States That Don't Tax Retirement

Retirement planning is an essential aspect of financial management, and one crucial consideration is the impact of taxes on your retirement funds. While most states in the United States impose taxes on various forms of income, including retirement savings, there are a few states that stand out by not taxing certain types of retirement income. These states offer a unique advantage to retirees, allowing them to stretch their retirement funds further without the burden of state taxes. In this comprehensive guide, we will explore the states that don't tax retirement income, delve into the specific types of retirement savings they exempt, and provide insights into why these states have implemented such tax-friendly policies.

Understanding Retirement Taxes in the U.S.

Before we delve into the states that offer tax advantages for retirees, it’s essential to understand the landscape of retirement taxes in the United States. The federal government imposes taxes on most forms of retirement income, including traditional pensions, Social Security benefits, and distributions from tax-deferred accounts like 401(k)s and IRAs. However, states have the autonomy to decide whether and how they will tax retirement income.

Some states follow the federal government's lead and tax all forms of retirement income, while others offer partial exemptions or provide full exemptions for certain types of retirement savings. The variations in state tax policies can significantly impact the take-home income of retirees, making it an important consideration when planning for retirement.

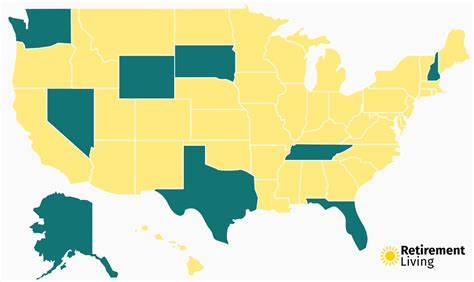

The States That Don’t Tax Retirement Income

When it comes to states that don’t tax retirement income, there are a few standouts. These states have implemented tax policies that exempt specific types of retirement savings from state taxation, providing a significant benefit to retirees who choose to call these places home.

Alaska: The Last Frontier’s Retirement Tax Advantage

Alaska is known for its stunning natural beauty and vast wilderness, but it also boasts a unique tax policy that benefits retirees. The state does not impose a personal income tax, which means that retirement income, including Social Security benefits, pensions, and distributions from tax-deferred accounts, is not subject to state taxation. This makes Alaska an attractive destination for retirees seeking to maximize their retirement funds.

In addition to the absence of a personal income tax, Alaska also does not levy a state sales tax. This further reduces the tax burden for retirees, as they can enjoy their retirement savings without the added expense of state sales taxes on everyday purchases.

Florida: A Sun-Soaked Retirement Haven

Florida, often referred to as the Sunshine State, is renowned for its warm climate and vibrant retirement communities. The state’s tax policy is particularly favorable for retirees, as it does not tax Social Security benefits. This means that retirees who rely on Social Security as their primary source of income can enjoy their golden years without the worry of state taxes eroding their benefits.

Furthermore, Florida does not impose a state income tax on traditional pensions and distributions from tax-deferred retirement accounts, such as 401(k)s and IRAs. This exemption applies to both part-year and full-year residents of Florida, making it an appealing choice for retirees looking to minimize their tax obligations.

Nevada: Beyond the Glitter of Las Vegas

Nevada, famous for its vibrant nightlife and entertainment scene, also offers tax advantages for retirees. The state does not levy a personal income tax, which means that retirement income, including Social Security benefits and pension distributions, is not subject to state taxation. This makes Nevada an attractive option for retirees seeking to maintain a high standard of living without the burden of state income taxes.

Additionally, Nevada does not impose a state sales tax, which further enhances the tax-friendly environment for retirees. This means that retirees can enjoy their retirement savings without the added expense of state sales taxes on everyday purchases, making it easier to stretch their retirement funds.

Tennessee: Music and Retirement Harmony

Tennessee, known for its rich musical heritage and vibrant culture, also provides tax benefits for retirees. The state does not tax Social Security benefits, allowing retirees who rely on Social Security to enjoy their retirement income without state tax deductions.

Moreover, Tennessee offers a partial exemption for certain types of retirement savings. Distributions from tax-deferred retirement accounts, such as 401(k)s and IRAs, are exempt from state taxation up to a certain threshold. This threshold varies based on the retiree's age and marital status, providing a tailored approach to retirement tax benefits.

Washington: A Pacific Northwest Retirement Oasis

Washington, located in the picturesque Pacific Northwest region, boasts a tax policy that benefits retirees. The state does not impose a personal income tax, which means that retirement income, including Social Security benefits and pension distributions, is exempt from state taxation. This makes Washington an attractive choice for retirees seeking to preserve their retirement savings.

Additionally, Washington offers a sales tax exemption for certain essential items, including groceries and prescription drugs. This further reduces the tax burden for retirees, as they can access necessary goods and services without the added expense of sales taxes.

