Seattle Sugar Tax

In recent years, cities and municipalities around the world have been exploring innovative ways to tackle public health concerns and generate revenue. One such initiative that has garnered attention is the implementation of a sugar tax. Seattle, a city known for its vibrant culture and progressive policies, took a bold step by introducing a sugar tax aimed at reducing sugar consumption and improving public health. In this comprehensive article, we delve into the intricacies of Seattle's sugar tax, its impact, and the broader implications it holds for public health initiatives worldwide.

Understanding Seattle’s Sugar Tax: An Overview

Seattle’s sugar tax, officially known as the “Sweetened Beverage Tax,” came into effect on January 1, 2018. This tax targets beverages with added sweeteners, including sodas, energy drinks, and sweetened teas. The primary objective of this tax is twofold: to discourage the consumption of sugary drinks, which are linked to various health issues, and to generate revenue for much-needed public health programs.

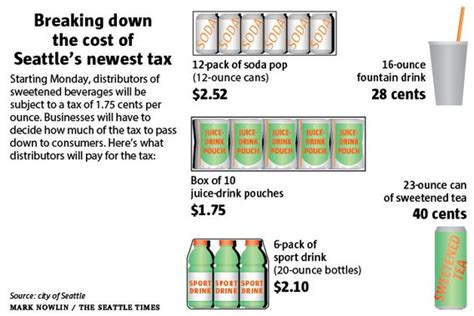

The tax is levied on distributors and manufacturers of sweetened beverages, who are responsible for paying a rate of 1.1 cents per ounce of the sweetened beverage. This means that for a typical 12-ounce can of soda, the tax amounts to approximately 13.2 cents. The revenue generated from this tax is directed towards funding initiatives such as early childhood education, community health programs, and infrastructure improvements related to public health.

The Impact on Consumer Behavior and Public Health

One of the key objectives of Seattle’s sugar tax is to influence consumer behavior and reduce the consumption of sugary drinks. Early studies and surveys conducted in the city indicate a positive shift in consumer choices. According to a report by the Seattle-King County Department of Health, there was a noticeable decline in the sales of taxed beverages, particularly among low-income households, where the impact of the tax was most evident.

Furthermore, the tax has sparked conversations and raised awareness about the potential health risks associated with excessive sugar consumption. Public health advocates and nutritionists have seized the opportunity to educate the community about the benefits of reducing sugar intake and adopting healthier dietary habits. The tax serves as a tangible reminder of the importance of making informed choices when it comes to beverage consumption.

Specific Impact on Youth and Vulnerable Populations

One of the most significant impacts of Seattle’s sugar tax has been observed among youth and vulnerable populations. Studies show that sugary drink consumption is disproportionately higher among these groups, leading to an increased risk of obesity, diabetes, and other health complications. The tax has been instrumental in reducing the availability and affordability of sugary drinks in schools and communities, creating a healthier environment for children and adolescents.

Additionally, the revenue generated from the sugar tax has been strategically allocated to fund programs specifically targeted at youth wellness. These programs include nutrition education initiatives, access to fresh produce in low-income neighborhoods, and the establishment of recreational facilities to promote physical activity.

Economic Implications and Revenue Generation

Seattle’s sugar tax has not only had a positive impact on public health but has also contributed significantly to the city’s revenue stream. In its first year of implementation, the tax generated over $17 million, surpassing initial projections. This revenue has been a welcome addition to the city’s budget, allowing for the expansion of existing health programs and the implementation of new initiatives.

The tax has also encouraged businesses and beverage manufacturers to explore healthier alternatives. Many companies have responded by reformulating their products, reducing the sugar content, and promoting healthier options. This shift in industry practices has the potential to have a long-lasting impact on consumer choices and the overall health of the population.

Balancing Revenue Generation and Consumer Affordability

One of the challenges associated with implementing a sugar tax is striking a balance between revenue generation and consumer affordability. While the tax has been successful in raising funds for public health programs, it has also raised concerns about the impact on low-income households. To address this, Seattle has implemented measures to ensure that the tax does not disproportionately burden vulnerable communities.

The city has introduced a sliding scale for the tax, where the rate varies based on the income level of the distributor or manufacturer. This approach aims to ease the financial burden on smaller businesses and those serving lower-income neighborhoods. Additionally, the revenue generated is allocated to programs that directly benefit these communities, ensuring a more equitable distribution of resources.

Broader Implications and Future Prospects

Seattle’s sugar tax has served as a pioneering example for other cities and countries considering similar public health initiatives. The success and positive outcomes observed in Seattle have sparked interest and discussions worldwide. As more municipalities explore the potential of sugar taxes, it is crucial to analyze the long-term effects and potential challenges associated with such policies.

One of the key considerations is the potential for industry backlash and legal challenges. Beverage manufacturers and distributors may argue that such taxes infringe upon their business practices and rights. However, the success of Seattle's tax and its positive impact on public health suggest that these challenges can be overcome with careful planning and effective communication.

Global Perspectives and Future Initiatives

Beyond Seattle, cities and countries across the globe are taking note of the potential benefits of sugar taxes. Mexico, for instance, implemented a sugar tax in 2014, leading to a significant decline in the consumption of sugary drinks. Similarly, countries like the United Kingdom, South Africa, and several European nations have introduced or are considering similar measures.

The global trend towards sugar taxes highlights a growing recognition of the need to address public health concerns related to sugar consumption. As more jurisdictions adopt these initiatives, it is essential to conduct thorough research and share best practices to ensure the effectiveness and sustainability of such policies.

| Sweetened Beverage Tax Rate | 1.1 cents per ounce |

|---|---|

| Revenue Generated in First Year | $17 million |

| Primary Objectives | Reduce sugar consumption, fund public health programs |

Frequently Asked Questions

How does the sugar tax affect local businesses and consumers?

+The sugar tax primarily impacts distributors and manufacturers of sweetened beverages, who pay the tax based on the volume of sweetened drinks they distribute. This cost is often passed on to consumers, resulting in slightly higher prices for these beverages. However, the tax has also incentivized businesses to offer healthier alternatives and reformulate their products.

What are the specific health concerns addressed by the sugar tax?

+The sugar tax aims to reduce the consumption of sugary drinks, which are linked to obesity, type 2 diabetes, dental issues, and cardiovascular diseases. By discouraging the intake of these beverages, the tax seeks to improve public health outcomes and reduce the burden on healthcare systems.

How is the revenue generated from the sugar tax utilized?

+The revenue generated from the sugar tax is allocated to fund various public health initiatives, including early childhood education programs, community health centers, and infrastructure improvements related to public health. The focus is on using the funds to create a healthier and more resilient community.

Are there any exemptions or special considerations for certain beverages?

+Yes, certain beverages are exempt from the sugar tax. These include milk, milk substitutes, fruit and vegetable juices with no added sweeteners, and beverages specifically marketed for infants and young children. The exemptions aim to ensure that essential nutritional beverages are not burdened by the tax.

What has been the overall impact of the sugar tax on Seattle’s public health landscape?

+The sugar tax has had a positive impact on Seattle’s public health. It has contributed to a reduction in sugary drink consumption, especially among vulnerable populations. The revenue generated has enabled the expansion of health programs, improved access to healthy foods, and promoted a culture of wellness within the community.