State Of Washington Tax Rate

When it comes to taxation, the state of Washington has a unique approach compared to many other states in the United States. With a progressive income tax system and a range of sales and property taxes, understanding the tax rates in Washington is essential for individuals, businesses, and investors. In this comprehensive guide, we will delve into the various tax structures, rates, and implications specific to the Evergreen State, shedding light on the financial landscape for those residing or conducting business within its borders.

Washington’s Progressive Income Tax Structure

Washington is one of the few states in the U.S. that does not impose a general sales tax. Instead, it relies heavily on a progressive income tax system, where the tax rate increases as taxable income rises. This approach ensures that higher-income earners contribute a larger portion of their income towards state revenue.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $2,400 | 0% |

| $2,401 - $6,000 | 2.2% |

| $6,001 - $8,400 | 3.2% |

| $8,401 - $11,000 | 4.2% |

| $11,001 - $14,000 | 5.2% |

| $14,001 - $17,000 | 6.2% |

| $17,001 - $20,000 | 7.2% |

| $20,001 - $30,000 | 7.7% |

| $30,001 - $40,000 | 8.7% |

| $40,001 - $50,000 | 9.2% |

| $50,001 - $75,000 | 9.5% |

| $75,001 and above | 9.9% |

For the year 2023, these tax brackets and rates are in effect, offering a progressive tax structure that benefits lower- and middle-income earners while ensuring higher earners contribute a substantial portion to the state's revenue. It's important to note that these rates may be subject to change in future tax years.

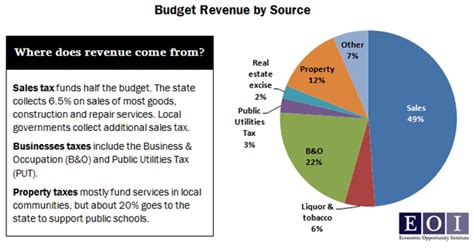

Income Tax for Businesses

Washington imposes a Business and Occupation (B&O) tax on businesses operating within the state. This tax is calculated based on the gross income or revenue generated by the business, with different tax rates applied to various business activities. The B&O tax is a significant source of revenue for the state and is a key consideration for businesses operating in Washington.

| Business Activity | Tax Rate |

|---|---|

| Retail Sales | 0.471% |

| Manufacturing | 0.484% |

| Service and Other Activities | 1.5% |

| Public Utility Services | 2.88% |

| Commercial Fishing | 0.17% |

These rates represent a snapshot of the B&O tax structure as of 2023. It's essential for businesses to stay updated on any changes to these rates and understand the specific tax obligations associated with their industry.

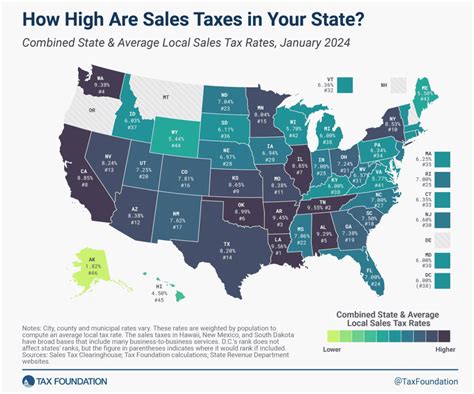

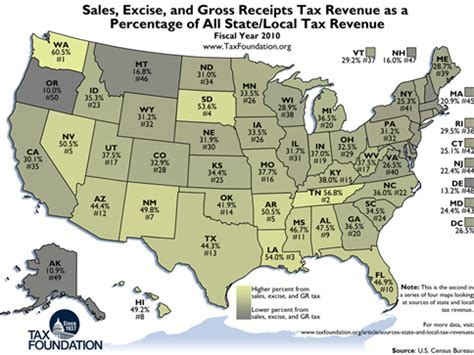

Sales and Use Tax in Washington

Washington’s sales tax system is unique, as it applies only to certain goods and services. While there is no general sales tax, specific items like prepared food, rental cars, and certain services are subject to a combined state and local sales tax. The rates can vary depending on the location within the state.

Sales Tax Rates by County

Washington’s sales tax rates are determined at the county level, with some counties imposing additional taxes on top of the state rate. Here’s a breakdown of sales tax rates in select counties as of 2023:

| County | State Sales Tax Rate | Local Sales Tax Rate | Combined Rate |

|---|---|---|---|

| King County | 6.5% | 0.9% | 7.4% |

| Pierce County | 6.5% | 0.5% | 7.0% |

| Snohomish County | 6.5% | 1.0% | 7.5% |

| Spokane County | 6.5% | 1.1% | 7.6% |

| Whatcom County | 6.5% | 0.5% | 7.0% |

It's crucial to note that these rates may change over time, and certain cities within counties may have additional taxes. Businesses and consumers should refer to the Washington State Department of Revenue for the most up-to-date information on sales tax rates.

