Severance Pay Tax

Understanding severance pay and its tax implications is crucial for both employers and employees. Severance packages are a common practice when terminating employment, offering financial support to departing employees. However, the tax treatment of these payments can be complex and varies depending on several factors. In this comprehensive guide, we will delve into the intricacies of severance pay taxes, providing you with valuable insights and practical advice.

What is Severance Pay and How is it Taxed?

Severance pay, also known as termination pay or redundancy pay, is a sum of money provided to an employee upon the end of their employment contract. It serves as a compensation package and can include various components such as base pay, bonuses, benefits, and other agreed-upon amounts. The purpose of severance pay is to provide financial assistance during the transition period and help cover living expenses while the employee seeks new employment opportunities.

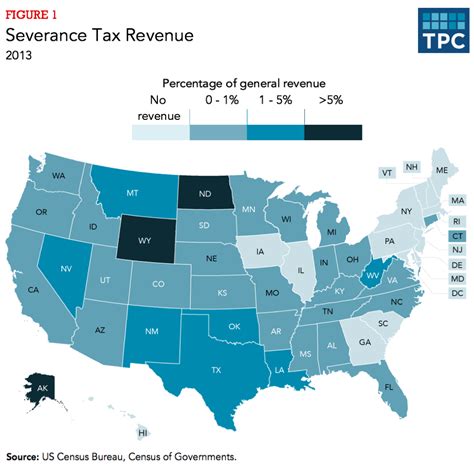

From a tax perspective, severance pay is treated differently in various jurisdictions. In general, severance payments are considered taxable income, just like regular wages or salaries. However, certain countries or regions may offer tax exemptions or favorable tax treatments for specific circumstances. It is essential to consult with tax professionals or refer to the relevant tax authorities for accurate information regarding your specific situation.

Tax Implications and Considerations

When it comes to severance pay taxes, several factors come into play. These factors can impact the tax liability and the overall financial outcome for both the employer and the employee. Here are some key considerations:

1. Employment Status and Eligibility

The tax treatment of severance pay often depends on the employment status and eligibility requirements. Different countries have varying regulations regarding who qualifies for severance payments and under what conditions. Some countries require a minimum period of employment or specific reasons for termination to trigger severance eligibility. Understanding these criteria is vital to determine the tax implications accurately.

For instance, in the United States, severance pay is generally taxable for both federal and state income taxes. However, there are certain exceptions, such as when the payment is considered a "wage substitute" or when it meets the criteria for tax-exempt status under specific regulations.

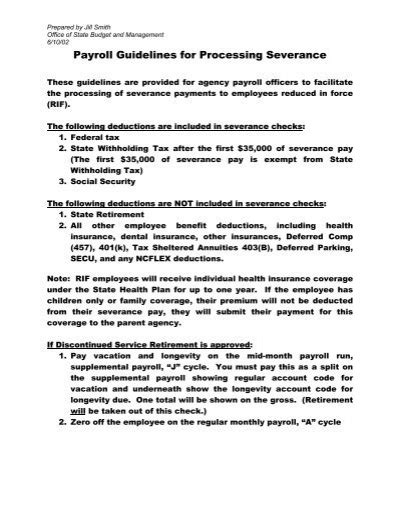

2. Tax Withholding and Reporting

Employers have a responsibility to withhold and report taxes on severance payments. This process is similar to regular payroll tax withholding. The employer must calculate the appropriate tax amounts, deduct them from the severance pay, and remit the taxes to the relevant tax authorities. Failure to comply with tax withholding requirements can result in penalties and legal consequences.

It is crucial for employers to stay updated on the latest tax regulations and ensure accurate tax withholding. This includes understanding the applicable tax rates, filing requirements, and any potential deductions or credits that may apply to severance pay.

3. Lump Sum vs. Periodic Payments

The method of payment for severance can also impact tax obligations. Severance pay can be provided as a lump sum payment or in periodic installments. Lump sum payments are typically taxed at the employee’s regular tax rate, considering their overall income for the year. On the other hand, periodic payments may be subject to different tax treatments, such as being considered as regular wages or being taxed as pension income.

Employees should carefully review their severance agreements and consult tax advisors to understand the tax implications of their specific payment structure. This ensures accurate tax planning and compliance.

4. Deductions and Exemptions

Certain deductions or exemptions may apply to severance pay, reducing the overall tax liability. These can vary depending on the jurisdiction and the circumstances of the termination. For example, some countries allow deductions for legal fees or outplacement services incurred during the severance process.

Additionally, some jurisdictions offer tax exemptions for specific types of severance payments. These exemptions can be based on the reason for termination, the duration of employment, or other criteria. It is essential to research and understand the applicable tax laws to maximize any potential deductions or exemptions.

5. International Considerations

Severance pay taxes can become more complex when dealing with international employment or cross-border situations. Tax treaties between countries may influence the tax treatment of severance payments, providing favorable tax provisions or clarifying the jurisdiction responsible for taxing the income.

Employees and employers involved in international employment should seek advice from tax professionals who specialize in cross-border tax matters. This ensures compliance with international tax laws and helps navigate the complexities of dual taxation or tax residency issues.

Maximizing Tax Efficiency

To optimize the tax efficiency of severance pay, both employers and employees can take certain steps:

1. Consult Tax Advisors

Seeking professional tax advice is crucial when dealing with severance pay taxes. Tax advisors can provide personalized guidance based on your specific circumstances, ensuring compliance and maximizing tax benefits. They can help navigate complex tax laws, identify potential deductions, and minimize tax liabilities.

