Vermont Property Tax

Vermont, known for its stunning natural beauty and picturesque landscapes, has a unique approach to property taxation. The property tax system in this northeastern U.S. state is an integral part of its local government funding and plays a significant role in the lives of its residents. Understanding the intricacies of Vermont's property tax is essential for both current and prospective homeowners in the state.

Unraveling the Complexity of Vermont Property Tax

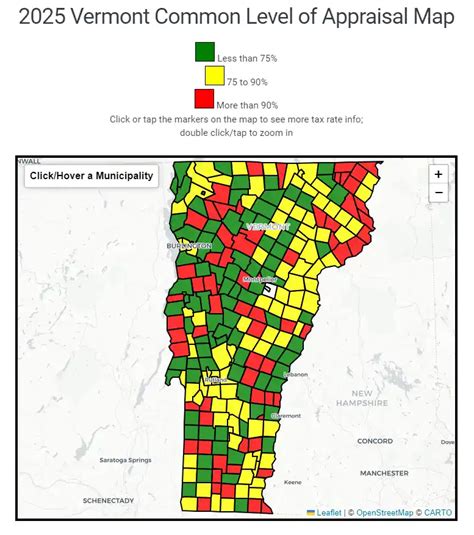

Vermont’s property tax system is renowned for its complexity, primarily due to the diverse factors that influence tax rates and assessments. These factors include the property’s location, its usage, and the specific taxing district’s needs and budget. The tax rates can vary significantly, not only between towns but also within a single town’s different taxing districts.

The property tax rate is expressed as a percentage of a property's appraised value, and this rate is determined by each town's governing body, typically the Selectboard or the Town Meeting. This rate is applied to the property's equalized grand list value to calculate the annual tax bill. The equalized grand list value is an important concept in Vermont's property tax system. It represents the appraised value of all taxable properties in a town, adjusted to ensure fairness across different towns, thus equalizing the tax burden.

Factors Influencing Property Tax Rates

Several key factors come into play when determining property tax rates in Vermont. These include the cost of education, local infrastructure projects, and the need for municipal services like fire and police protection. The state’s education funding formula is particularly significant, as it can have a substantial impact on property tax rates. In addition, Vermont’s unique Current Use program, which encourages landowners to maintain their property in an open, undeveloped state, can also influence tax assessments.

| Factor | Impact on Property Tax |

|---|---|

| Education Funding | Can significantly increase or decrease rates. |

| Local Infrastructure Projects | Influence tax rates based on funding requirements. |

| Municipal Services | Fire and police services impact tax assessments. |

| Current Use Program | Encourages undeveloped land, affecting assessments. |

Vermont's property tax system also features a Current Use Tax Rate, which is typically lower than the standard tax rate, and applies to properties enrolled in the Current Use program. This rate is designed to incentivize landowners to maintain their properties in an open, undeveloped state, thereby preserving the state's natural beauty and rural character.

Property Assessment and Equalization

The assessment process in Vermont involves evaluating a property’s worth based on its physical characteristics, location, and market conditions. This value is then adjusted to the town’s equalized grand list value, ensuring a fair and consistent valuation across the state. The assessment is a critical step, as it directly influences the property tax bill. Property owners have the right to appeal their assessment if they believe it is inaccurate or unfair.

Tax Relief Programs

Vermont offers several tax relief programs to ease the property tax burden on certain groups of taxpayers. These include the Homestead Declaration program, which provides a tax exemption for a portion of a primary residence’s value, and the Income Sensitivity Program, which reduces property taxes for qualifying elderly or disabled Vermonters based on their income. Additionally, the Estate Tax Deferral program allows heirs to defer property tax payments for up to two years after a property owner’s death.

| Tax Relief Program | Description |

|---|---|

| Homestead Declaration | Provides a tax exemption for a portion of a primary residence's value. |

| Income Sensitivity Program | Reduces property taxes for qualifying elderly or disabled Vermonters based on income. |

| Estate Tax Deferral | Allows heirs to defer property tax payments for up to two years after a property owner's death. |

The Future of Vermont Property Tax

The Vermont property tax system is subject to continuous review and potential reform. As the state’s population ages and the demand for services grows, the need for adequate funding becomes increasingly critical. At the same time, there is a growing recognition of the need to provide tax relief for certain groups, such as low-income earners and those on fixed incomes. Balancing these needs will be a key challenge for the state’s policymakers in the coming years.

One potential reform could involve a reevaluation of the state's property tax rates and the criteria for tax relief programs. This could include expanding eligibility criteria for tax relief programs or exploring alternative funding mechanisms, such as a sales tax or income tax increase, to reduce the reliance on property taxes.

Potential Reforms and Challenges

Vermont’s property tax system, while effective in many ways, faces challenges in keeping up with the changing needs of its residents and the evolving real estate market. As property values rise, so do the tax bills, which can create a burden for homeowners, especially those on fixed incomes. This situation underscores the need for a comprehensive review of the state’s tax policies and potential reforms.

One potential reform could involve the introduction of a circuit breaker program, which would provide tax relief to homeowners whose property taxes exceed a certain percentage of their income. This type of program is designed to protect vulnerable homeowners from excessive tax burdens. Additionally, exploring the possibility of a statewide property tax cap could provide some relief for homeowners across Vermont.

The state could also consider implementing a more progressive tax structure, where higher-value properties are taxed at a higher rate. This approach could help redistribute the tax burden more equitably and provide additional revenue for essential services. However, any significant changes to the property tax system would require careful consideration and a comprehensive understanding of their potential impacts on Vermont's economy and communities.

Conclusion

Understanding Vermont’s property tax system is crucial for homeowners, prospective buyers, and anyone interested in Vermont real estate. While the system can be complex, it is designed to fund essential services and preserve the state’s unique character. As Vermont continues to evolve, its property tax system will likely undergo further refinement to meet the changing needs of its residents and the state’s fiscal responsibilities.

How often are property tax rates reviewed in Vermont?

+

Property tax rates are typically reviewed annually by each town’s governing body. This allows for adjustments to be made based on the town’s budgetary needs and the cost of services.

What is the role of the ‘Current Use’ program in Vermont’s property tax system?

+

The ‘Current Use’ program encourages landowners to maintain their properties in an open, undeveloped state. Properties enrolled in this program are assessed at a lower tax rate, known as the ‘Current Use Tax Rate’, thus incentivizing the preservation of Vermont’s natural landscape.

Are there any tax relief programs available for Vermont homeowners?

+

Yes, Vermont offers several tax relief programs, including the Homestead Declaration, Income Sensitivity Program, and Estate Tax Deferral. These programs aim to reduce the property tax burden for specific groups, such as primary homeowners, the elderly, and disabled individuals.

How can I appeal my property assessment in Vermont?

+

If you believe your property assessment is inaccurate or unfair, you have the right to appeal. The process typically involves contacting your town’s listers or appealing to the Board of Civil Authority. It’s recommended to gather evidence and documentation to support your case.