Town Of Hamden Ct Tax Collector

Welcome to Hamden, Connecticut, a vibrant town nestled in New Haven County. Today, we delve into the role of the Town of Hamden's Tax Collector, an essential position that plays a crucial part in the financial management and operations of this thriving community.

The Tax Collector's Office in Hamden is responsible for the efficient and effective collection of various taxes and fees, ensuring the town's fiscal stability and providing essential services to its residents. In this comprehensive guide, we will explore the functions, responsibilities, and impact of the Tax Collector's Office, offering valuable insights for Hamden's citizens and stakeholders.

The Role of the Tax Collector

The Tax Collector in Hamden is entrusted with a critical mission: to manage and oversee the town’s tax revenue collection process. This role is pivotal in maintaining the town’s financial health and sustainability. Here’s an in-depth look at the key responsibilities and functions of the Tax Collector’s Office:

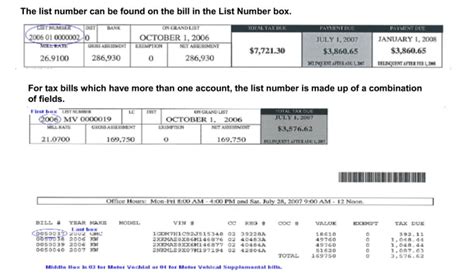

Tax Assessment and Billing

The Tax Collector’s Office collaborates closely with the Assessor’s Office to determine the fair market value of properties within Hamden. This assessment forms the basis for property tax calculations. The Tax Collector’s team then generates and distributes tax bills to property owners, ensuring transparency and accuracy in the billing process.

For the tax year 2023-2024, the town has implemented a new online billing system, allowing residents to access their tax bills and make payments conveniently through the Hamden Tax Portal. This initiative streamlines the billing process and provides real-time updates on tax obligations.

Tax Collection and Payment Options

The Tax Collector’s Office offers a range of payment options to cater to the diverse needs of Hamden’s residents. These include online payments, in-person payments at the Town Hall, and even payment plans for those facing financial difficulties. The office also accepts various payment methods, such as credit cards, checks, and money orders, ensuring accessibility and convenience.

| Payment Method | Description |

|---|---|

| Online Payments | Secure payment portal accessible 24/7. |

| In-Person Payments | Cash, check, or money order at Town Hall. |

| Payment Plans | Customized plans for residents facing financial challenges. |

Delinquent Tax Collection

One of the critical responsibilities of the Tax Collector’s Office is managing delinquent tax accounts. When taxpayers fail to pay their taxes on time, the office initiates a series of collection actions, including sending reminders, imposing penalties, and, if necessary, pursuing legal remedies to recover the outstanding taxes.

To encourage timely payments, the town offers an early payment discount for taxpayers who pay their taxes in full by a specified deadline. This incentive not only promotes fiscal responsibility but also helps the town maintain a stable revenue stream.

Community Engagement and Support

Beyond tax collection, the Tax Collector’s Office plays an active role in supporting the Hamden community. The team provides educational resources and workshops to help residents understand their tax obligations and explore available tax relief programs. Additionally, the office collaborates with local businesses and organizations to promote economic growth and ensure compliance with tax regulations.

The Impact on Hamden’s Financial Health

The efficient management of tax collection by the Tax Collector’s Office has a profound impact on Hamden’s financial stability and its ability to provide essential services to its residents. By effectively collecting taxes, the town can allocate resources to critical areas such as education, infrastructure development, public safety, and community initiatives.

Budget Allocation and Planning

The Tax Collector’s Office works closely with the Town Manager and Finance Department to ensure accurate budgeting and planning. Timely and accurate tax collection allows for more precise financial projections, enabling the town to make informed decisions regarding resource allocation and strategic planning.

Economic Development and Investment

A well-managed tax collection process attracts businesses and investors to Hamden. By demonstrating fiscal responsibility and a stable revenue stream, the town becomes an attractive destination for economic growth and development. This, in turn, creates job opportunities and enhances the overall economic vitality of the community.

Community Programs and Initiatives

The revenue generated through tax collection funds various community programs and initiatives. From recreational activities for youth to senior citizen support services, the Tax Collector’s Office plays an indirect yet vital role in enhancing the quality of life for Hamden’s residents.

| Community Initiative | Description |

|---|---|

| Hamden Summer Recreation Program | Provides affordable summer activities for children and adolescents. |

| Senior Citizen Tax Relief Program | Offers reduced property taxes for eligible seniors. |

| Small Business Grants | Supports local entrepreneurship and business growth. |

The Future of Tax Collection in Hamden

As technology continues to advance, the Tax Collector’s Office in Hamden is committed to staying at the forefront of innovation. The office is exploring ways to further enhance the efficiency and accessibility of its services, including the potential implementation of a mobile app for tax payment and the integration of blockchain technology for secure and transparent transactions.

Digital Transformation

Recognizing the importance of digital transformation, the Tax Collector’s Office is dedicated to making its services more accessible and user-friendly. The office is currently developing a comprehensive online platform that will allow residents to manage their tax accounts, track payments, and access important tax-related information with ease.

Community Feedback and Collaboration

The Tax Collector’s Office values community feedback and actively seeks input from residents and stakeholders. By engaging in open dialogue, the office can better understand the needs and concerns of the community, leading to more effective tax policies and improved services. The office hosts regular town hall meetings and encourages residents to participate in the decision-making process.

Sustainable Practices

In line with Hamden’s commitment to sustainability, the Tax Collector’s Office is exploring ways to reduce its environmental impact. This includes initiatives such as paperless billing, electronic payment options, and the use of energy-efficient technologies in its operations. By embracing sustainable practices, the office aims to contribute to the town’s overall environmental goals.

What is the Hamden Tax Portal, and how can I access it?

+The Hamden Tax Portal is an online platform that allows residents to view and pay their tax bills conveniently. You can access it by visiting the official Hamden website and navigating to the Tax Collector’s section. From there, you’ll find a link to the portal, where you can create an account and manage your tax obligations.

Are there any tax relief programs available for eligible residents in Hamden?

+Yes, Hamden offers several tax relief programs to support eligible residents. These include the Senior Citizen Tax Relief Program, which provides reduced property taxes for seniors, and the Veterans’ Tax Relief Program, which offers tax benefits to qualifying veterans. For more information, you can contact the Tax Collector’s Office or visit their website for detailed guidelines.

How can I stay updated on tax-related news and updates in Hamden?

+The best way to stay informed is to subscribe to the official Hamden newsletter, which provides regular updates on tax-related matters, important deadlines, and any changes to tax policies. You can also follow the Tax Collector’s Office on social media platforms for timely announcements and reminders.