Seminole County Property Tax

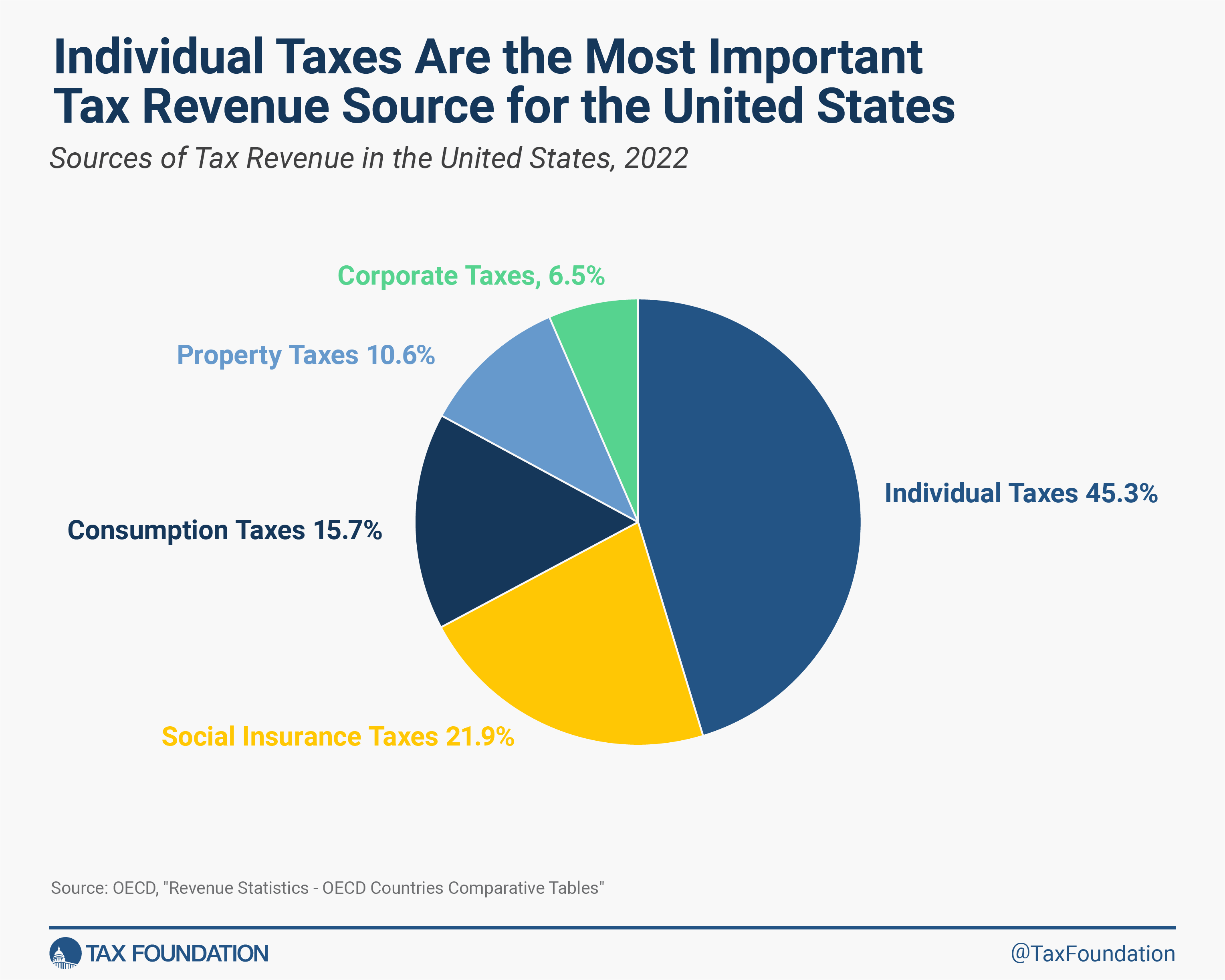

Welcome to our comprehensive guide on Seminole County Property Tax. In this expert-level journal article, we will delve into the intricacies of property taxation in Seminole County, Florida, providing you with valuable insights and information. Property taxes are an essential component of local government funding, and understanding how they work is crucial for both homeowners and investors.

Understanding Seminole County Property Tax

Seminole County, located in the heart of Central Florida, is known for its vibrant communities, thriving businesses, and beautiful natural landscapes. The county’s property tax system plays a significant role in maintaining the quality of life and supporting various public services.

