Tax Return Status Mn

Welcome to this in-depth exploration of the tax return status in Minnesota, a topic of great importance to both residents and businesses in the state. Understanding the tax return process and its status is crucial for financial planning and compliance. This article aims to provide a comprehensive guide, offering insights, practical tips, and expert analysis to help navigate the complexities of tax return status in Minnesota.

Unveiling the Tax Return Status: A Comprehensive Guide for Minnesotans

In the world of personal finance, staying informed about tax return status is essential. For residents of Minnesota, a state known for its vibrant economy and diverse industries, understanding the intricacies of tax returns is paramount. This guide aims to demystify the process, offering a comprehensive look at tax return status and its implications.

Whether you're an individual filing your annual tax return or a business managing complex tax obligations, having a clear understanding of the status of your tax return is crucial. This guide will delve into the specific processes, timelines, and resources available in Minnesota, ensuring you're equipped with the knowledge to navigate this essential financial aspect with confidence.

The Importance of Tax Return Status: A Closer Look

Tax return status serves as a vital indicator of one’s financial standing and compliance with state regulations. In Minnesota, where tax laws can be intricate, staying informed about the status of your tax return is not just a legal obligation but a strategic financial move.

For individuals, a timely understanding of tax return status can impact financial planning, refund expectations, and even eligibility for certain state benefits. Businesses, on the other hand, rely on accurate tax return status information to manage cash flow, ensure compliance, and make informed decisions about investments and growth strategies.

In the following sections, we'll explore the specific processes, resources, and best practices for checking and managing tax return status in Minnesota. By the end of this guide, you should have a clear roadmap to navigate this essential aspect of financial management with ease and confidence.

Understanding the Process: A Step-by-Step Guide to Checking Tax Return Status

Checking the status of your tax return in Minnesota is a straightforward process, thanks to the state’s online resources and services. Here’s a step-by-step guide to help you navigate this process seamlessly:

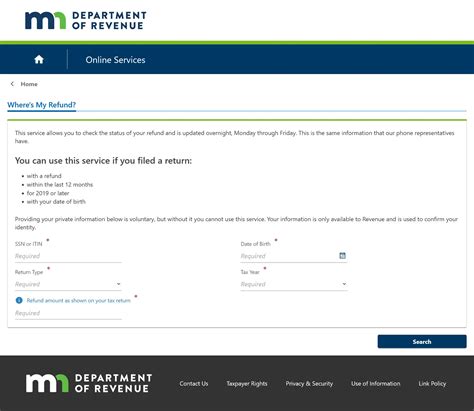

- Access the Minnesota Department of Revenue Website: Begin by visiting the official website of the Minnesota Department of Revenue (MDR). This is the primary source for all tax-related information and services in the state.

- Navigate to the Tax Return Status Section: Once on the MDR website, look for the section dedicated to tax return status. This is typically easy to find and often includes a prominent link or button on the homepage.

- Select Your Return Type: The MDR website provides separate sections for individual and business tax return status. Choose the appropriate section based on your needs.

- Enter Your Information: You'll be prompted to enter specific details to access your tax return status. This may include your Social Security Number (SSN) or Employer Identification Number (EIN), along with other relevant information.

- Submit Your Request: After entering the required information, submit your request. The MDR system will process your request and provide you with the current status of your tax return.

- Review the Status: The status update will typically include information such as the date your return was received, the processing stage it's currently in, and any expected timeline for further updates or refund issuance.

It's important to note that the MDR website is designed to be user-friendly and secure. The process of checking your tax return status is typically straightforward and can be completed in a matter of minutes. However, if you encounter any issues or have specific questions, the MDR website also provides comprehensive help resources and contact information for further assistance.

Real-Time Insights: Utilizing Online Tools for Tax Return Status Tracking

In today’s digital age, tracking the status of your tax return in real-time has never been easier. Minnesota, like many other states, offers a range of online tools and resources to provide taxpayers with up-to-date information on the status of their tax returns.

The Minnesota Department of Revenue (MDR) has developed a user-friendly online portal that allows taxpayers to check the status of their returns at any time. This portal, accessible through the MDR website, provides a secure and efficient way to obtain real-time updates on the processing of tax returns.

By logging into the portal, taxpayers can view the current stage of their return's processing, from the initial receipt of the return to the final stages of refund issuance or payment processing. This transparency helps taxpayers plan their finances more effectively and provides peace of mind knowing the exact status of their tax obligations.

In addition to the online portal, MDR also offers a mobile app that provides similar functionalities. This app, available for both iOS and Android devices, allows taxpayers to check their tax return status on the go, ensuring they stay informed even when away from their desktops.

These online tools not only enhance convenience but also improve overall efficiency in tax administration. By leveraging technology, MDR is able to provide timely and accurate updates to taxpayers, reducing the need for phone calls and physical visits to tax offices. This digital approach aligns with the state's commitment to modernization and improves the overall taxpayer experience.

Timely Updates: The Importance of Staying Informed About Tax Return Status

In the world of tax administration, staying informed about the status of your tax return is crucial. Timely updates on the processing and status of your tax return can provide valuable insights into your financial situation and help you make informed decisions.

