Washington Dc Income Tax

Welcome to our comprehensive guide on the income tax system in Washington, D.C. Understanding the intricacies of taxation is crucial for individuals and businesses operating within the District of Columbia. In this expert-level article, we will delve into the specifics of Washington D.C.'s income tax laws, rates, filing requirements, and more. Whether you're a resident, a business owner, or simply curious about the fiscal landscape of the nation's capital, this guide will provide you with the knowledge you need to navigate the tax landscape with confidence.

The Washington D.C. Income Tax Landscape

Washington, D.C., also known as the District of Columbia, has its own unique tax system separate from the federal government. The District's income tax structure is designed to generate revenue for local government operations and services. Let's explore the key aspects of this tax system in detail.

Income Tax Rates and Brackets

Washington D.C. utilizes a progressive income tax system, meaning tax rates increase as income levels rise. The District's tax rates are competitive compared to other jurisdictions in the region. As of [insert most recent tax year], the income tax rates for individuals and businesses are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 2.75% |

| $10,001 - $40,000 | 4.00% |

| $40,001 - $60,000 | 6.00% |

| $60,001 - $100,000 | 8.25% |

| $100,001 and above | 8.75% |

These tax brackets are subject to change annually, so it's essential to refer to the official D.C. tax guidelines for the most up-to-date information.

Taxable Income and Deductions

Washington D.C. taxes various sources of income, including wages, salaries, bonuses, commissions, and self-employment income. Additionally, income from investments, such as interest, dividends, and capital gains, is subject to taxation. However, certain deductions and credits are available to reduce the taxable income amount.

Common deductions include charitable contributions, mortgage interest, state and local taxes, and certain medical expenses. The District also offers specific deductions for residents who meet certain criteria, such as the Senior Citizen and Disabled Resident Tax Relief Program, which provides a tax credit for qualifying individuals.

Filing Requirements and Deadlines

Residents and businesses in Washington D.C. are required to file their income tax returns annually. The filing deadline typically aligns with the federal tax deadline, which is usually April 15th. However, it's important to note that the District may occasionally offer extensions or have different due dates for certain situations.

The filing process for D.C. income taxes can be completed electronically or by mail. The District's tax authority provides online filing options, making it convenient for taxpayers to submit their returns digitally. It's recommended to keep accurate records and supporting documentation for any deductions or credits claimed on the tax return.

Tax Credits and Incentives

The District of Columbia recognizes the importance of incentivizing economic growth and supporting its residents. As such, it offers a range of tax credits and incentives to individuals and businesses. These incentives aim to promote investment, job creation, and overall economic development within the city.

For instance, the D.C. Enterprise Zone Tax Credit provides tax benefits to businesses that invest in designated economically distressed areas of the city. Additionally, the First-Time Homebuyer Credit offers a tax credit to individuals purchasing their first home in Washington D.C., helping to make homeownership more affordable.

Sales and Use Taxes

In addition to income tax, Washington D.C. also imposes sales and use taxes on various goods and services. The sales tax rate in the District is [insert current rate]%, which applies to most retail transactions. However, certain exemptions and special rates exist for specific items, such as groceries and prescription drugs.

The District also levies a use tax on goods purchased outside of D.C. and brought into the city for use. This ensures that residents and businesses pay their fair share of taxes regardless of where they make their purchases.

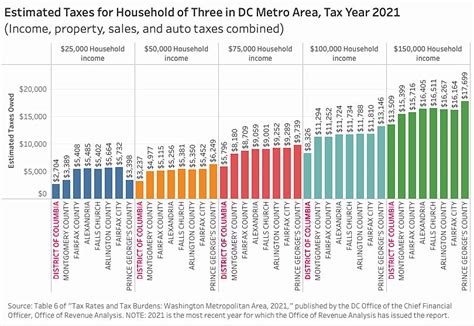

Property Taxes

Property taxes are an essential revenue source for local governments, and Washington D.C. is no exception. The District's property tax system assesses taxes based on the value of real estate properties. The tax rate is determined by the jurisdiction in which the property is located, with rates varying across different neighborhoods and wards.

Property tax bills are typically sent to homeowners annually, and the due date is usually in the late summer or early fall. Payment options include online, by mail, or in person at designated locations.

