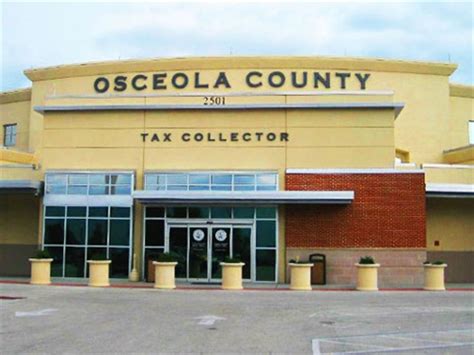

Tax Collector Osceola Fl

Welcome to our comprehensive guide on the Tax Collector's Office in Osceola County, Florida. This article will provide an in-depth analysis of the services, operations, and impact of this essential government entity. With a focus on Osceola County, we'll explore the role of the Tax Collector in the local community and how they contribute to the smooth functioning of the county's financial ecosystem.

The Role of the Tax Collector in Osceola County

The Tax Collector’s Office in Osceola County plays a pivotal role in the administration and collection of various taxes, fees, and related services. It serves as a crucial link between the county’s residents, businesses, and the government, ensuring that tax obligations are met and that the revenue generated is used effectively for the development and maintenance of the county.

The Tax Collector's responsibilities encompass a wide range of services, including:

- Property Taxes: One of the primary functions is the collection of property taxes, which form a significant portion of the county's revenue. The Tax Collector's Office handles the assessment, billing, and collection of these taxes, ensuring that property owners meet their financial obligations.

- Vehicle Registration and Titles: Residents of Osceola County rely on the Tax Collector's Office for vehicle registration, title transfers, and related services. This includes issuing license plates, processing title changes, and handling the renewal of vehicle registrations.

- Voter Registration: In collaboration with the Department of Highway Safety and Motor Vehicles, the Tax Collector's Office assists with voter registration. They provide a convenient service, allowing residents to register to vote when conducting other transactions, such as vehicle registration.

- Boating and Hunting Licenses: The office also facilitates the issuance of boating and hunting licenses, ensuring that recreational activities are conducted within the legal framework.

- Business Taxes and Permits: For businesses operating in Osceola County, the Tax Collector's Office handles the collection of various business taxes, occupational licenses, and related permits, streamlining the process for local businesses.

- Other Services: Additionally, the Tax Collector's Office offers a range of convenient services, such as the acceptance of passport applications, the processing of concealed weapon license applications, and the provision of tax information and assistance.

The Tax Collector's Office is committed to providing efficient, friendly, and professional service to all Osceola County residents and businesses. Their aim is to make the often complex process of tax payment and registration as straightforward and accessible as possible.

Office Locations and Contact Information

The Tax Collector’s Office in Osceola County operates through several convenient locations to serve the diverse needs of the county’s residents. Here are the main offices and their contact details:

| Office Location | Address | Phone Number |

|---|---|---|

| Main Office, Kissimmee | 1 Courthouse Square, Kissimmee, FL 34741 | (407) 742-2800 |

| North Office, St. Cloud | 2000 13th Street, St. Cloud, FL 34769 | (407) 742-2800 |

| South Office, Poinciana | 4455 Pleasant Hill Road, Poinciana, FL 34759 | (407) 742-2800 |

| Osceola County Appraiser's Office | 1000 Congress Avenue, Kissimmee, FL 34741 | (407) 742-2800 |

Each office is equipped to handle a wide range of tax-related services, ensuring that residents have easy access to the assistance they need. The Tax Collector's Office also provides an online portal for many services, allowing for convenient and efficient transactions from the comfort of home.

Hours of Operation and Special Services

The Tax Collector’s Office in Osceola County maintains regular business hours to accommodate the needs of its residents. The main offices and the North and South branches are open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding county-observed holidays.

In addition to these regular hours, the Tax Collector's Office also offers extended hours during certain times of the year, particularly around tax deadlines. These extended hours ensure that residents have ample time to complete their tax obligations and avoid late fees or penalties.

Furthermore, the office provides special services to accommodate the needs of residents who may face challenges with traditional office hours. This includes offering services through the mail, online, and even at special events and community gatherings. The Tax Collector's Office is committed to ensuring that all residents have equal access to the services they need, regardless of their circumstances.

Online Services and Resources

Recognizing the importance of digital accessibility, the Tax Collector’s Office in Osceola County has developed a robust online platform to serve the needs of its residents. This platform offers a wide range of services and resources, making it easier and more convenient for residents to manage their tax obligations.

Key online services include:

- Property Tax Payment: Residents can view their property tax bills, make payments, and even set up automated payments to ensure timely payment without the need for physical visits to the office.

- Vehicle Registration Renewal: The online platform allows residents to renew their vehicle registrations, pay associated fees, and even receive their new registration and license plate stickers by mail.

- Tax Estimate Calculator: A useful tool that provides residents with an estimate of their tax obligations, helping them plan their finances more effectively.

- Tax Payment History: Residents can access their tax payment history, which provides transparency and helps them keep track of their financial obligations.

- Online Document Requests: The platform enables residents to request various documents, such as vehicle titles, boat registrations, and tax receipts, which can then be delivered electronically or by mail.

