furniture and Appliances | Couches, refrigerators, washing machines |

| Business Equipment | Machinery, computers, tools |

| Inventory | Goods held for sale or distribution |

The Impact of Personal Property Tax on Businesses

Personal property tax can have a significant impact on businesses, especially those with large inventories or valuable equipment. For instance, a manufacturing company with extensive machinery and tools may face a substantial tax liability. To manage this, businesses often engage in tax planning strategies, such as depreciating assets over time to reduce their taxable value.

Additionally, businesses may also explore tax incentives offered by local governments. These incentives, such as tax abatements or exemptions, are often used to attract businesses and stimulate economic growth in a particular region.

Personal Property Tax and Its Role in Funding Local Services

Personal property tax is a critical component of the tax base for local governments. It helps fund essential services like schools, fire departments, police forces, and public works projects. By levying this tax, local governments can ensure the provision of vital community services and maintain infrastructure.

The revenue generated from personal property tax often forms a substantial part of a municipality's budget. For instance, in many US states, personal property tax accounts for a significant portion of local government revenue, with some states relying on it for over 20% of their total tax revenue.

Challenges and Controversies in Personal Property Tax Assessment

While personal property tax is a vital revenue source for local governments, it is not without its challenges and controversies. One of the main challenges is ensuring that the assessment process is fair and consistent across all taxpayers. This requires regular training and updating of tax assessors to keep up with changing market conditions and valuation techniques.

Another challenge is the potential for tax evasion or underreporting of personal property. To address this, many jurisdictions conduct regular audits and employ advanced data analytics to identify discrepancies in tax returns. These measures help ensure that all taxpayers contribute their fair share to the community's tax base.

Addressing Inequities in Personal Property Taxation

Personal property tax has been a subject of debate due to concerns about its fairness and potential impact on certain sectors. For instance, some argue that personal property tax places an undue burden on businesses, especially those with significant investments in equipment and inventory. This can lead to a competitive disadvantage compared to businesses in jurisdictions with lower tax rates.

To address these concerns, some jurisdictions have implemented reforms to make personal property tax more equitable. These reforms may include adjusting assessment rates, offering tax incentives for specific industries, or shifting the tax burden to other types of property, such as real estate.

The Future of Personal Property Tax

As technology advances and tax policies evolve, the landscape of personal property tax is likely to change. One potential development is the increasing use of data analytics and artificial intelligence in tax assessment. These tools can improve the accuracy and efficiency of the assessment process, ensuring a more equitable tax system.

Additionally, there may be a shift towards more uniform assessment practices across jurisdictions. This could involve standardizing assessment rates and valuation methods to create a more level playing field for taxpayers, especially businesses operating across multiple regions.

The future of personal property tax also depends on broader economic and policy trends. For instance, if there is a shift towards more centralized taxation or a move away from property taxes altogether, personal property tax could decline in importance. However, given its current role in funding local services, it is likely to remain a significant component of the tax system for the foreseeable future.

Conclusion

Personal property tax is a critical component of the tax system, providing essential revenue for local governments to fund vital services and maintain infrastructure. While it presents challenges and controversies, such as fairness and enforcement issues, it remains a necessary tool for ensuring the financial health of communities. As the tax landscape evolves, personal property tax will continue to play a crucial role, adapting to new technologies and policy changes to remain an effective and equitable source of revenue.

What is the difference between personal property tax and real property tax?

+Personal property tax is levied on tangible assets that are not permanently affixed to real estate, such as vehicles, furniture, and business equipment. Real property tax, on the other hand, is imposed on land and any permanent structures on that land, including buildings and improvements. The assessment and tax rates for these two types of property can vary significantly.

How often are personal property tax assessments conducted?

+The frequency of personal property tax assessments varies by jurisdiction. Some places conduct annual assessments, while others may do it every few years. The assessment schedule is typically determined by the local taxing authority and may depend on factors like the stability of property values in the region.

Can personal property tax be deducted on tax returns?

+In many jurisdictions, personal property tax is a deductible expense for businesses. This means that the tax can be subtracted from the business’s taxable income, reducing its overall tax liability. However, the deductibility of personal property tax for individuals may vary, and it’s essential to consult with a tax professional or refer to the specific tax laws in your region.