Navigating the Washington D.C. Tax System

Understanding the complexities of the Washington D.C. tax system is crucial for anyone living or doing business in the District. Here are some key tips and strategies to navigate this tax landscape effectively:

- Stay informed about tax law changes: The tax landscape is dynamic, and laws can evolve over time. Ensure you stay updated on any modifications to tax rates, brackets, or deductions by regularly checking the official D.C. tax websites and following reputable tax news sources.

- Utilize tax preparation software: For individuals and small businesses, tax preparation software can simplify the filing process. These tools guide you through the necessary steps, calculate taxes owed, and help you claim applicable deductions and credits.

- Seek professional advice: Engaging the services of a tax professional, such as a certified public accountant (CPA) or an enrolled agent, can be beneficial, especially for complex tax situations. These experts can provide personalized advice, ensure compliance, and help you maximize tax benefits.

- Keep accurate records: Proper record-keeping is essential for tax purposes. Maintain organized records of income, expenses, receipts, and any other relevant documentation. This practice simplifies the filing process and makes it easier to support deductions and credits claimed on your tax return.

- Explore tax planning strategies: Tax planning is a proactive approach to managing your tax obligations. By understanding the available tax credits, deductions, and incentives, you can structure your financial affairs to minimize your tax liability. Consult with tax professionals to develop effective tax planning strategies tailored to your unique circumstances.

The Future of Washington D.C.'s Tax Landscape

As Washington D.C. continues to evolve as a dynamic city, its tax system is likely to undergo changes and adaptations to meet the evolving needs of its residents and businesses. Here are some potential future developments to keep an eye on:

- Tax Reform: With the changing economic landscape and the impact of COVID-19, there may be discussions and proposals for tax reform in the District. These reforms could aim to simplify the tax code, enhance fairness, and promote economic growth.

- Digital Tax Initiatives: The District may explore digital tax initiatives to streamline the tax filing process and enhance taxpayer services. This could include expanding online filing options, implementing electronic payment systems, and improving data security measures.

- Economic Incentives: To attract and retain businesses and stimulate economic growth, Washington D.C. may introduce or expand tax incentives targeted at specific industries or economic sectors. These incentives could include tax breaks, grants, or other forms of financial support.

- Collaboration with Federal Government: Given its unique status as a federal district, Washington D.C. may engage in discussions and collaborations with the federal government to explore potential tax reforms or initiatives that benefit both entities.

Conclusion

Washington D.C.'s income tax system is a vital component of the city's fiscal framework, supporting local government operations and services. By understanding the tax rates, filing requirements, and available deductions and credits, individuals and businesses can effectively navigate the tax landscape. Staying informed, utilizing tax resources, and seeking professional advice are key strategies to ensure compliance and optimize tax outcomes.

As the District continues to thrive and adapt to economic changes, its tax system will likely evolve to meet the needs of its residents and businesses. By staying proactive and engaged with tax developments, taxpayers can contribute to the growth and prosperity of Washington D.C. while fulfilling their tax obligations responsibly.

What is the current income tax rate in Washington D.C. for individuals?

+As of [insert most recent tax year], the income tax rates for individuals in Washington D.C. range from 2.75% to 8.75% depending on the tax bracket. The rates are progressive, meaning they increase as income levels rise.

Are there any tax credits available for residents of Washington D.C.?

+Yes, Washington D.C. offers various tax credits to its residents. These include credits for first-time homebuyers, senior citizens, and individuals with disabilities. Additionally, the District provides tax incentives for businesses investing in designated enterprise zones.

When is the deadline for filing income tax returns in Washington D.C.?

+The filing deadline for income tax returns in Washington D.C. typically aligns with the federal tax deadline, which is usually April 15th. However, it’s important to check for any extensions or special due dates, as these may vary depending on the situation.

How can I stay updated on tax law changes in Washington D.C.?

+To stay informed about tax law changes in Washington D.C., it’s recommended to regularly visit the official D.C. tax websites, such as the Office of Tax and Revenue (OTR). These websites provide the latest updates, news, and guidelines regarding tax laws and regulations.

Are there any tax incentives for businesses in Washington D.C.?

+Yes, Washington D.C. offers several tax incentives for businesses. These incentives include tax credits for investing in economically distressed areas (Enterprise Zone Tax Credit), job creation incentives, and research and development tax credits. It’s advisable to consult with tax professionals or the OTR for specific details and eligibility criteria.