Small Business Tax Preparation

For small business owners, tax preparation can be a daunting task, often filled with complex regulations and potential pitfalls. However, with the right knowledge and strategies, navigating the tax landscape can become a manageable process. This comprehensive guide aims to provide an expert-level overview, offering insights and practical tips to help small businesses tackle tax season efficiently and effectively.

Understanding the Tax Landscape for Small Businesses

The tax environment for small businesses is unique, with various considerations that differ from larger corporations. Understanding these nuances is crucial for accurate and compliant tax preparation. Small businesses often face challenges such as keeping up with ever-changing tax laws, determining the right tax structure, and managing cash flow to meet tax obligations.

The Internal Revenue Service (IRS) offers specific guidelines and resources tailored to small businesses. For instance, the IRS provides a Small Business and Self-Employed Tax Center, which serves as a one-stop shop for tax information and resources, including forms, publications, and educational tools.

Key Tax Considerations for Small Businesses

-

Tax Structure: Choosing the right business structure, such as a sole proprietorship, partnership, or corporation, has significant tax implications. Each structure offers different tax benefits and obligations, affecting how business income is taxed and how the business itself is taxed.

-

Tax Deductions and Credits: Small businesses can take advantage of various deductions and credits to reduce their tax liability. These include deductions for business expenses like office rent, utilities, and supplies, as well as potential tax credits for research and development, hiring new employees, or investing in energy-efficient upgrades.

-

Record Keeping and Reporting: Accurate record keeping is essential for small businesses to substantiate their tax positions and ensure compliance. This includes maintaining records of income, expenses, assets, and liabilities. Proper record-keeping practices also facilitate easier tax preparation and audit defense.

| Tax Structure | Key Considerations |

|---|---|

| Sole Proprietorship | Simplest structure; taxes are filed on personal tax returns; limited liability protection. |

| Partnership | Profits and losses are passed through to partners; partners are responsible for their share of taxes. |

| Corporation | Offers liability protection; taxes are filed separately; potential for tax savings through corporate tax rates and strategies. |

Step-by-Step Guide to Small Business Tax Preparation

Effective tax preparation for small businesses involves a systematic approach. Here’s a comprehensive guide to help business owners navigate the process efficiently:

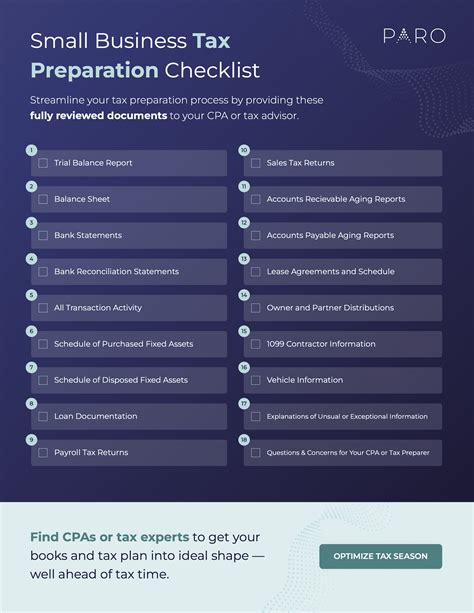

Step 1: Gather Necessary Documents and Information

Start by collecting all relevant financial documents and records. This includes bank statements, invoices, receipts, payroll records, and any other documentation related to business income and expenses. Organize these documents systematically to facilitate easier reference during tax preparation.

Additionally, ensure you have the following information readily available:

- Business income statements and balance sheets.

- Details of any investments or assets acquired during the tax year.

- Information on business-related expenses, including travel, entertainment, and office expenses.

- Details of any tax deductions or credits claimed in previous years.

Step 2: Choose the Right Tax Software or Professional Assistance

Small businesses have the option to use tax preparation software or seek professional assistance. Tax software can be a cost-effective solution, offering user-friendly interfaces and step-by-step guidance. However, for more complex tax situations, it's advisable to consult a tax professional or accountant.

When choosing a tax professional, consider their experience with small businesses and their familiarity with the industry-specific tax laws and regulations. Ensure they are reputable and have a good track record of providing accurate and timely services.

Step 3: Determine Tax Liability and Payment Options

Once you have gathered all the necessary information and chosen your preferred method of tax preparation, it’s time to calculate your tax liability. This involves determining the total amount of tax owed based on your business income, expenses, and deductions.