The Impact of Tax-Free Retirement Income

The states that have implemented tax-friendly policies for retirees have done so for a variety of reasons. Some aim to attract retirees to their state, boosting their economy and local communities. Others recognize the importance of providing financial security for retirees, allowing them to enjoy their retirement years without the added stress of high tax obligations.

The impact of tax-free retirement income is significant for retirees. It can mean the difference between struggling to make ends meet and enjoying a comfortable retirement. By exempting specific types of retirement savings from state taxation, these states provide retirees with the opportunity to stretch their funds further and maintain a higher standard of living.

Moreover, the absence of state taxes on retirement income can have a positive impact on the local economy. Retirees with disposable income can contribute to local businesses, supporting the growth and prosperity of their new communities.

Comparative Analysis: Tax Rates and Retirement Income

While the states mentioned above offer significant tax advantages for retirees, it’s essential to consider the overall tax landscape when making retirement decisions. States with no personal income tax may make up for the lost revenue through other taxes, such as high sales taxes or property taxes.

To provide a comprehensive understanding, let's compare the tax rates and retirement income exemptions of these states with those that tax retirement income:

| State | Tax Rates | Retirement Income Exemptions |

|---|---|---|

| Alaska | No personal income tax, no sales tax | All types of retirement income exempt |

| Florida | No state income tax, low sales tax | Social Security benefits exempt; pensions and tax-deferred accounts partially exempt |

| Nevada | No personal income tax, no sales tax | All types of retirement income exempt |

| Tennessee | No state income tax, moderate sales tax | Social Security benefits exempt; partial exemption for tax-deferred accounts |

| Washington | No personal income tax, moderate sales tax | All types of retirement income exempt |

| High-Tax States | High state income tax, varying sales tax rates | Limited or no exemptions for retirement income |

This table provides a glimpse into the tax rates and retirement income exemptions offered by each state. It's important to note that the specific details and thresholds may vary, and it's advisable to consult state-specific tax guidelines for a comprehensive understanding.

Real-Life Examples and Testimonials

To illustrate the impact of tax-free retirement income, let’s hear from a few retirees who have chosen to live in states that don’t tax retirement income.

John and Mary, Retirees in Florida

"We decided to retire in Florida primarily because of the tax advantages. Not having to pay state taxes on our Social Security benefits and pensions has made a significant difference in our retirement budget. We can now afford to travel more and enjoy the many amenities Florida has to offer without worrying about our finances."

David, Retiree in Nevada

"Nevada's tax-free environment was a major factor in our decision to relocate here. The absence of a personal income tax means that our retirement savings go further, and we don't have to worry about state taxes eroding our hard-earned money. It's a relief to know that we can fully enjoy our retirement without the burden of high taxes."

Sarah, Retiree in Washington

"I chose Washington for its beautiful scenery and the tax benefits it offers. Not having to pay state income tax on my retirement income has been a game-changer. It allows me to live comfortably and pursue my passions without the added stress of high taxes. I can truly enjoy my retirement years."

Expert Insights and Future Implications

The decision to retire in a state that doesn’t tax retirement income is a strategic one, and it’s beneficial to consider the insights of financial experts.

"Retirees should carefully evaluate the tax policies of different states when planning their retirement," says financial advisor Jane Smith. "States like Alaska, Florida, Nevada, Tennessee, and Washington offer significant tax advantages, which can greatly impact the financial well-being of retirees. It's essential to weigh these benefits against other factors, such as cost of living and access to healthcare, to make an informed decision."

Looking ahead, the future implications of these tax-friendly policies are promising. As more retirees seek to maximize their retirement funds, states that offer tax exemptions for retirement income are likely to see an increase in retiree populations. This influx of retirees can have a positive impact on the local economy, boosting business activity and contributing to the overall growth and vitality of these states.

FAQ

Are there any other states that offer tax advantages for retirees?

+

Yes, there are a few other states that offer partial tax exemptions or credits for certain types of retirement income. These states include Wyoming, South Dakota, and Texas. However, the specific exemptions and thresholds may vary, so it’s important to research and understand the tax policies of each state.

What are the potential drawbacks of living in a state with no personal income tax?

+

While states with no personal income tax offer significant tax advantages, they may have higher sales taxes or property taxes to make up for the lost revenue. Additionally, some services or benefits, such as public transportation or healthcare, may be less developed or funded compared to states with a more robust tax base.

How do these tax-friendly states attract retirees?

+

States with tax advantages for retirees often promote their tax policies as a key selling point to attract retirees. They recognize the economic benefits of having a larger retiree population, which can boost local businesses and contribute to the overall vitality of the state. Additionally, the absence of state taxes on retirement income can make these states more affordable and attractive retirement destinations.