Status Of Ma Tax Refund

In the realm of personal finance, tax refunds are a significant topic of interest, particularly in the context of the state of Massachusetts. The status of MA tax refund is a crucial aspect for individuals and businesses alike, as it directly impacts their financial planning and cash flow management. This article aims to provide a comprehensive overview of the process, timelines, and factors influencing the status of tax refunds in Massachusetts.

Understanding the MA Tax Refund Process

The Massachusetts Department of Revenue (DOR) is responsible for processing tax returns and issuing refunds to eligible taxpayers. The process begins with the submission of tax returns, which can be done electronically or through traditional mail. The DOR strives to process returns as efficiently as possible, but the timeline for refunds can vary based on several factors.

For instance, the complexity of the return, the accuracy of the information provided, and the method of filing can all influence the speed of processing. Additionally, the DOR prioritizes returns with direct deposit information, as these refunds can be issued more rapidly compared to those requiring a paper check.

Key Factors Affecting Refund Status

Several key factors can impact the status of a MA tax refund. Firstly, the time of year when the return is filed plays a significant role. Returns filed early in the tax season often receive quicker processing, as the DOR’s systems are less congested. However, returns filed towards the end of the season or during the extension period may experience delays due to the increased volume of filings.

Secondly, the accuracy of the return is crucial. Errors or discrepancies in the information provided can lead to delays or even audits, which can significantly prolong the refund process. Taxpayers should ensure their returns are complete and accurate to avoid unnecessary complications.