Small businesses often have the option to pay taxes in installments. The IRS offers various payment plans and options to help businesses manage their tax obligations. It's important to explore these options and choose the one that best suits your cash flow and financial situation.

Step 4: File Tax Returns Accurately and Timely

Filing tax returns is a critical step in the tax preparation process. Ensure that you file your returns accurately and on time to avoid penalties and interest charges. Late filing can result in significant financial consequences and may impact your business’s reputation.

Keep in mind that the due date for filing business tax returns is typically March 15th for partnerships and S corporations, and April 15th for sole proprietorships and C corporations. Mark these dates on your calendar and ensure you have sufficient time to complete the filing process without rushing.

Step 5: Post-Filing Review and Audit Preparation

After filing your tax returns, it’s essential to review them thoroughly to ensure accuracy. Look for any errors or omissions that may have occurred during the preparation process. If you identify any mistakes, correct them immediately and file amended returns as necessary.

Additionally, prepare for potential audits by keeping detailed records and documentation. The IRS may select businesses for audit based on various factors, including random selection, discrepancies in tax returns, or changes in tax laws. Being well-prepared can help ease the audit process and reduce any potential tax liabilities.

Common Tax Challenges and Strategies for Small Businesses

Small businesses often face unique challenges when it comes to tax preparation. Understanding these challenges and developing effective strategies can help mitigate potential issues and ensure a smoother tax experience.

Challenge: Cash Flow Management

One of the most significant challenges for small businesses is managing cash flow to meet tax obligations. With various expenses and income fluctuations, ensuring sufficient funds to cover tax payments can be a daunting task.

To address this challenge, consider the following strategies:

- Implement robust accounting practices to track income and expenses accurately.

- Set aside a portion of business income specifically for tax payments.

- Explore financing options, such as business loans or lines of credit, to cover tax liabilities if needed.

- Consider tax-efficient payment structures, such as pre-tax contributions to employee benefit plans.

Challenge: Record Keeping and Organization

Maintaining accurate and organized records is essential for small businesses to substantiate their tax positions and facilitate easier tax preparation. However, with the multitude of financial transactions, this task can become overwhelming.

Here are some strategies to overcome this challenge:

- Implement a comprehensive accounting system to track income, expenses, and assets.

- Use digital tools and software to streamline record-keeping processes.

- Establish a consistent filing system for physical documents and receipts.

- Regularly review and reconcile financial records to identify any discrepancies or errors.

Challenge: Navigating Complex Tax Laws

Tax laws and regulations are constantly evolving, making it challenging for small businesses to stay updated and compliant. This complexity can lead to potential errors and non-compliance issues.

To navigate this challenge, consider the following strategies:

- Stay informed about tax law changes through reputable sources and industry publications.

- Consult with tax professionals or accountants who specialize in small business taxation.

- Attend workshops or webinars focused on tax updates and strategies for small businesses.

- Use tax preparation software that automatically incorporates the latest tax laws and regulations.

Maximizing Tax Benefits for Small Businesses

Small businesses have access to a range of tax benefits and incentives designed to support their growth and success. By understanding and leveraging these opportunities, businesses can minimize their tax liabilities and optimize their financial position.

Tax Deductions and Credits for Small Businesses

Small businesses can claim various tax deductions and credits to reduce their tax liability. These incentives are designed to encourage specific behaviors or support particular industries. Here are some key deductions and credits to consider:

-

Business Expenses: Deduct ordinary and necessary business expenses, such as rent, utilities, insurance, and marketing costs. These deductions reduce taxable income, lowering your overall tax liability.

-

Research and Development (R&D) Credit: If your business engages in qualifying research activities, you may be eligible for the R&D tax credit. This credit provides a financial incentive for businesses to invest in innovation and technological advancements.

-

Section 179 Deduction: This provision allows businesses to deduct the full purchase price of qualifying assets, such as equipment and software, in the year they are placed in service. It encourages businesses to invest in their operations and can significantly reduce tax liabilities.

-

Energy-Efficient Property Credit: If your business invests in energy-efficient equipment or property, you may be eligible for this credit. It promotes sustainable practices and can provide a significant tax benefit.

Tax Strategies for Business Growth and Expansion

Small businesses can employ various tax strategies to support their growth and expansion plans. These strategies involve careful planning and a thorough understanding of tax laws and incentives.