In addition to these services, the Tax Collector's Office website provides a wealth of resources, including tax guides, forms, and frequently asked questions. These resources are designed to educate and inform residents, helping them navigate the complex world of taxes with ease and confidence.

Community Outreach and Education

The Tax Collector’s Office in Osceola County is committed to not only collecting taxes but also to serving and educating the community. They actively engage in community outreach initiatives and educational programs to ensure that residents understand their tax obligations and the importance of timely payment.

Some of the key community outreach initiatives include:

- Tax Workshops: The Tax Collector's Office regularly hosts workshops and seminars to educate residents on various tax-related topics. These workshops cover a range of issues, from understanding property tax assessments to navigating the vehicle registration process.

- Community Events: The office actively participates in local community events, setting up booths and information desks to provide on-the-spot assistance and answer tax-related queries. This helps to create a more accessible and friendly environment for residents to engage with the Tax Collector's Office.

- Social Media Presence: Recognizing the importance of digital communication, the Tax Collector's Office maintains an active presence on various social media platforms. They use these platforms to share tax-related updates, announcements, and educational content, ensuring that residents have access to the latest information.

- Partnerships with Local Organizations: The office collaborates with local community organizations, schools, and businesses to spread tax awareness and provide support to residents who may face challenges in meeting their tax obligations.

Through these initiatives, the Tax Collector's Office aims to build a more informed and engaged community, fostering a culture of tax compliance and understanding.

Performance and Transparency

The Tax Collector’s Office in Osceola County operates with a strong commitment to transparency and accountability. They recognize that the public’s trust is earned through open and honest communication and a dedication to efficient service delivery.

To ensure transparency, the office provides regular updates on its operations, including financial reports, performance metrics, and customer satisfaction surveys. These reports are accessible to the public, providing a clear picture of the office's activities and outcomes.

In terms of performance, the Tax Collector's Office has consistently achieved high marks in efficiency and customer satisfaction. They have implemented innovative technologies and streamlined processes to make tax payment and registration more convenient and faster. As a result, the office has seen significant improvements in customer wait times and overall satisfaction.

The office also prioritizes the security and confidentiality of taxpayer information. They have robust data protection measures in place to safeguard sensitive data, ensuring that taxpayer privacy is respected at all times.

Future Outlook and Initiatives

Looking ahead, the Tax Collector’s Office in Osceola County is focused on continued innovation and improvement. They are committed to leveraging technology to enhance their services, making tax obligations even more accessible and convenient for residents.

Some of the initiatives on the horizon include:

- Mobile App Development: The office is exploring the development of a mobile application that will allow residents to access tax-related services and information on the go. This app will further enhance convenience and accessibility, especially for those who may not have easy access to computers or the internet.

- Expanded Online Services: Building on their existing online platform, the Tax Collector's Office plans to expand the range of services available online. This will include the introduction of new features and the enhancement of existing ones, making it even easier for residents to manage their tax obligations digitally.

- Enhanced Data Analytics: The office is investing in data analytics tools to gain deeper insights into their operations and customer behavior. This will enable them to make data-driven decisions, improve service delivery, and better meet the needs of the community.

- Community Engagement Programs: The Tax Collector's Office aims to further deepen its engagement with the community. They plan to launch new educational programs, host more community events, and collaborate with local organizations to create a more tax-literate and engaged community.

With these initiatives, the Tax Collector's Office in Osceola County is committed to staying at the forefront of tax administration, ensuring that residents receive the best possible service and that the county's revenue is collected efficiently and transparently.

Conclusion

In conclusion, the Tax Collector’s Office in Osceola County plays a vital role in the smooth functioning of the county’s financial ecosystem. Through its diverse range of services, community outreach initiatives, and commitment to transparency and efficiency, the office ensures that tax obligations are met and that the county’s residents and businesses receive the support they need.

As the county continues to grow and evolve, the Tax Collector's Office remains dedicated to adapting and innovating, ensuring that it remains a trusted and valued partner in the community.

What is the Tax Collector’s Office’s role in voter registration?

+The Tax Collector’s Office in Osceola County assists with voter registration as part of its collaborative efforts with the Department of Highway Safety and Motor Vehicles. Residents can register to vote when conducting other transactions, such as vehicle registration, making the process more convenient.

How can I renew my vehicle registration online?

+To renew your vehicle registration online, visit the Tax Collector’s Office website and navigate to the “Vehicle Registration Renewal” section. Follow the step-by-step instructions, which will guide you through the process of renewing your registration, paying associated fees, and receiving your new registration and license plate stickers by mail.

What steps is the Tax Collector’s Office taking to ensure data security and confidentiality?

+The Tax Collector’s Office in Osceola County places a high priority on data security and confidentiality. They have implemented robust data protection measures, including encryption technologies and access control mechanisms, to safeguard sensitive taxpayer information. Regular security audits and staff training ensure that data security remains a top priority.

How can I stay updated on the Tax Collector’s Office’s initiatives and community events?

+To stay informed about the Tax Collector’s Office’s initiatives and community events, you can follow their social media accounts, subscribe to their newsletter (if available), and regularly visit their official website. These channels provide updates on upcoming events, new services, and important tax-related information.