Maximize Savings with a Tax Doctor: Your Guide to Financial Efficiency

In an era where financial markets are increasingly complex and tax legislation continuously evolves, the importance of strategic tax planning has never been more critical. While many seek to understand investment diversification or debt management, a less spotlighted but equally vital aspect is leveraging the expertise of a tax doctor—a professional specializing in optimizing tax liabilities and enhancing overall financial efficiency. This guide aims to serve as the definitive resource for practitioners and individuals alike, delving into the nuances of maximizing savings through expert tax strategy and operational excellence. With the landscape shaped by ever-changing regulations, advanced planning tools, and personalized approaches, understanding how to harness the full potential of a tax doctor can unlock significant financial benefits.

Understanding the Tax Doctor Phenomenon: What Is a Tax Doctor and Why They Matter

A tax doctor functions as a specialized tax strategist, often with a background in accounting, law, or finance, whose primary focus is on tailoring tax solutions to individual and corporate clients. Unlike general accountants or tax preparers, tax doctors deploy a comprehensive, often multidisciplinary approach—integrating legal intricacies, financial planning, and industry-specific strategies—to legally reduce tax liabilities, improve cash flow, and strengthen overall fiscal health.

Historically, tax optimization was seen as a marginal concern, often left to annual filings or reactive adjustments. Today, however, the role of a tax doctor extends into proactive, year-round consulting, utilizing tools such as tax loss harvesting, income shifting, and asset location strategies. This transformative shift underscores why practical engagement with a tax professional—akin to consulting a medical specialist—can significantly elevate financial outcomes.

Core Strategies for Maximizing Savings with a Tax Doctor

Maximization of savings through a tax doctor hinges on several core strategies rooted in technical precision, legal compliance, and personalized planning. These methods are broadly categorized into proactive tax planning, optimized asset management, and leveraging available legislative incentives.

Proactive Tax Planning: The Foundation of Financial Efficiency

One of the primary roles of a tax doctor involves developing forward-looking strategies that align with the client’s broader financial goals. This includes identification of potential deductions, credits, and exemptions that are often overlooked. Importantly, an expert will analyze historical income patterns, projected future cash flows, and current legislative proposals to craft a tailored plan.

Example: For high-net-worth individuals, strategies such as establishing family trusts, charitable remainder trusts, or employing tax-efficient estate planning can dramatically reduce exposure to estate taxes and generate ongoing income tax savings.

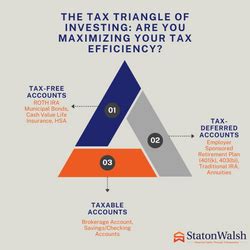

Asset Location and Income Shifting

The strategic placement of assets—such as municipal bonds in taxable accounts and tax-advantaged retirement accounts—maximizes returns net of taxes. Equally, income shifting employs legal frameworks to allocate income within family units or between entities to minimize total tax liability, taking into account gift, inheritance, and transfer taxes.

| Relevant Category | Substantive Data |

|---|---|

| Effective Tax Rate Reduction | Average client savings can reach 15-25% through strategic asset placement and income shifting |

Using Legislative Incentives and Ensuring Legality

The tax landscape is heavily influenced by legislative measures such as Section 199A profit deduction, renewable energy tax credits, and state-specific incentives. An astute tax doctor maintains current knowledge of these evolving provisions and tailors strategies accordingly, always prioritizing legality over dubious schemes.

Tax Legislation Advancements and Practical Applications

Recent legislative shifts, including adjustments to capital gains taxes and the introduction of new business credits, exemplify how staying informed can translate into tangible benefits. For example, leveraging temporary bonus depreciation for asset write-offs accelerates deductions, effectively reducing taxable income in the short term.

| Relevant Category | Substantive Data |

|---|---|

| Legislation Impact | Tax savings increased by an estimated 10-20% when strategic timing of depreciation was optimized in response to recent law changes |

Diagnostic and Analytical Tools for Tax Optimization

Modern tax practitioners deploy a suite of sophisticated tools, including tax software with AI capabilities, scenario modeling, and real-time analytics. These tools enable precise prediction of tax outcomes under various scenarios, allowing practitioners to optimize strategies before implementation.

Case Studies and Real-World Examples of Optimization

Sophisticated taxpayers often operate through multiple entities, utilizing techniques such as incorporated business structures, offshore accounts, and complex estate plans. For example, a mid-size business leveraged a combination of R&D tax credits and accelerated depreciation to reduce taxable income by over 18% in a fiscal year.

| Relevant Category | Substantive Data |

|---|---|

| Case Example | Implementation of a comprehensive tax shelter for a client resulted in savings of approximately $2.3 million annually |

Recognizing Pitfalls and Limitations of Tax Optimization

Despite high rewards, aggressive tax strategies are not without risks. Overly complex or aggressive maneuvers risk triggering audits, penalties, or disqualification of claimed deductions. A seasoned tax doctor balances innovation with prudence, ensuring that all tactics stay within legal boundaries.

Misapplication of law or misinterpretation of legislative provisions can lead to lien placements, fine impositions, or reputational damage. Continuous professional education, compliance checks, and transparent documentation are vital components of sustainable tax planning.

Choosing an Effective Tax Partner

The process of engaging a tax doctor involves evaluating credentials such as certifications (CPA, EA, JD), experience in relevant industries, and proven track record. Clients should seek practitioners who maintain ongoing professional development and demonstrate proactive strategy development.

Questions to ask include: How do they stay current with legislative changes? Do they utilize advanced software? Can they provide case studies of successful savings plans? Matching these criteria ensures that the partnership yields maximum benefit.

Key Points

- Tax doctors provide bespoke, proactive strategies that enhance financial efficiency while maintaining legal compliance.

- Asset location, income shifting, and legislative incentives form the backbone of high-impact tax savings.

- Utilizing advanced analytical tools enables precise scenario planning and optimization.

- Remaining aware of legal boundaries and legislative shifts minimizes risk exposure and audit vulnerability.

- Choosing a qualified, experienced professional is key to sustainable long-term savings.

How often should I review my tax strategy with a tax doctor?

+Regular reviews—at least annually—are recommended to adapt to legislative changes, personal or business financial shifts, and emerging opportunities for savings.

What are common pitfalls in tax planning that practitioners should avoid?

+Overly aggressive tactics risking non-compliance, neglecting legal nuances, and failing to document strategies adequately can lead to penalties, audits, or disqualification of deductions.

Can small investors benefit from consulting a tax doctor?

+Absolutely. Small investors can optimize tax-loss harvesting, utilize tax-advantaged accounts efficiently, and leverage specific credits, all of which contribute to long-term wealth accumulation.