The property tax in Seminole County is based on the assessed value of real estate properties, including residential homes, commercial buildings, and land. This value is determined by the Seminole County Property Appraiser's Office, which conducts annual assessments to ensure fairness and accuracy.

The property tax rate in Seminole County is expressed as millage, which represents the amount of tax owed per $1,000 of the property's assessed value. This rate is set by various taxing authorities, including the county government, school districts, and special districts. The combined millage rate determines the total tax liability for each property owner.

Property Tax Calculation in Seminole County

To calculate the property tax in Seminole County, the following formula is used:

Property Tax = Assessed Value x Millage Rate

Let's break down the components:

- Assessed Value: This is the taxable value of your property as determined by the Property Appraiser's Office. It is typically lower than the market value and may be influenced by factors such as property improvements, depreciation, and local assessment practices.

- Millage Rate: This rate is set annually by the taxing authorities and is expressed in mills. One mill represents $1 of tax for every $1,000 of assessed value. For example, if the millage rate is 10 mills, you would pay $10 for every $1,000 of assessed value.

By multiplying the assessed value of your property by the millage rate, you can estimate your annual property tax liability. It's important to note that the millage rate may vary from one taxing district to another within Seminole County.

| Taxing Authority | Millage Rate (Example) |

|---|---|

| Seminole County | 5.00 mills |

| School District | 7.50 mills |

| Special District (e.g., Fire Department) | 2.50 mills |

Property Tax Exemptions and Discounts

Seminole County offers various property tax exemptions and discounts to eligible homeowners. These incentives aim to provide relief and encourage homeownership.

Homestead Exemption

The Homestead Exemption is one of the most significant property tax benefits available in Seminole County. To qualify, you must meet the following criteria:

- Own and occupy the property as your primary residence.

- Have legal title or a life estate in the property.

- Reside in Florida for at least six months of the year.

- File a Homestead Exemption application with the Seminole County Property Appraiser's Office by March 1st.

The Homestead Exemption reduces the assessed value of your property, resulting in lower property taxes. The exemption amount varies based on your income and the date you established residency in Florida. It's important to note that the Homestead Exemption is non-transferable if you sell your property.

Additional Exemptions and Discounts

Seminole County offers additional exemptions and discounts to eligible homeowners, including:

- Senior Exemption: Seniors aged 65 or older may qualify for an additional exemption on their homestead property. The exemption amount depends on income and other factors.

- Disabled Veteran Exemption: Qualified disabled veterans may be eligible for an exemption on their homestead property, providing tax relief for their service.

- Widow/Widower Exemption: Spouses of deceased veterans may be entitled to an exemption if they meet certain criteria, ensuring continued support for military families.

- Early Filing Discount: Property owners who file their Homestead Exemption applications before March 1st may be eligible for a discount on their property taxes.

It's crucial to explore all available exemptions and discounts to maximize your property tax savings. Consulting with the Seminole County Property Appraiser's Office or a tax professional can help you understand your eligibility and ensure you take advantage of these benefits.

Property Tax Payment and Due Dates

Property taxes in Seminole County are due twice a year, with specific payment periods and due dates. The tax year runs from January 1st to December 31st, and payments are typically due in November and March.

The First Installment is due in November and covers the period from January 1st to September 30th. The Second Installment is due in March and covers the remaining months of the tax year.

To ensure timely payment and avoid penalties, property owners can choose from various payment methods, including online payment through the Seminole County Tax Collector's website, mail-in payments, or in-person payments at designated locations.

Late Payment Penalties and Interest

If property taxes are not paid by the due date, Seminole County imposes penalties and interest charges. The penalty for late payment is typically 3% of the unpaid tax amount, and interest accrues at a rate of 1.5% per month (18% annually) until the taxes are paid in full.

It's important to stay informed about the payment due dates and take advantage of the available payment options to avoid unnecessary penalties and interest charges.

Appealing Your Property Tax Assessment

If you believe that your property’s assessed value is incorrect or unfair, you have the right to appeal the assessment. Seminole County provides a fair and transparent process for property tax appeals.

Steps to Appeal Your Assessment

- Review Your Notice of Proposed Property Taxes: When you receive your Notice of Proposed Property Taxes, carefully review the assessed value and compare it to similar properties in your area. Identify any discrepancies or errors.

- Gather Evidence: Collect supporting documentation, such as recent sales of comparable properties, appraisals, or any other relevant information that supports your case.

