Scctax Property Taxes

Property taxes are an essential component of local government revenue, playing a vital role in funding various public services and infrastructure. In the state of South Carolina, the South Carolina Commission of Tax Administration (SCCTA) oversees the administration and collection of property taxes, known as the Scctax system. This article aims to provide an in-depth analysis of the Scctax property tax system, its workings, and its implications for property owners and the state's economy.

Understanding the Scctax Property Tax System

The Scctax property tax system is a complex mechanism designed to assess and collect taxes on real estate properties within the state. It is a critical source of revenue for local governments, including counties, municipalities, and special purpose districts, enabling them to finance essential services such as education, public safety, transportation, and infrastructure development.

The tax rate for Scctax is determined by each individual taxing jurisdiction within the state. These jurisdictions include counties, cities, towns, and special purpose districts like school districts or water districts. The tax rate is expressed as a millage rate, which represents the amount of tax owed per $1,000 of assessed property value. For instance, a millage rate of 100 mills would equate to $10 in taxes for every $1,000 of assessed value.

Assessment Process

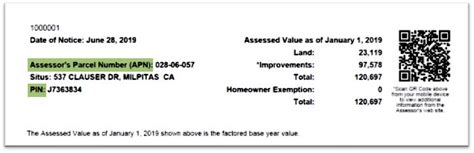

The property assessment process is a fundamental step in the Scctax system. It involves evaluating the fair market value of each property to determine the appropriate tax liability. This process is carried out by county assessors, who are responsible for ensuring that properties are accurately valued and classified.

The assessment methodology considers various factors, including the property's location, size, improvements, and recent sales data. By employing these criteria, assessors aim to establish a fair and equitable value for each property, ensuring that the tax burden is distributed appropriately among property owners.

Tax Calculation

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the tax liability. The tax rate is set by the local taxing authority and can vary significantly from one jurisdiction to another. This rate reflects the specific needs and financial requirements of the local government, such as funding for schools, emergency services, or road maintenance.

For instance, consider a property with an assessed value of $200,000 located in a jurisdiction with a tax rate of 500 mills. In this case, the property owner would owe $1,000 in property taxes, calculated as follows: $200,000 x 0.005 (500 mills) = $1,000.

| Assessed Property Value | Tax Rate (Mills) | Estimated Property Taxes |

|---|---|---|

| $150,000 | 400 | $600 |

| $250,000 | 550 | $1,375 |

| $300,000 | 600 | $1,800 |

Tax Collection and Payment

The collection and payment of Scctax property taxes are typically managed by the local taxing authority. Property owners receive tax bills, which outline the assessed value of their property, the applicable tax rate, and the total amount due. These bills are typically sent out annually, and the due date is set by the local government.

Payment options may vary, but common methods include online payment portals, mail-in checks, or in-person payments at designated tax offices. It's essential for property owners to adhere to the payment schedule to avoid late fees and potential penalties.

Impact of Scctax on Property Owners and the Economy

The Scctax property tax system has a significant impact on both property owners and the state’s economy. Understanding these implications is crucial for making informed decisions and advocating for equitable tax policies.

Property Owners’ Perspective

Property taxes, such as those imposed by the Scctax system, represent a substantial financial obligation for property owners. The amount of tax owed can vary widely based on factors like property value, location, and the local tax rate. This variability can lead to situations where property owners in similar circumstances face significantly different tax burdens, potentially impacting their financial planning and long-term stability.

Moreover, the impact of property taxes extends beyond the financial aspect. It can influence a property owner's decision-making, such as whether to invest in improvements or upgrades, or even their willingness to maintain their property. High property taxes can discourage investment and maintenance, potentially leading to a decline in property values and overall community well-being.

Economic Implications

The Scctax property tax system plays a critical role in funding essential public services and infrastructure. The revenue generated through property taxes supports education, public safety, transportation, and other vital sectors. However, the system’s impact on the economy is not without complexities.

On one hand, property taxes can encourage responsible land use and development by providing a stable source of revenue for local governments. This revenue can be invested in projects that enhance the community's quality of life, such as improved schools, better roads, and enhanced public spaces. These improvements, in turn, can attract businesses and residents, fostering economic growth.

