Uk Tax Year

The tax year, also known as the fiscal year, is a fundamental concept in the United Kingdom's taxation system. It plays a crucial role in determining when and how individuals and businesses calculate and pay their taxes to Her Majesty's Revenue and Customs (HMRC). Understanding the UK tax year is essential for financial planning and compliance with tax obligations.

Defining the UK Tax Year

In the United Kingdom, the tax year is a 12-month period that runs from 6th April one year to 5th April the following year. This unique system differs from the calendar year, which runs from 1st January to 31st December. The UK’s tax year is often referred to as a “tax year” or “fiscal year” to distinguish it from the standard calendar year.

The reason for this unique calendar lies in the historical evolution of the British tax system. Initially, the tax year aligned with the agricultural cycle, which meant it began on Lady Day, the 25th of March. However, with the introduction of the Gregorian calendar in 1752, the tax year was adjusted to begin on the 5th of April, creating a 12-month fiscal period that doesn't align with any particular season.

Key Dates and Deadlines

Understanding the key dates within the tax year is vital for taxpayers to ensure they meet their obligations and take advantage of any available tax benefits.

- 6th April: The start of a new tax year. This date is significant as it marks the beginning of a fresh 12-month cycle for tax calculations and planning.

- 31st July: The deadline for paying the first instalment of income tax for the current tax year if you're self-employed and pay tax through the Self Assessment system.

- 31st January: A crucial date for all taxpayers. This is the deadline for submitting your Self Assessment tax return for the previous tax year and paying any tax owed. It's also the deadline for paying the second instalment of income tax for the current tax year if you're self-employed.

- 5th April: The end of the tax year. This date marks the conclusion of the 12-month fiscal period, and it's essential for finalising tax calculations and making any necessary adjustments.

Self Assessment and Tax Returns

Self Assessment is a system used by HMRC to collect income tax, capital gains tax, and other taxes from individuals and businesses. If you’re self-employed, a company director, or have additional income from investments or property, you may need to complete a Self Assessment tax return. The deadline for submitting your tax return online is typically 31st January following the end of the tax year.

Tax Codes and PAYE

Most UK employees have their tax deducted directly from their pay through the Pay As You Earn (PAYE) system. Your tax code determines how much tax you pay, and it’s based on your personal circumstances, such as your income, benefits, and tax allowances. Understanding your tax code is crucial for ensuring you pay the correct amount of tax.

Tax Allowances and Deductions

The UK tax system offers various allowances and deductions to help reduce your taxable income. These include:

- Personal Allowance: A standard amount of income you can earn each year without paying tax. The personal allowance for the 2023/2024 tax year is £12,570.

- Marriage Allowance: If you're married or in a civil partnership, you may be able to transfer £1,260 of your Personal Allowance to your spouse or civil partner if they earn less than you.

- Pension Contributions: You can reduce your taxable income by making contributions to a pension scheme. The annual allowance for pension contributions is £40,000.

- Gift Aid: If you donate to charity, you can increase the value of your donation by 25% through Gift Aid. This scheme allows charities to reclaim the basic rate of tax on your donation.

Tax Rates and Bands

The UK tax system operates on a progressive basis, meaning you pay a higher rate of tax as your income increases. The current tax rates and bands for the 2023⁄2024 tax year are as follows:

| Tax Band | Tax Rate | Income Range |

|---|---|---|

| Basic Rate | 20% | £12,571 - £50,270 |

| Higher Rate | 40% | £50,271 - £150,000 |

| Additional Rate | 45% | Over £150,000 |

It's important to note that these rates and bands may change annually, so it's essential to stay updated with the latest tax information.

National Insurance Contributions

In addition to income tax, you also contribute to National Insurance. National Insurance Contributions (NICs) fund state benefits such as the State Pension, maternity allowance, and unemployment benefits. The rates and thresholds for NICs are different from income tax and can vary depending on your employment status and earnings.

Capital Gains Tax and Inheritance Tax

The UK tax system also applies to capital gains and inheritance. When you sell an asset, such as a property or shares, you may be subject to Capital Gains Tax (CGT) on the profit you make. The CGT rate depends on your income and whether the asset is a residential property or a non-residential asset.

Inheritance Tax (IHT) is a tax on the estate (money, property, and possessions) of someone who has died. IHT is currently charged at 40% on anything above the nil-rate band, which is £325,000 for the 2023/2024 tax year. However, there are various exemptions and reliefs that can reduce the amount of IHT payable.

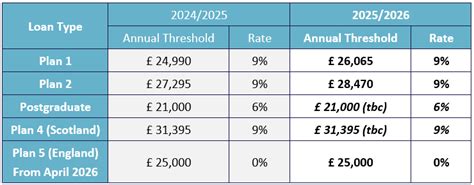

Future Changes and Tax Planning

The UK tax system is subject to regular reviews and changes. The government may introduce new taxes, adjust existing tax rates, or modify tax allowances and thresholds. Staying informed about these changes is crucial for effective tax planning.

Effective tax planning involves understanding your personal financial situation and making strategic decisions to minimise your tax liability. This may include optimising your pension contributions, taking advantage of tax-efficient investments, or structuring your business to reduce tax burdens.

Seeking Professional Advice

Taxation is a complex field, and the rules and regulations can be challenging to navigate. For many individuals and businesses, seeking professional advice from an accountant or tax advisor is essential. These professionals can provide tailored guidance based on your specific circumstances and help ensure you meet your tax obligations while making the most of available tax benefits.

Conclusion

The UK tax year is a unique 12-month period that plays a vital role in the country’s taxation system. Understanding the tax year, key dates, and the various components of the tax system is essential for effective financial planning and compliance. By staying informed and seeking professional advice when needed, individuals and businesses can navigate the UK’s tax landscape with confidence.

What happens if I miss the Self Assessment deadline?

+If you miss the Self Assessment deadline of 31st January, you may face a late filing penalty of £100. The penalty can increase to £10 per day up to a maximum of £900 if your return is more than 3 months late. It’s important to note that you’ll also continue to accrue interest on any tax owed from the original payment deadline.

Can I change my tax code if it’s incorrect?

+Yes, if you believe your tax code is incorrect, you should contact HMRC as soon as possible. They will review your circumstances and issue a new tax code if necessary. It’s important to ensure your tax code is accurate to avoid overpaying or underpaying tax.

How can I track my tax payments and refunds?

+You can track your tax payments and refunds through the HMRC online service. By creating an account, you can view your tax records, check your payments and refunds, and manage your tax affairs online. This service provides a convenient way to stay on top of your tax obligations and ensures you have access to your tax information at any time.