- File an Appeal: Contact the Seminole County Property Appraiser’s Office and request an informal review or formal appeal. Follow their guidelines and provide all necessary documentation.

- Informal Review: The Property Appraiser’s Office will conduct an informal review to determine if an adjustment is warranted. If not satisfied with the outcome, you can proceed to a formal appeal.

- Formal Appeal: A formal appeal is heard by the Value Adjustment Board (VAB), an independent body that reviews property tax disputes. You will have the opportunity to present your case and evidence before the VAB.

- Decision and Resolution: The VAB will issue a decision, and if you disagree with the outcome, you may have the right to further appeal to the circuit court.

It's important to note that appealing your property tax assessment requires careful preparation and a strong understanding of the process. Seeking professional advice from a tax attorney or consultant can greatly improve your chances of a successful appeal.

Future Implications and Property Tax Trends

Seminole County’s property tax landscape is constantly evolving, influenced by various factors such as economic conditions, population growth, and government policies. Understanding these trends can help property owners and investors make informed decisions.

Economic Factors and Property Values

The Seminole County real estate market is dynamic, and property values can fluctuate based on economic conditions. During periods of economic growth and low-interest rates, property values may increase, leading to higher assessed values and, consequently, higher property taxes.

Conversely, economic downturns or recessions can result in lower property values, providing some relief to homeowners. However, it's important to note that property values can take time to adjust, and tax assessments may lag behind market trends.

Population Growth and Infrastructure Development

Seminole County’s population has been steadily growing, attracting new residents and businesses. This growth can put pressure on local infrastructure and public services, leading to increased demand for funding. As a result, taxing authorities may propose higher millage rates to support these developments.

Staying informed about local development plans and infrastructure projects can help property owners anticipate potential tax increases and plan their financial strategies accordingly.

Government Initiatives and Tax Reforms

Seminole County and state governments periodically review and reform property tax policies to ensure fairness and efficiency. These reforms may include changes to assessment methodologies, exemption programs, or tax relief initiatives.

Keeping an eye on local and state legislative updates can provide valuable insights into potential tax changes and allow property owners to adapt their financial planning.

Conclusion

Understanding Seminole County Property Tax is crucial for homeowners and investors alike. By familiarizing yourself with the assessment process, available exemptions, payment options, and appeal procedures, you can navigate the property tax landscape with confidence.

Stay informed about local economic trends, population growth, and government initiatives to make well-informed decisions regarding your property taxes. Remember, property taxes play a vital role in supporting the community's infrastructure and public services, and by staying proactive, you can ensure your financial well-being while contributing to the vibrant Seminole County community.

What is the average property tax rate in Seminole County?

+The average property tax rate in Seminole County varies depending on the taxing district and the property’s assessed value. As of [current year], the combined millage rate for Seminole County and the School District is approximately [rate mills], while special districts may have different rates. It’s essential to calculate your specific tax rate based on your property’s assessed value and the applicable millage rates.

When are property taxes due in Seminole County?

+Property taxes in Seminole County are due twice a year. The First Installment is due in November and covers the period from January 1st to September 30th. The Second Installment is due in March and covers the remaining months of the tax year. It’s crucial to pay by the due dates to avoid late payment penalties and interest charges.

How can I estimate my property tax liability in Seminole County?

+To estimate your property tax liability, you can use the formula: Property Tax = Assessed Value x Millage Rate. You can find your property’s assessed value on your Notice of Proposed Property Taxes. The millage rate is set by the taxing authorities and can be found on the Seminole County Tax Collector’s website or by contacting the relevant taxing districts.

Are there any property tax exemptions available in Seminole County?

+Yes, Seminole County offers several property tax exemptions, including the Homestead Exemption, Senior Exemption, Disabled Veteran Exemption, and Widow/Widower Exemption. These exemptions provide tax relief to eligible homeowners based on various criteria, such as residency, age, and income. It’s important to review the eligibility requirements and file the necessary applications to take advantage of these benefits.

How can I appeal my property tax assessment in Seminole County?

+If you believe your property’s assessed value is incorrect or unfair, you can appeal the assessment. The process involves gathering evidence, such as comparable property sales data, and filing an appeal with the Seminole County Property Appraiser’s Office. You may first request an informal review, and if not satisfied, proceed to a formal appeal before the Value Adjustment Board (VAB). Seeking professional advice from a tax attorney or consultant can be beneficial during the appeal process.