Consider the following approaches:

-

Tax-Efficient Business Structure: Choose a business structure that aligns with your growth goals and offers the most tax advantages. For instance, converting to an S corporation can provide pass-through taxation and potential tax savings.

-

Strategic Investment in Assets: Plan your asset purchases strategically to maximize tax benefits. Consider the timing of purchases to align with tax deadlines and take advantage of tax deductions or credits.

-

Employee Benefits and Incentives: Offer tax-efficient employee benefits, such as health insurance or retirement plans, to attract and retain top talent. These benefits can also provide tax savings for your business.

-

Business Expansion Incentives: Research and leverage state and local incentives for business expansion. These may include tax credits, grants, or reduced tax rates to encourage investment and job creation.

Future Trends and Innovations in Small Business Taxation

The field of small business taxation is constantly evolving, driven by technological advancements, changing economic landscapes, and shifting government policies. Staying informed about these trends and innovations can help small businesses stay ahead of the curve and adapt their tax strategies accordingly.

Digitalization and Tax Technology

The rise of digital technologies has revolutionized the tax landscape, offering small businesses new tools and platforms to streamline their tax processes. Digital tax software, cloud-based accounting systems, and online tax filing platforms have made tax preparation more accessible and efficient.

Additionally, data analytics and machine learning are being increasingly used to identify tax trends, optimize tax strategies, and improve compliance. These technologies can help small businesses make more informed decisions and stay on top of their tax obligations.

Tax Policy and Regulatory Changes

Tax policies and regulations are subject to change, often influenced by political and economic factors. Small businesses need to stay updated on these changes to ensure compliance and take advantage of new tax incentives or opportunities.

For instance, recent tax reforms, such as the Tax Cuts and Jobs Act (TCJA) in the United States, have brought significant changes to tax laws, including reduced corporate tax rates and expanded tax credits. Understanding these reforms and their implications is crucial for small businesses to maximize their tax benefits.

Sustainable and Socially Responsible Tax Strategies

There is a growing trend towards sustainable and socially responsible tax practices among small businesses. This includes adopting environmentally friendly initiatives, supporting community development, and promoting ethical business practices.

Small businesses can leverage tax incentives and credits that encourage sustainable practices, such as investments in renewable energy or energy-efficient upgrades. Additionally, engaging in community initiatives and supporting social causes can lead to tax benefits through charitable deductions or credits.

Conclusion

Tax preparation for small businesses is a complex but essential process. By understanding the tax landscape, adopting systematic preparation strategies, and leveraging available tax benefits, small businesses can navigate the tax season with confidence and optimize their financial position.

Staying informed, seeking professional advice when needed, and staying compliant are key principles for successful tax management. With the right approach and mindset, small businesses can turn tax season into an opportunity for growth and financial stability.

Frequently Asked Questions

What are the key tax deductions available to small businesses?

+Small businesses can deduct a wide range of expenses, including rent, utilities, insurance, marketing costs, and employee salaries. Additionally, they can take advantage of specific deductions like the Section 179 deduction for equipment purchases and the Research and Development tax credit.

How can small businesses manage their cash flow to meet tax obligations?

+Small businesses can manage their cash flow by implementing effective accounting practices, setting aside funds specifically for tax payments, exploring financing options, and considering tax-efficient payment structures. It’s crucial to plan and budget for tax obligations to avoid cash flow issues.

What is the role of a tax professional in small business tax preparation?

+Tax professionals, such as accountants or tax advisors, play a crucial role in guiding small businesses through the complex tax landscape. They provide expert advice, ensure compliance with tax laws, and help maximize tax benefits. They can also assist in preparing and filing tax returns, managing audits, and developing tax strategies tailored to the business’s needs.

How can small businesses stay updated on tax law changes and regulations?

+Small businesses can stay updated on tax law changes by subscribing to reputable tax publications, following industry associations and their websites, and attending workshops or webinars focused on tax updates. Additionally, consulting with tax professionals or accountants who specialize in small business taxation can provide valuable insights and guidance.

What are some common mistakes to avoid during small business tax preparation?

+Common mistakes to avoid include failing to keep accurate records, missing important tax deadlines, claiming ineligible deductions or credits, and not taking advantage of available tax benefits. It’s crucial to stay organized, seek professional advice when needed, and thoroughly review tax returns before filing.