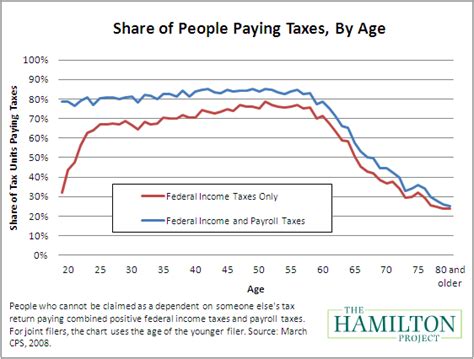

What Age Do You Start Paying Taxes

Understanding when and how individuals become liable for paying taxes is an essential aspect of financial literacy. In most countries, including the United States, tax obligations begin at a specific age, and it's crucial for individuals to be aware of these requirements to navigate their financial responsibilities effectively. This article aims to provide a comprehensive guide on the age at which one starts paying taxes, the associated legal obligations, and practical tips to manage tax payments efficiently.

The Age of Tax Liability

The age at which an individual becomes responsible for paying taxes varies across jurisdictions. In the United States, for instance, the Internal Revenue Service (IRS) considers individuals of any age who have earned income to be subject to taxation. This means that even minors with part-time jobs or investment income may have tax obligations.

While the IRS does not set a minimum age for tax liability, it does provide guidelines on when and how to file taxes for minors. The responsibility often falls on the parents or guardians to ensure their child's tax obligations are met.

Key Milestones for Tax Liability

Here are some critical age-related milestones regarding tax obligations:

- Under 18 Years: Minors with earned income, such as from a part-time job or freelance work, may need to file tax returns. The requirement to file depends on the amount earned and the tax brackets.

- 18-25 Years: Young adults, especially those pursuing higher education, might have unique tax considerations. For instance, they may be eligible for education-related tax credits or deductions.

- 26+ Years: Individuals in this age group are generally considered independent for tax purposes and are responsible for filing their own tax returns and managing their financial obligations.

It's important to note that tax obligations can also vary based on an individual's marital status, family size, and other factors. For instance, married individuals may have different tax brackets and deductions compared to single filers.

Tax Obligations for Specific Age Groups

Let’s delve into the tax responsibilities of individuals in different age groups:

Minors (Under 18)

Minors who have earned income must generally file a tax return if their earnings exceed certain thresholds. For instance, in the U.S., if a minor’s earned income exceeds 12,950 in 2023, they may need to file a tax return. Additionally, if a minor's unearned income (e.g., from investments) exceeds 1,150, they may also be required to file.

Parents or guardians are responsible for ensuring their child's tax obligations are met. This may involve helping the minor file their tax return or claiming the minor as a dependent on the parent's tax return.

| Income Type | Filing Requirement |

|---|---|

| Earned Income | File if income exceeds $12,950 |

| Unearned Income | File if income exceeds $1,150 |

Young Adults (18-25)

Young adults often have unique tax considerations due to their transitional life stage. They may be pursuing higher education, starting their first full-time jobs, or navigating complex financial decisions. Here are some key tax obligations for this age group:

- Student Loan Interest Deduction: Young adults with student loans may be eligible for a deduction on the interest paid on their loans. This can reduce their taxable income and provide a financial benefit.

- Education Credits: Tax credits like the American Opportunity Tax Credit or the Lifetime Learning Credit can provide significant savings for students and recent graduates.

- Rental Income: If a young adult owns rental property or shares a home with roommates, they may need to report rental income and expenses on their tax return.

Adults (26+)

Individuals aged 26 and above are generally considered independent for tax purposes. They are responsible for filing their own tax returns, making estimated tax payments if self-employed, and managing their financial obligations without parental involvement.

For adults in this age group, tax obligations can become more complex as they navigate career advancements, investments, and family planning. It's essential to stay informed about tax laws and consider seeking professional advice to optimize their financial strategies.

Navigating Tax Obligations: Practical Tips

Understanding when and how to pay taxes is crucial, but it’s equally important to know how to manage these obligations efficiently. Here are some practical tips to navigate tax responsibilities at any age:

Keep Detailed Records

Maintaining organized financial records is essential for accurate tax reporting. Keep track of income, expenses, and deductions to simplify the tax preparation process. Consider using digital tools or software to manage your financial records.

Understand Tax Brackets and Deductions

Familiarize yourself with the tax brackets applicable to your income level and the deductions or credits you may be eligible for. This knowledge can help you optimize your tax strategy and potentially reduce your tax liability.

Seek Professional Advice

Tax laws can be complex, and seeking advice from a qualified tax professional can provide valuable insights. A tax advisor can help you understand your specific obligations, navigate complex scenarios, and ensure you’re taking advantage of all available tax benefits.

Stay Informed About Tax Changes

Tax laws and regulations can evolve over time. Stay updated on any changes that may impact your tax obligations. This can help you plan your financial strategies accordingly and avoid unexpected tax liabilities.

Plan for Long-Term Financial Goals

Tax planning is not just about the current tax year. Consider your long-term financial goals, such as retirement planning or investing. Understanding the tax implications of these goals can help you make informed decisions and optimize your financial strategies over time.

Conclusion

Understanding when and how tax obligations begin is a crucial step toward financial literacy and responsibility. While the age at which individuals start paying taxes can vary, being aware of one’s obligations and managing them efficiently is essential for financial well-being. By staying informed, seeking professional advice when needed, and adopting practical financial management strategies, individuals can navigate their tax obligations with confidence and ensure compliance with the law.

What happens if a minor doesn’t file taxes when required?

+If a minor fails to file taxes when required, they may face penalties and interest charges from the IRS. Additionally, unreported income may impact their future financial aid eligibility for education.

Are there any tax benefits for students or recent graduates?

+Yes, students and recent graduates may be eligible for various tax benefits, such as the American Opportunity Tax Credit, which can provide a credit of up to $2,500 for qualified education expenses. Other credits and deductions may also be available.

How can I stay updated on tax law changes?

+Staying informed about tax law changes is crucial. You can subscribe to tax newsletters, follow reputable tax websites, or consult with a tax professional to ensure you’re aware of any updates that may impact your tax obligations.