Property Tax in Washington

Property taxes are a significant source of revenue for local governments in Washington. The tax rate for property taxes is determined by the assessed value of the property and the tax levy set by local jurisdictions, including cities, counties, and special purpose districts.

Understanding Property Tax Assessments

Property assessments in Washington are conducted by county assessors. The assessed value is based on the property’s market value, which can fluctuate based on various factors. Property owners receive a Notice of Value each year, informing them of the assessed value and the corresponding tax rate.

The tax rate is determined by dividing the total tax levy by the total assessed value of all properties within a jurisdiction. This rate is then applied to the assessed value of each individual property to calculate the property tax owed.

Residential and Commercial Property Tax Rates

Residential and commercial property tax rates can vary significantly across different areas of Washington. As of 2023, here are some examples of effective tax rates for residential and commercial properties in select counties:

| County | Residential Effective Tax Rate | Commercial Effective Tax Rate |

|---|---|---|

| King County | 1.1% | 1.3% |

| Pierce County | 1.0% | 1.2% |

| Snohomish County | 1.2% | 1.4% |

| Spokane County | 1.3% | 1.5% |

| Whatcom County | 1.1% | 1.3% |

These rates are subject to change annually and can be influenced by various factors, including local budget requirements and the assessed value of properties.

Other Taxes and Fees in Washington

Washington imposes various other taxes and fees to fund specific services and initiatives. These include:

- Real Estate Excise Tax (REET): This tax is levied on the sale of real estate and is based on the sales price or the assessed value, whichever is greater.

- Motor Vehicle Excise Tax: Owners of motor vehicles in Washington pay an annual tax based on the value of their vehicle.

- Lodging Tax: A tax is applied to the cost of hotel and motel stays, with rates varying by location.

- Special Purpose Taxes: Certain taxes are imposed to fund specific initiatives, such as transportation or conservation efforts.

Tax Incentives and Credits in Washington

Washington offers a range of tax incentives and credits to encourage economic development, support businesses, and promote certain industries. These incentives can be a significant factor for businesses considering relocation or expansion within the state.

Business and Occupation (B&O) Tax Incentives

Washington provides B&O tax incentives for various industries, including manufacturing, biotechnology, and software development. These incentives can take the form of tax credits, deductions, or reduced tax rates, making Washington an attractive location for businesses in these sectors.

Research and Development Tax Credits

Businesses engaged in research and development activities in Washington may be eligible for tax credits. These credits can offset a portion of the B&O tax liability, providing a financial incentive for companies investing in innovation.

Renewable Energy Tax Incentives

Washington promotes the development of renewable energy sources through tax incentives. Businesses involved in the production of renewable energy, such as solar or wind power, can benefit from tax credits and reduced tax rates.

Small Business Tax Incentives

Washington offers various tax incentives to support small businesses, including tax credits for hiring veterans and tax deductions for certain startup expenses. These incentives aim to foster a thriving small business environment within the state.

FAQs

What is the state income tax rate in Washington for 2023?

+

The state income tax rates for Washington in 2023 range from 0% to 9.9% based on income brackets. The rate increases progressively as income rises, with the highest rate applying to incomes above $75,000.

Are there any sales taxes in Washington?

+

Washington does not have a general sales tax, but it does impose sales taxes on specific goods and services, such as prepared food and rental cars. The rates can vary depending on the county and local taxes.

How are property taxes calculated in Washington?

+

Property taxes in Washington are determined by the assessed value of the property and the tax levy set by local jurisdictions. The tax rate is calculated by dividing the total tax levy by the total assessed value, and then applied to individual properties.

Are there any tax incentives for businesses in Washington?

+

Yes, Washington offers a range of tax incentives for businesses, including B&O tax credits, research and development tax credits, renewable energy incentives, and small business tax deductions. These incentives aim to attract and support businesses in various industries.

What is the Business and Occupation (B&O) tax in Washington?

+

The B&O tax is a tax on the gross income or revenue of businesses operating in Washington. The tax rate varies based on the type of business activity, with rates ranging from 0.471% to 2.88% as of 2023.