2. Review Severance Agreements

Employees should carefully review their severance agreements to understand the tax implications. These agreements should clearly outline the payment structure, any applicable deductions or exemptions, and the employer’s responsibilities regarding tax withholding. Clarifying any uncertainties or discrepancies early on can prevent future tax-related issues.

3. Consider Tax-Efficient Payment Structures

Employers can work with tax advisors to structure severance payments in a tax-efficient manner. This may involve spreading the payments over multiple tax years or utilizing tax-favored payment methods. By optimizing the payment structure, employers can help employees minimize their tax liabilities and maximize the net value of the severance package.

4. Track and Document Expenses

Employees should maintain records of any expenses related to the severance process, such as legal fees, outplacement services, or job search costs. These expenses may be deductible and can reduce the overall tax liability. Proper documentation and record-keeping are essential for claiming these deductions accurately.

5. Stay Informed on Tax Updates

Both employers and employees should stay updated on tax regulations and any changes that may impact severance pay taxes. Tax laws can evolve, and keeping abreast of these changes ensures compliance and allows for timely adjustments to tax strategies.

Case Studies: Severance Pay Tax Scenarios

To provide a clearer understanding of severance pay taxes, let’s explore a few real-world scenarios:

Scenario 1: Lump Sum Severance Payment

John, an employee based in the United States, receives a lump sum severance payment of 20,000 upon termination. His regular salary was 60,000 per year. The severance payment is considered taxable income and will be included in his annual tax return. John’s tax liability for the severance payment will depend on his overall income and applicable tax brackets.

Scenario 2: Periodic Severance Payments

Emily, an employee in Canada, is entitled to periodic severance payments over a period of 12 months. Her severance agreement specifies that these payments will be treated as regular wages for tax purposes. Each payment will be subject to payroll deductions, including income tax, employment insurance, and pension plan contributions. Emily’s employer will withhold the appropriate taxes and remit them to the Canadian Revenue Agency.

Scenario 3: International Severance

David, an expat employee working in the United Kingdom, receives a severance package upon his return to his home country, Germany. Due to the cross-border nature of his employment, David’s severance pay is subject to tax in both the UK and Germany. However, a tax treaty between the two countries allows David to claim tax credits for the taxes paid in the UK, ensuring he is not double-taxed on his severance income.

Future Implications and Trends

The tax landscape surrounding severance pay is continuously evolving. As employment dynamics change and tax regulations adapt, it is essential to stay informed about emerging trends and potential future developments. Here are some key considerations for the future:

1. Remote Work and Global Employment

With the rise of remote work and global employment, the tax treatment of severance pay for cross-border employees may become more complex. Tax authorities are likely to pay closer attention to these situations, and employers and employees should anticipate potential challenges and seek professional guidance to navigate international tax obligations.

2. Tax Reform and Simplification

Many countries are undergoing tax reform processes to simplify and modernize their tax systems. These reforms may impact the tax treatment of severance pay, potentially introducing new deductions, credits, or exemptions. Staying updated on these reforms can help employers and employees make informed decisions regarding severance packages.

3. Digitalization of Tax Processes

The digitalization of tax processes is gaining momentum, with many tax authorities adopting online platforms and digital filing systems. This trend is likely to continue, making tax compliance more efficient and accessible. Employers and employees should embrace these digital tools to streamline tax reporting and ensure accurate tax calculations for severance pay.

4. Employee Advocacy and Awareness

As employees become more aware of their rights and tax obligations, they are likely to advocate for transparent and fair tax treatment of severance pay. Employers should anticipate increased scrutiny and be prepared to provide clear and concise information regarding tax implications. Building trust and transparency in severance negotiations can lead to more favorable outcomes for both parties.

5. Alternative Payment Structures

Employers may explore alternative payment structures for severance packages to optimize tax efficiency. This could involve offering a combination of lump sum and periodic payments or providing additional benefits such as healthcare coverage or retirement plan contributions. These alternative structures can help employees maximize the net value of their severance while complying with tax regulations.

Conclusion

Severance pay taxes can be complex, but with proper understanding and planning, employers and employees can navigate these complexities effectively. By staying informed about tax regulations, consulting professionals, and adopting tax-efficient strategies, both parties can ensure compliance and optimize the financial outcomes associated with severance payments.

Remember, the information provided in this article is a general overview, and specific tax laws may vary depending on your jurisdiction. Always seek professional advice to address your unique circumstances and ensure accurate tax compliance.

How do I calculate the tax on my severance pay?

+The calculation of tax on severance pay depends on various factors, including your jurisdiction’s tax laws, your overall income, and the payment structure. It’s best to consult a tax professional or use tax calculation tools to determine the exact tax liability.

Are there any tax benefits for severance pay in my country?

+Tax benefits for severance pay can vary by country. Some countries offer tax exemptions or reduced tax rates for specific circumstances. Check with your local tax authority or a tax advisor to understand the tax benefits available in your jurisdiction.

What happens if I don’t pay taxes on my severance pay?

+Failing to pay taxes on severance pay can result in significant penalties and legal consequences. It’s important to fulfill your tax obligations to avoid potential issues with tax authorities. Consult a tax professional to ensure compliance.

Can I negotiate the tax treatment of my severance pay with my employer?

+While it’s generally not possible to negotiate the tax treatment directly with your employer, you can discuss tax-efficient payment structures or seek their support in understanding the tax implications. Employers may provide guidance or recommend tax professionals to assist you.

Are there any tax-saving strategies for severance pay?

+Yes, there are tax-saving strategies that can be employed to minimize the tax liability on severance pay. These may include spreading the payments over multiple tax years, utilizing tax-favored payment methods, or claiming eligible deductions. Consult a tax advisor for personalized advice.