On the other hand, high property taxes can be a disincentive for investment and business growth. They can make it more expensive to own and operate a business, potentially driving away potential investors and entrepreneurs. Additionally, high property taxes can impact the affordability of housing, especially for low- and middle-income households, further exacerbating economic inequality.

| Economic Sector | Impact of Scctax |

|---|---|

| Housing | High property taxes can impact housing affordability, especially for low-income households. |

| Business | Scctax can influence business decisions, with high taxes potentially deterring investment and entrepreneurship. |

| Infrastructure | Property taxes provide funding for infrastructure development, enhancing the community's overall well-being. |

| Education | Scctax revenue supports education, ensuring access to quality schools and educational resources. |

Future Considerations and Potential Reforms

As the Scctax property tax system continues to evolve, several considerations and potential reforms could shape its future direction. These reforms aim to address issues related to equity, efficiency, and adaptability to changing economic conditions.

Equity and Fairness

One of the primary concerns with property taxes is ensuring fairness and equity among property owners. The current system, where tax rates can vary significantly between jurisdictions, can lead to situations where similar properties are taxed differently based on their location. This lack of uniformity can create a sense of inequity and dissatisfaction among property owners.

To address this issue, some experts propose a state-wide reassessment of property values, coupled with a standardized tax rate. This approach would ensure that all properties are valued and taxed consistently, regardless of their location. Additionally, it could lead to a more equitable distribution of the tax burden, potentially reducing tax obligations for some property owners while increasing them for others.

Efficiency and Streamlining

The administration and collection of property taxes can be a complex and resource-intensive process. To enhance efficiency, local governments could explore the adoption of modern technology and data analytics. By digitizing tax records, implementing online payment systems, and leveraging data-driven assessment methodologies, governments can reduce administrative costs and improve the accuracy and speed of tax assessments.

Furthermore, streamlining the tax collection process can benefit both property owners and tax administrators. Online payment portals, for instance, provide a convenient and efficient way for property owners to pay their taxes, while also reducing the administrative burden on tax offices. Additionally, implementing automated payment systems, such as direct debits or mobile payment options, can further enhance efficiency and reduce the risk of errors or late payments.

Adaptability to Economic Changes

Economic conditions can fluctuate, impacting property values and, consequently, property tax revenue. To ensure the stability and sustainability of the Scctax system, it’s essential to consider implementing mechanisms that allow for adjustments in tax rates or assessment methodologies during economic downturns or periods of rapid growth.

One approach could involve establishing a flexible tax rate structure that can be adjusted based on economic indicators. For instance, during economic downturns, local governments could consider reducing tax rates temporarily to provide relief to property owners. Conversely, during periods of economic growth, tax rates could be increased to capture the increased property values and generate additional revenue for public services.

Conclusion

The Scctax property tax system is a critical component of South Carolina’s revenue stream, funding essential public services and infrastructure. While it provides a stable source of revenue for local governments, the system’s complexity and variability in tax rates can lead to equity and fairness concerns. By considering reforms focused on standardization, efficiency, and adaptability, the Scctax system can evolve to better serve the needs of property owners and the state’s economy.

How often are property values reassessed in South Carolina for Scctax purposes?

+

Property values in South Carolina are typically reassessed every five years, although some counties may conduct reassessments more frequently. The reassessment process aims to ensure that property values remain up-to-date and accurately reflect the current market conditions.

Can property owners appeal their Scctax assessment if they believe it is inaccurate?

+

Absolutely! Property owners have the right to appeal their assessment if they believe it is incorrect. The appeal process varies by county, but generally involves submitting an appeal to the county’s assessment board, providing evidence to support the claim, and potentially attending a hearing to present their case.

Are there any exemptions or discounts available for certain types of properties under the Scctax system?

+

Yes, South Carolina offers various property tax exemptions and discounts to eligible property owners. These include homestead exemptions for primary residences, veteran exemptions, and exemptions for certain types of agricultural or conservation lands. It’s important to check with the local tax assessor’s office to determine eligibility and the specific requirements for each exemption.

How does the Scctax system handle property transfers or sales?

+

When a property is sold or transferred, the new owner typically becomes responsible for the property taxes. However, the timing and amount of tax liability can vary. In some cases, the taxes are prorated between the buyer and seller based on the date of the transfer. It’s crucial for both parties to understand their tax obligations and consult with a tax professional if needed.

Are there any online resources available for property owners to estimate their Scctax obligations?

+

Yes, many counties in South Carolina provide online tools and calculators to help property owners estimate their tax obligations. These tools often consider the property’s assessed value, applicable tax rates, and any exemptions or discounts. Property owners can use these resources to gain a better understanding of their potential tax liability.