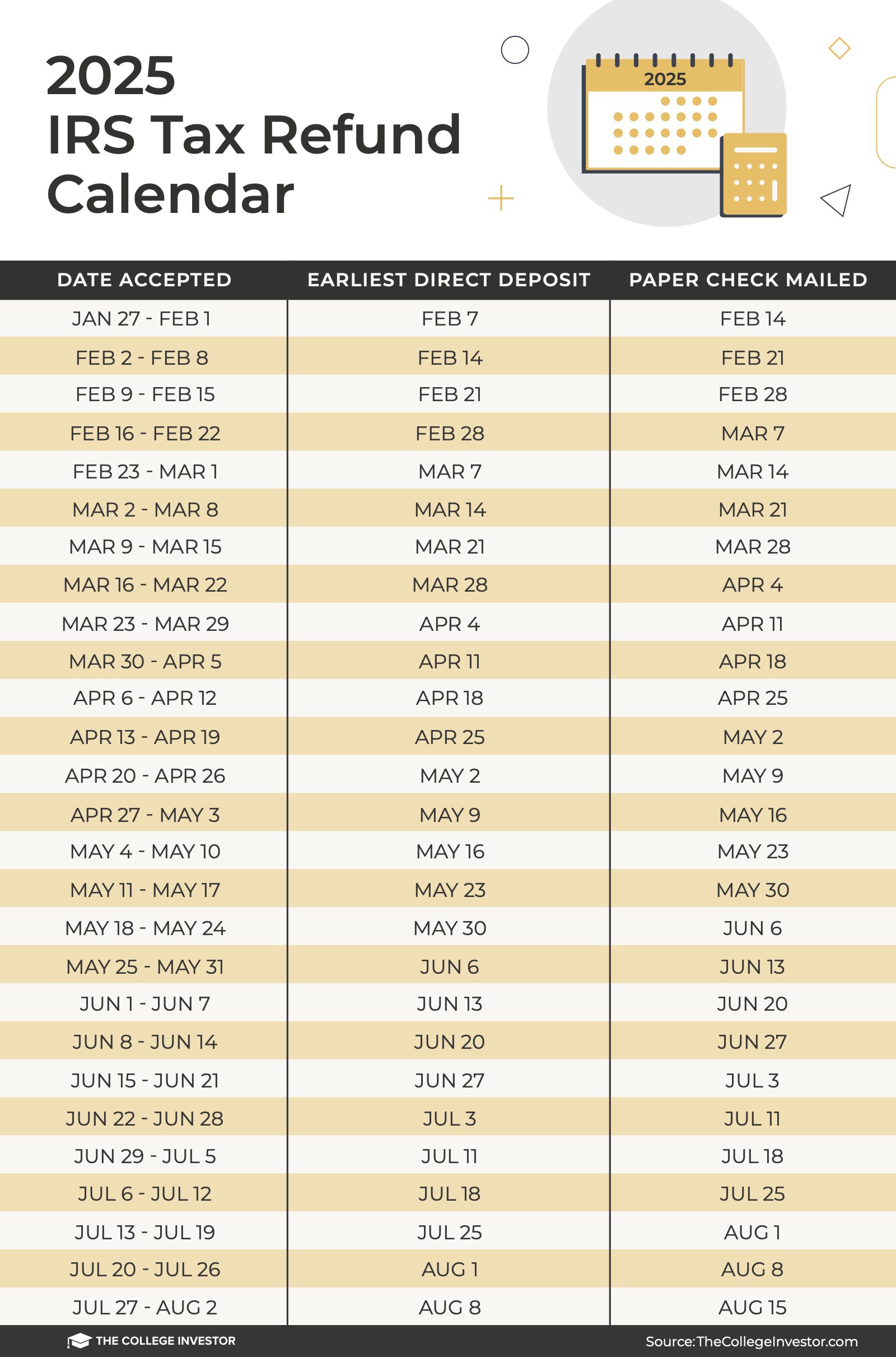

Thirdly, the method of refund payment can impact the timeline. As mentioned earlier, direct deposit refunds are typically processed faster than paper checks. Additionally, taxpayers who choose to receive their refunds on a prepaid debit card may experience a slightly longer wait compared to direct deposit or paper check options.

| Refund Payment Method | Processing Timeline |

|---|---|

| Direct Deposit | Typically 1-2 weeks |

| Paper Check | 2-3 weeks |

| Prepaid Debit Card | 2-3 weeks |

Tracking the Status of Your MA Tax Refund

Staying informed about the status of your MA tax refund is essential for effective financial planning. The Massachusetts DOR provides several tools and resources to help taxpayers track their refunds.

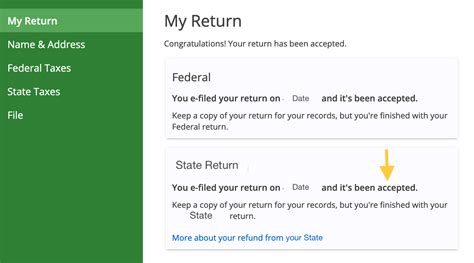

Online Refund Status Check

The most convenient way to check the status of your MA tax refund is through the DOR’s online refund status tool. This tool allows taxpayers to enter their Social Security Number, date of birth, and refund amount to retrieve the current status of their refund. The tool provides real-time updates, ensuring taxpayers have the most accurate information available.

It's important to note that the online status check tool is only available for individual income tax refunds. For other types of refunds, such as corporate or estate tax refunds, taxpayers will need to contact the DOR directly for an update.

Refund Hotline

For those who prefer a more traditional method, the DOR operates a refund hotline that provides recorded messages with the latest information on refund status. Taxpayers can call the hotline to listen to updates and receive general information about the refund process.

While the hotline is a valuable resource, it may not provide as detailed information as the online status check tool. Additionally, callers may experience longer wait times during peak tax season.

Addressing Common Issues with MA Tax Refunds

Despite the DOR’s best efforts, taxpayers may encounter issues or delays with their MA tax refunds. Understanding these potential challenges and knowing how to address them is crucial for a smooth refund process.

Delays and Error Messages

Delays in refund processing can occur for various reasons. In some cases, the DOR may need additional information from the taxpayer to verify their identity or the accuracy of their return. This process, known as correspondence, can prolong the refund timeline.

Taxpayers who encounter error messages when checking their refund status should carefully review the provided information. Common errors include incorrect Social Security Numbers or dates of birth, which can easily be rectified by providing the correct details.

Refund Reissues and Adjustments

In certain situations, the DOR may need to reissue or adjust a tax refund. This can happen if there are errors in the original refund calculation, if additional taxes are owed, or if the taxpayer’s refund was lost or stolen.

If a taxpayer believes their refund was lost or stolen, they should contact the DOR immediately to report the issue. The DOR will investigate the claim and determine the appropriate course of action, which may include issuing a replacement refund.

Conclusion: A Comprehensive Approach to MA Tax Refunds

Understanding the status of your MA tax refund is crucial for effective financial planning. By familiarizing yourself with the refund process, utilizing the available tools for tracking refunds, and being aware of potential issues, you can navigate the tax refund landscape with confidence.

Remember, timely and accurate filing of your tax return is key to receiving your refund promptly. Stay informed, and don't hesitate to reach out to the Massachusetts DOR for assistance if needed. Your tax refund is an important part of your financial journey, and taking a proactive approach can ensure a smooth and stress-free experience.

How long does it typically take to receive a MA tax refund?

+The timeline for receiving a MA tax refund can vary. On average, direct deposit refunds are processed within 1-2 weeks, while paper checks and prepaid debit cards may take 2-3 weeks. However, factors like the time of year, accuracy of the return, and the need for further verification can impact the processing time.

What should I do if I receive an error message when checking my refund status online?

+If you encounter an error message, carefully review the information you provided. Common errors include incorrect Social Security Numbers or dates of birth. Double-check your details and try again. If the issue persists, contact the Massachusetts DOR for assistance.

Can I receive my MA tax refund on a prepaid debit card?

+Yes, you can choose to receive your MA tax refund on a prepaid debit card. However, it’s important to note that refunds issued on prepaid debit cards may take slightly longer to process compared to direct deposit or paper checks. Consider the potential delay when choosing this payment method.