For instance, if you're expecting a refund, knowing the status of your tax return can help you plan your finances accordingly. You can anticipate when the refund will be issued and make arrangements to manage your cash flow effectively. Similarly, if there are any issues or delays with your return, early awareness can prompt you to take appropriate actions, such as contacting the tax authorities or providing additional documentation.

Staying informed about tax return status also ensures compliance with tax laws and regulations. By monitoring the progress of your return, you can identify any potential red flags or discrepancies early on. This proactive approach can help you address any issues promptly and avoid potential penalties or legal complications.

In Minnesota, the Minnesota Department of Revenue (MDR) provides a range of resources to keep taxpayers informed about their tax return status. From online portals to mobile apps, MDR offers convenient and accessible ways to track the progress of tax returns. By utilizing these resources, taxpayers can stay on top of their tax obligations and make the most of their financial planning.

| Resource | Description |

|---|---|

| Online Portal | A secure online platform that allows taxpayers to view the status of their tax returns, track processing progress, and receive updates. |

| Mobile App | A user-friendly mobile application that provides similar functionalities as the online portal, allowing taxpayers to check their tax return status on the go. |

| Email/Text Alerts | A subscription service that sends timely notifications to taxpayers' email or mobile devices, providing updates on key milestones in the tax return processing. |

Navigating Complexities: Expert Insights on Managing Tax Return Status

While checking the status of your tax return is a straightforward process, there may be instances where additional guidance is needed, especially for more complex tax scenarios. In such cases, seeking expert advice can be invaluable.

Tax professionals, such as certified public accountants (CPAs) and enrolled agents, possess in-depth knowledge of tax laws and regulations. They can provide personalized advice and assistance, ensuring that your tax return status is accurately managed and any potential issues are addressed promptly.

For instance, if you have multiple income streams, own a business, or have complex investments, a tax professional can help navigate the intricacies of your tax situation. They can provide guidance on how to accurately report your income, claim deductions, and ensure compliance with relevant tax laws.

Additionally, tax professionals can assist with the resolution of any issues that may arise during the tax return process. This includes addressing errors, clarifying misunderstandings, and providing solutions to complex tax scenarios. Their expertise can help prevent delays and ensure a smooth tax filing experience.

Furthermore, tax professionals can offer strategic tax planning advice. By understanding your financial goals and obligations, they can provide insights on how to optimize your tax return status to your advantage. This may include recommending tax-efficient strategies, identifying opportunities for tax savings, or suggesting ways to maximize your refund.

In summary, while the basic process of checking tax return status is accessible to all, seeking expert guidance can provide significant benefits, especially for complex tax situations. Tax professionals offer valuable insights, strategic advice, and personalized assistance, ensuring that your tax return status is managed effectively and efficiently.

Looking Ahead: Future Implications and Best Practices for Tax Return Status Management

As we look ahead to the future, the management of tax return status is likely to become even more streamlined and efficient. Technological advancements and digital transformation in the tax industry are set to play a significant role in enhancing the overall experience for taxpayers.

One key development is the increasing use of artificial intelligence (AI) and machine learning in tax administration. These technologies can automate many aspects of tax return processing, from data entry to status updates. This not only reduces the potential for human error but also speeds up the entire process, allowing taxpayers to receive timely status updates and refunds.

Additionally, the integration of blockchain technology is expected to revolutionize the way tax returns are tracked and managed. Blockchain's inherent security and transparency can ensure the integrity of tax data, providing an immutable record of transactions and statuses. This can enhance trust and confidence in the tax system, while also reducing the risk of fraud and errors.

In the context of best practices, taxpayers can expect to see continued emphasis on digital tools and resources for tax return status management. Online portals and mobile apps will likely become even more sophisticated, offering real-time updates and personalized recommendations. These tools will not only make the process more convenient but also empower taxpayers to take control of their financial planning.

Furthermore, education and awareness campaigns will play a crucial role in ensuring taxpayers understand the importance of managing their tax return status. By providing clear and concise information, taxpayers can make informed decisions and take proactive steps to stay compliant and manage their finances effectively.

In conclusion, the future of tax return status management in Minnesota looks bright, with technological advancements and best practices set to enhance the overall experience. By staying informed and utilizing the available resources, taxpayers can navigate the tax landscape with confidence and ease.

What is the average processing time for tax returns in Minnesota?

+

The average processing time for tax returns in Minnesota varies depending on the complexity of the return and the time of year. Simple returns with no issues or errors can be processed within a few weeks, while more complex returns may take several months. The Minnesota Department of Revenue provides regular updates on processing times, which can be found on their website.

How can I check the status of my tax refund in Minnesota?

+

You can check the status of your tax refund in Minnesota by visiting the Minnesota Department of Revenue’s website. The website provides an online tool where you can enter your information to track the status of your refund. Alternatively, you can call the MDR’s Refund Hotline for assistance.

What should I do if there are errors or discrepancies in my tax return status?

+

If you notice any errors or discrepancies in your tax return status, it’s important to take prompt action. Contact the Minnesota Department of Revenue’s Taxpayer Services division and provide them with the details of the issue. They will guide you through the necessary steps to resolve the problem and ensure your tax return is processed accurately.