Tax Levels 2018

Taxation is a complex and ever-evolving system, and understanding the tax landscape is crucial for individuals and businesses alike. As we delve into the tax levels of 2018, we will uncover the intricacies of this financial domain, shedding light on the rates, regulations, and strategies that shaped this pivotal year in the world of taxation.

Unraveling the 2018 Tax Landscape

The year 2018 marked a significant turning point in global taxation, with various countries implementing new policies and reforms. From individual income tax rates to corporate tax structures, let’s explore the key aspects that defined this era.

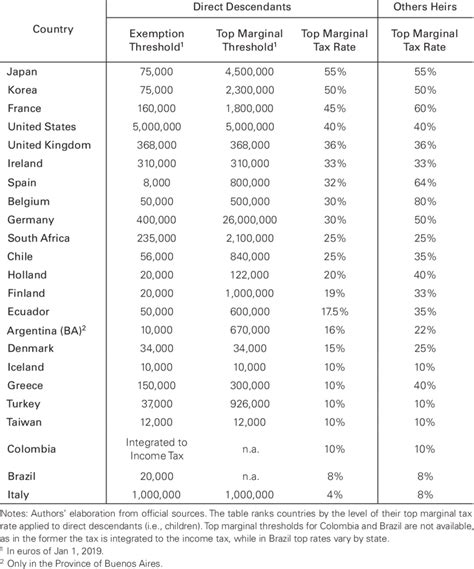

Individual Income Tax Rates: A Global Perspective

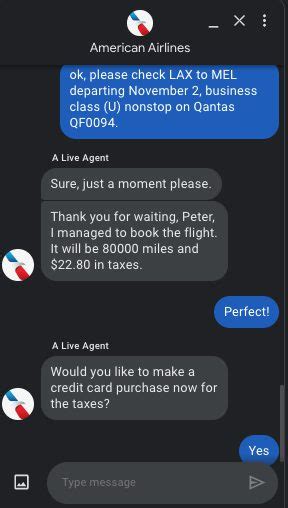

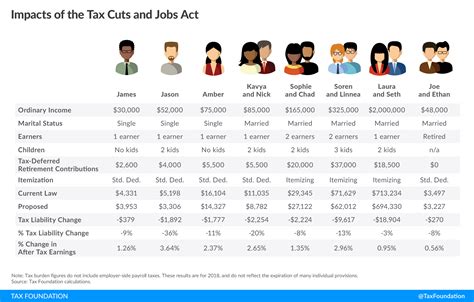

In 2018, many nations witnessed fluctuations in their income tax brackets. For instance, the United States underwent a notable tax reform, known as the Tax Cuts and Jobs Act, which brought about substantial changes. The act introduced a new tax structure with seven brackets, ranging from 10% to 37%, and altered the standard deduction amounts.

Contrastingly, in the United Kingdom, the income tax system remained largely unchanged, with three primary brackets of 20%, 40%, and 45% for higher earners. However, the personal allowance, the amount of income one can earn tax-free, was adjusted to £11,850, a slight increase from the previous year.

Moving eastward, China also saw tax reforms in 2018. The country implemented a progressive tax system with five brackets, ranging from 3% to 45%, aiming to provide relief to lower-income earners.

In Australia, the tax landscape was relatively stable, with three primary tax brackets: 19%, 32.5%, and 37% for the highest earners. However, the country introduced a Medicare levy, a 2% surcharge on taxable income, to fund healthcare services.

Below is a table comparing the top marginal income tax rates in these countries for a deeper understanding:

| Country | Top Marginal Tax Rate |

|---|---|

| United States | 37% |

| United Kingdom | 45% |

| China | 45% |

| Australia | 37% |

Corporate Tax Rates: Shaping Business Strategies

The corporate tax landscape in 2018 was equally dynamic, with governments aiming to attract investments and stimulate economic growth. Here’s a glimpse at the corporate tax rates during this period:

- United States: The Tax Cuts and Jobs Act brought about a significant reduction in the corporate tax rate, dropping it from 35% to 21%, making it one of the lowest rates among developed nations.

- United Kingdom: The corporate tax rate stood at 19%, a slight decrease from the previous year, as part of the government’s efforts to promote business competitiveness.

- China: China’s corporate tax rate varied based on the type of business and region. Generally, it ranged from 15% to 25%, with incentives offered to specific industries and regions.

- Australia: The corporate tax rate was 30% for most businesses, with some smaller companies eligible for a reduced rate of 27.5% as part of the government’s Small Business Entity concession.

Value Added Tax (VAT) and Sales Tax

Value Added Tax (VAT) and Sales Tax are essential components of indirect taxation. In 2018, these taxes played a significant role in shaping consumer prices and business operations.

Let’s explore some examples:

- European Union (EU): The EU has a common VAT system, with rates varying across member states. For instance, in 2018, the standard VAT rate in Germany was 19%, while France had a rate of 20%. However, there are also reduced rates for specific goods and services, such as 5% in Germany for books and newspapers.

- United States: The US does not have a federal VAT system but instead relies on state sales taxes. These rates can vary significantly, with some states having no sales tax (e.g., Alaska) while others have rates exceeding 10% (e.g., California at 7.25% plus local additions). This creates a complex landscape for businesses operating across state lines.

- Australia: Australia implemented a Goods and Services Tax (GST), similar to VAT, with a standard rate of 10%. This tax applies to most goods and services, with some exceptions, such as basic food items and healthcare.

The Impact of Tax Reforms

Tax reforms in 2018 had far-reaching consequences, affecting not only the tax burdens of individuals and businesses but also influencing economic growth and investment patterns.

For instance, the Tax Cuts and Jobs Act in the US aimed to boost economic growth by providing tax relief to individuals and corporations. However, it also led to a significant reduction in federal revenue, prompting concerns about the sustainability of public finances.

Similarly, in the UK, the slight adjustments to income tax brackets and the personal allowance aimed to provide some relief to taxpayers, but the impact on overall economic growth was relatively modest.

China’s progressive tax reforms, on the other hand, were part of a broader strategy to reduce income inequality and promote social welfare. This move had a significant impact on the distribution of wealth and the overall well-being of the population.

The tax landscape of 2018 was a testament to the intricate relationship between taxation, economic policy, and societal goals. As we move forward, it is essential to stay informed about these changes, as they continue to shape our financial and economic realities.

What were the key tax reforms in the United States in 2018?

+The Tax Cuts and Jobs Act, passed in 2017 but effective in 2018, brought significant changes to the US tax system, including lower corporate tax rates and alterations to individual tax brackets.

How did the UK’s tax system differ from other developed nations in 2018?

+The UK maintained a progressive income tax system with three primary brackets, similar to many other countries, but its personal allowance and tax rates were relatively modest compared to some of its European counterparts.

What were the main objectives of China’s tax reforms in 2018?

+China’s tax reforms aimed to reduce income inequality and promote social welfare by implementing a progressive tax system with lower tax rates for lower-income earners.