Taxes In South Carolina

South Carolina, nestled in the southeastern region of the United States, is known for its diverse landscapes, rich history, and vibrant culture. As an integral part of the state's economic landscape, understanding the intricacies of its tax system is crucial for both residents and businesses alike. This comprehensive guide delves into the world of South Carolina taxes, shedding light on its unique features, implications, and best practices for compliance.

Unraveling the South Carolina Tax Landscape

South Carolina’s tax structure is a blend of federal and state-specific regulations, designed to support the state’s economic growth and development. Let’s delve into the key components of this intricate system.

Income Tax: A Snapshot of South Carolina’s Individual Income Tax

South Carolina imposes an income tax on its residents, following a progressive tax structure. This means that as your income increases, so does the tax rate applied to your earnings. Currently, the state has six income tax brackets, ranging from 0% to 7% for taxable income exceeding $14,520.

| Tax Rate | Taxable Income Range |

|---|---|

| 0% | Up to $2,420 |

| 2% | $2,421 - $5,850 |

| 3% | $5,851 - $9,280 |

| 4% | $9,281 - $11,700 |

| 5% | $11,701 - $14,130 |

| 7% | Over $14,520 |

It's important to note that South Carolina offers several deductions and credits to reduce the tax burden for individuals. These include the standard deduction, personal exemptions, and credits for education, property taxes, and certain medical expenses.

Sales and Use Tax: Unpacking the State’s Consumption Tax

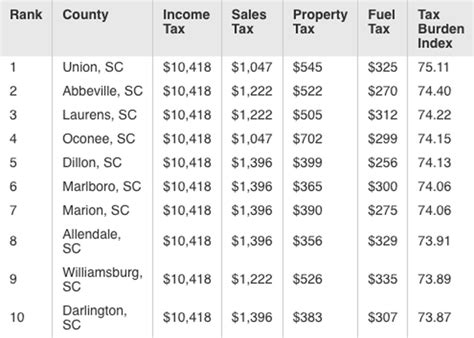

South Carolina levies a sales and use tax on the retail sale, lease, and rental of tangible personal property and certain services. The state’s sales tax rate stands at 6%, which is applied uniformly across the state. However, local governments may impose additional sales taxes, creating a combined rate that varies across South Carolina.

For instance, Charleston County has a local sales tax rate of 1%, bringing the total sales tax rate to 7% for purchases made within the county. These local variations can significantly impact the price of goods and services for consumers, highlighting the importance of understanding the sales tax landscape in South Carolina.

Property Tax: Navigating South Carolina’s Real Estate Taxes

Property taxes in South Carolina are primarily a local matter, with counties and municipalities setting their own tax rates. The state’s property tax system is based on the assessed value of the property, which is determined by local assessors. The assessed value is then multiplied by the millage rate, which is set by local governing bodies, to calculate the property tax liability.

For example, in Greenville County, the millage rate for residential property is 105.5 mills, which equates to $0.1055 per $1 of assessed value. So, a home with an assessed value of $200,000 would incur a property tax of $2,110 annually.

Business Taxes: A Complex Web of Regulations

South Carolina imposes a range of taxes on businesses operating within its borders. These include corporate income taxes, franchise taxes, and various other taxes depending on the nature of the business. For instance, businesses involved in the sale of tangible personal property are required to collect and remit sales tax to the state.

In addition, South Carolina offers several tax incentives and credits to encourage business growth and investment. These include job tax credits, research and development tax credits, and investment tax credits, among others. Navigating these incentives requires a deep understanding of the state's complex business tax landscape.

Compliance and Best Practices

Navigating South Carolina’s tax system requires a meticulous approach to ensure compliance and avoid penalties. Here are some key considerations for individuals and businesses alike.

Understanding Filing Requirements

South Carolina’s tax filing requirements vary depending on the type of taxpayer. Individuals typically file their income tax returns annually by April 15th. Businesses, on the other hand, may have different filing deadlines and requirements depending on their legal structure and tax obligations.

For instance, corporations must file their income tax returns within 3 months and 15 days after the close of their tax year, while partnerships and S corporations have until the 15th day of the 3rd month after the close of their tax year.

Maximizing Deductions and Credits

South Carolina offers a range of deductions and credits that can significantly reduce tax liabilities for individuals and businesses. It’s crucial to stay updated on these incentives and ensure you’re taking advantage of all applicable deductions and credits.

For instance, businesses may qualify for the South Carolina Economic Development Incentive, which provides tax credits for qualifying investments in new facilities or expansions. This incentive can be a powerful tool for businesses looking to reduce their tax burden and invest in the state's economy.

Staying Informed on Tax Law Changes

Tax laws are subject to frequent changes, and it’s essential to stay informed on any updates that may impact your tax obligations. South Carolina’s Department of Revenue provides regular updates and guidance on its website, making it a valuable resource for taxpayers.

Additionally, engaging with tax professionals who specialize in South Carolina's tax system can provide invaluable insights and ensure you're always in compliance with the latest regulations.

The Impact of South Carolina Taxes

South Carolina’s tax system plays a pivotal role in shaping the state’s economic landscape. Let’s explore some of the key impacts and considerations.

Economic Development and Tax Incentives

South Carolina’s tax incentives play a significant role in attracting businesses and driving economic development. By offering competitive tax rates and incentives, the state creates an environment conducive to business growth and investment.

For instance, the South Carolina Jobs Tax Credit provides a tax credit for qualifying wages paid to new employees, incentivizing businesses to create jobs and stimulate economic activity within the state.

Impact on Consumer Spending

South Carolina’s sales tax structure has a direct impact on consumer spending habits. Higher sales tax rates can deter consumers from making purchases, especially for high-value items. On the other hand, lower sales tax rates can encourage spending, boosting the state’s economy.

For instance, a study by the University of South Carolina found that a 1% increase in the state's sales tax rate led to a 1.5% decrease in consumer spending. This highlights the delicate balance that policymakers must strike when setting tax rates to encourage economic growth without overburdening consumers.

State Budget and Tax Revenue

South Carolina’s tax revenue plays a crucial role in funding state programs and initiatives. Income tax, sales tax, and property tax are the primary sources of revenue for the state’s budget. These funds are allocated to various sectors, including education, healthcare, infrastructure, and public safety.

For instance, in the 2022-2023 fiscal year, South Carolina's budget allocated $1.1 billion to the Department of Education, $1.3 billion to the Department of Health and Environmental Control, and $774 million to the Department of Transportation.

Conclusion: Navigating the Complexities of South Carolina Taxes

South Carolina’s tax system is a complex web of regulations, incentives, and obligations. While it can be daunting to navigate, a deep understanding of the system is crucial for both individuals and businesses looking to thrive in the Palmetto State.

By staying informed, maximizing deductions and credits, and engaging with tax professionals, taxpayers can ensure they're compliant with the state's tax laws and take advantage of the opportunities available. As South Carolina continues to evolve and adapt its tax policies, staying ahead of the curve will be essential for success.

What is the sales tax rate in South Carolina for online purchases?

+The sales tax rate for online purchases in South Carolina is the same as the general sales tax rate, which is 6% at the state level. However, local sales taxes may also apply, so the total sales tax rate can vary depending on the location of the buyer.

Are there any tax incentives for renewable energy investments in South Carolina?

+Yes, South Carolina offers several tax incentives for renewable energy investments. The state provides a 25% investment tax credit for qualified solar energy systems, as well as a property tax exemption for renewable energy systems. Additionally, there are incentives for businesses investing in energy efficiency and conservation measures.

How often are South Carolina’s tax laws updated and revised?

+South Carolina’s tax laws are subject to regular updates and revisions. The state’s General Assembly typically meets annually, and tax-related legislation can be introduced and passed during these sessions. Additionally, the South Carolina Department of Revenue periodically issues guidance and updates on tax regulations.